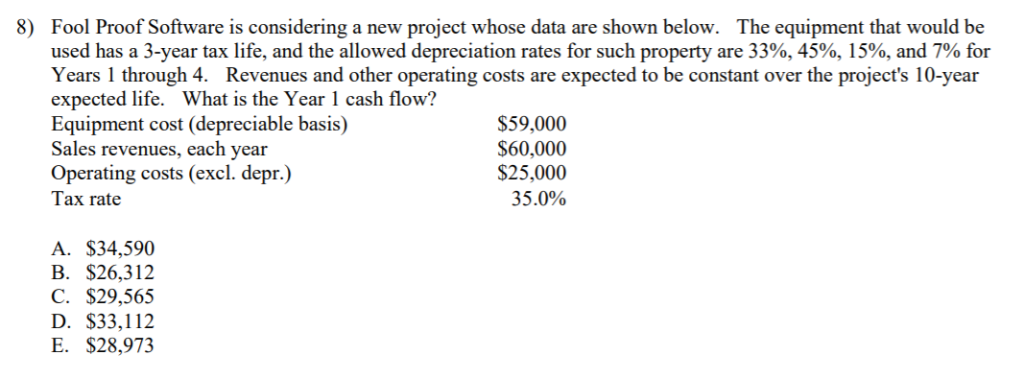

Question: Fool Proof Software is considering a new project whose data are shown below. used has a 3-year tax life, and the allowed depreciation rates for

Fool Proof Software is considering a new project whose data are shown below. used has a 3-year tax life, and the allowed depreciation rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected life. What is the Year 1 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. depr.) Tax rate The equipment that would be 8) S59,000 S60,000 $25,000 35.0% A. S34,590 B. $26,312 C. $29,565 D. $33,112 E. $28,973

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts