Question: Footloose 2 Case study example | Footloose Deloitte & Touche (M.E.) Introduction Duraflex is a German footwear company with annual mens footwear sales of approximately

Footloose 2 Case study example | Footloose Deloitte & Touche (M.E.)

Introduction Duraflex is a German footwear company with annual mens footwear sales of approximately 1.0 billion Euro(). They have always relied on the boot market for the majority of their volume and in this market they compete with three other major competitors. Together, these four brands represent approximately 72% of the 5.0 billion German mens boot market. The boots category includes four main sub-categories: Work boots, casual boots, field and hunting boots, and winter boots. Work boots is the largest sub- category and is geared to blue collar workers1 who purchase these boots primarily for on-the-job purposes. Casual boots is the fastest growing sub- category, and is geared more towards white collar workers2 and students who purchase these boots for week-end / casual wear and light work purposes. The four key competitors in the market are Badger, Duraflex, Steeler, and Trekker.

Work through these questions on your own, using the text and exhibits in the preceding slides. A question set is provided in the slides that follow 1. How big is the work boot market (expressed in euros)? Does Duraflex get more of its revenue from work boots or casual boots?

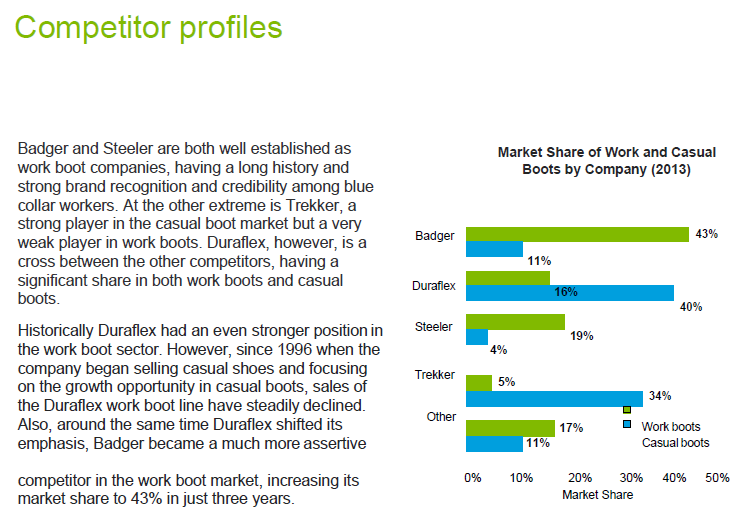

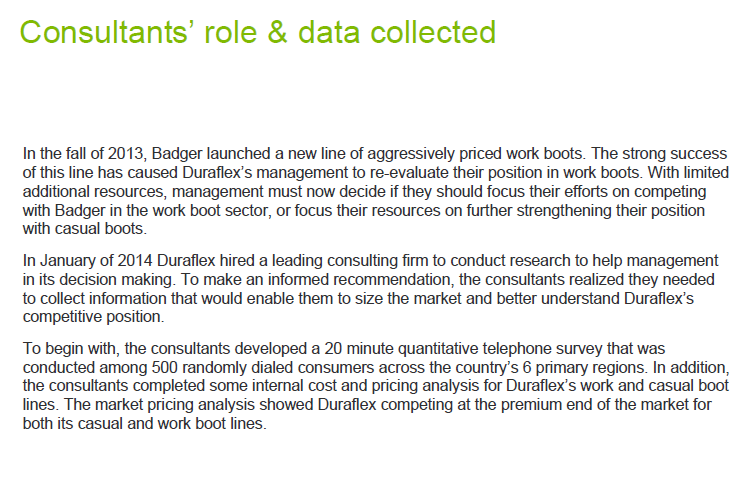

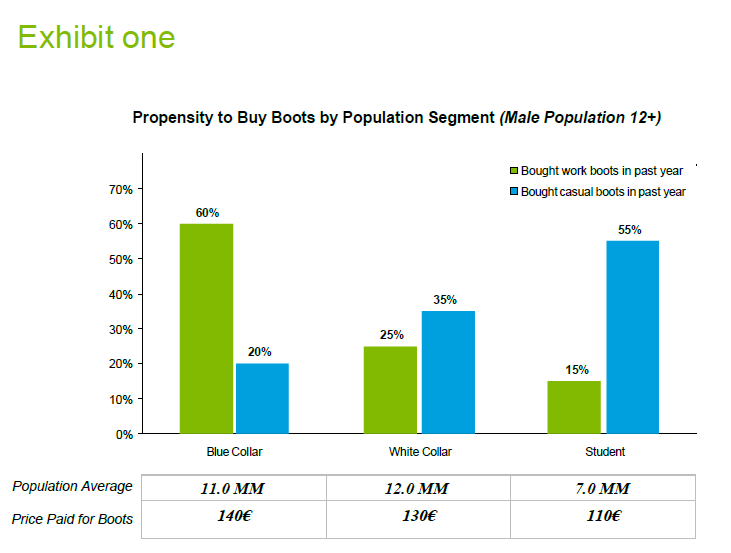

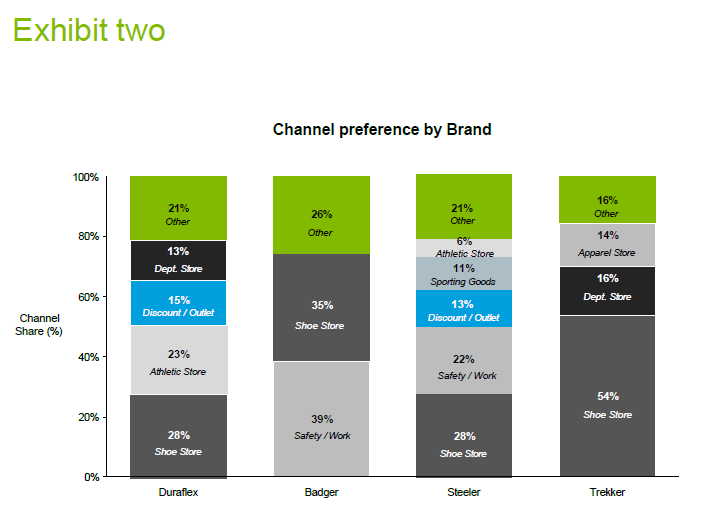

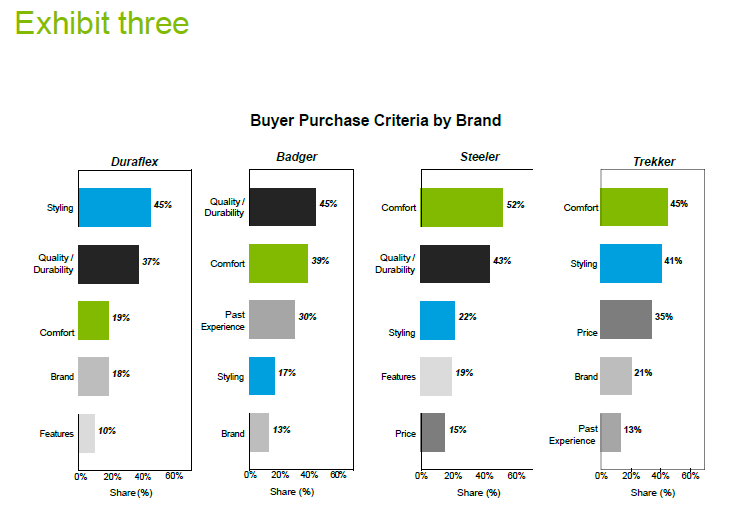

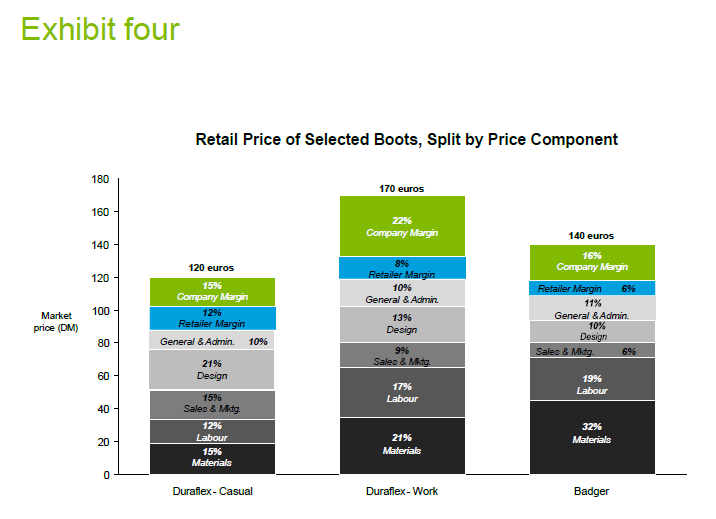

Competitor profiles Market Share of Work and Casual Boots by Company (2013) Badger 43% 11% Duraflex 16% 40% Badger and Steeler are both well established as work boot companies, having a long history and strong brand recognition and credibility among blue collar workers. At the other extreme is Trekker, a strong player in the casual boot market but a very weak player in work boots. Duraflex, however, is a cross between the other competitors, having a significant share in both work boots and casual boots. Historically Duraflex had an even stronger position in the work boot sector. However, since 1996 when the company began selling casual shoes and focusing on the growth opportunity in casual boots, sales of the Duraflex work boot line have steadily declined. Also, around the same time Duraflex shifted its emphasis, Badger became a much more assertive competitor in the work boot market, increasing its market share to 43% in just three years. Steeler 19% 4% Trekker 5% 34% Other 17% Work boots Casual boots 11% 0% 10% 40% 50% 20% 30% Market Share Consultants' role & data collected In the fall of 2013, Badger launched a new line of aggressively priced work boots. The strong success of this line has caused Duraflex's management to re-evaluate their position in work boots. With limited additional resources, management must now decide if they should focus their efforts on competing with Badger in the work boot sector, or focus their resources on further strengthening their position with casual boots. In January of 2014 Duraflex hired a leading consulting firm to conduct research to help management in its decision making. To make an informed recommendation, the consultants realized they needed to collect information that would enable them to size the market and better understand Duraflex's competitive position. To begin with, the consultants developed a 20 minute quantitative telephone survey that was conducted among 500 randomly dialed consumers across the country's 6 primary regions. In addition, the consultants completed some internal cost and pricing analysis for Duraflex's work and casual boot lines. The market pricing analysis showed Duraflex competing at the premium end of the market for both its casual and work boot lines. Exhibit one Propensity to Buy Boots by Population Segment (Male Population 12+) Bought work boots in past year Bought casual boots in past year 70% 60% 60% 55% 50% 40% 35% 30% 25% 20% 20% 15% 10% 0% Blue Collar White Collar Student Population Average 12.0 MM 11.0 MM 140 7.0 MM 110 Price Paid for Boots 130 Exhibit two Channel preference by Brand 100% 21% Other 16% Other 26% 80% Other 14% Apparel Store 13% Dept. Store 21% Other 6% Athletic Store 11% Sporting Goods 13% Discount / Outlet 16% 60% Dept. Store 15% Discount / Outlet 35% Channel Share (%) Shoe Store 40% 23% Athletic Store 22% Safety / Work 54% Shoe Store 20% 39% Safety Work 28% Shoe Store 28% Shoe Store 0% Duraflex Badger Steeler Trekker Exhibit three Buyer Purchase Criteria by Brand Duraflex Badger Steeler Trekker Styling 45% 45% Quality! Durability 52% 45% Comfort Comfort 37% 39% Quality Durability 43% Comfort Quality Durability Styling 41% 19% 30% 22% 35% Past Experience Comfort Styling Price 17% 18% 19% Brand 21% Styling Features Brand Features 10% 13% 15% Features 13% Brand Price Past Experience 0% 60% 0% 0% 0% 20% 40% 60% 20% 40% Share(%) 20% 40% 60% Share (%) 20% 40% 60% Share (%) Share (%) Exhibit four Retail Price of Selected Boots, Split by Price Component 180 170 euros 160 22% Company Margin 140 euros 140 120 - 896 Retailer Margin 10% General & Admin 13% Design 16% Company Margin Retailer Margin 6% 11% General & Admin 10% Design Sales & Mktg 696 120 euros 15% Company Margin 12% Retailer Margin General & Admin 10% 21% Design 100 Market price (DM) 80 99 Sales & Mato 60 17% Labour 19% Labour 40 20 15 Sales & Matg. 12% Labour 15% Materials 32% Materials 21% Materials 0 Duraflex - Casual Duraflex - Work BadgerStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts