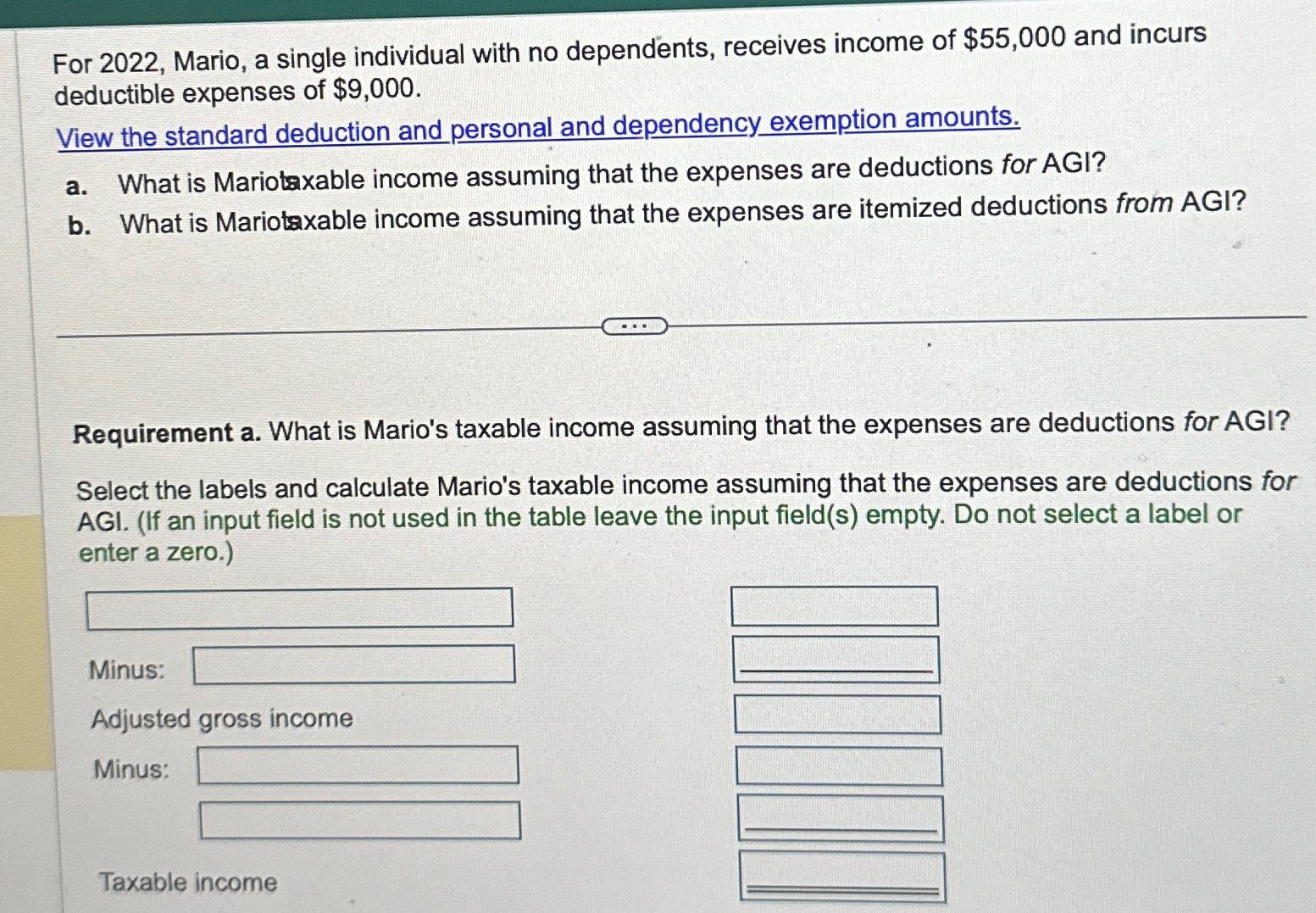

Question: For 2 0 2 2 , Mario, a single individual with no dependents, receives income of $ 5 5 , 0 0 0 and incurs

For Mario, a single individual with no dependents, receives income of $ and incurs deductible expenses of $

View the standard deduction and personal and dependency exemption amounts.

a What is Mariotaxable income assuming that the expenses are deductions for AGI?

b What is Mariotaxable income assuming that the expenses are itemized deductions from AGI?

Requirement a What is Mario's taxable income assuming that the expenses are deductions for AGI?

Select the labels and calculate Mario's taxable income assuming that the expenses are deductions for AGI. If an input field is not used in the table leave the input fields empty. Do not select a label or enter a zero.

Minus:

Adjusted gross income

Minus:

Taxable income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock