Question: For 2016, the personal exemption amount is $4,050. The 2016 standard deduction is $6,300 for unmarried taxpayers or married taxpayers filing separately, $12,600 for married

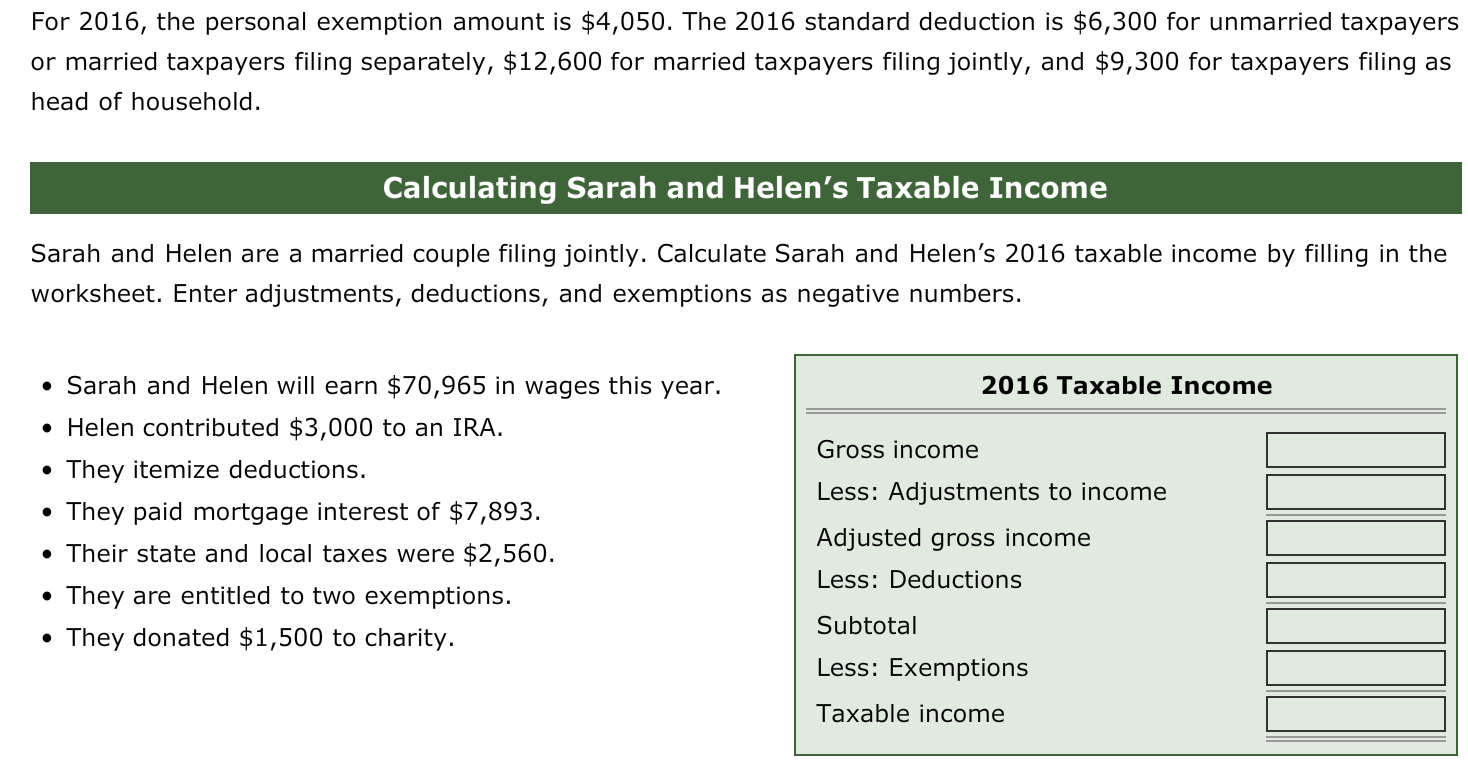

For 2016, the personal exemption amount is $4,050. The 2016 standard deduction is $6,300 for unmarried taxpayers or married taxpayers filing separately, $12,600 for married taxpayers filing jointly, and $9,300 for taxpayers filing as head of household. Calculating Sarah and Helen's Taxable Income Sarah and Helen are a married couple filing jointly. Calculate Sarah and Helen's 2016 taxable income by filling in the worksheet. Enter adjustments, deductions, and exemptions as negative numbers. 2016 Taxable Income Gross income Sarah and Helen will earn $70,965 in wages this year. Helen contributed $3,000 to an IRA. They itemize deductions. They paid mortgage interest of $7,893. Their state and local taxes were $2,560. They are entitled to two exemptions. They donated $1,500 to charity. 0 Less: Adjustments to income Adjusted gross income Less: Deductions . Subtotal Less: Exemptions Taxable income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts