Question: *For 2019 Thank you! 10 A Saved Help Save & Exit Submit 87 Check my work Problem 10-48 (LO 10-2) [The following information applies to

*For 2019

Thank you!

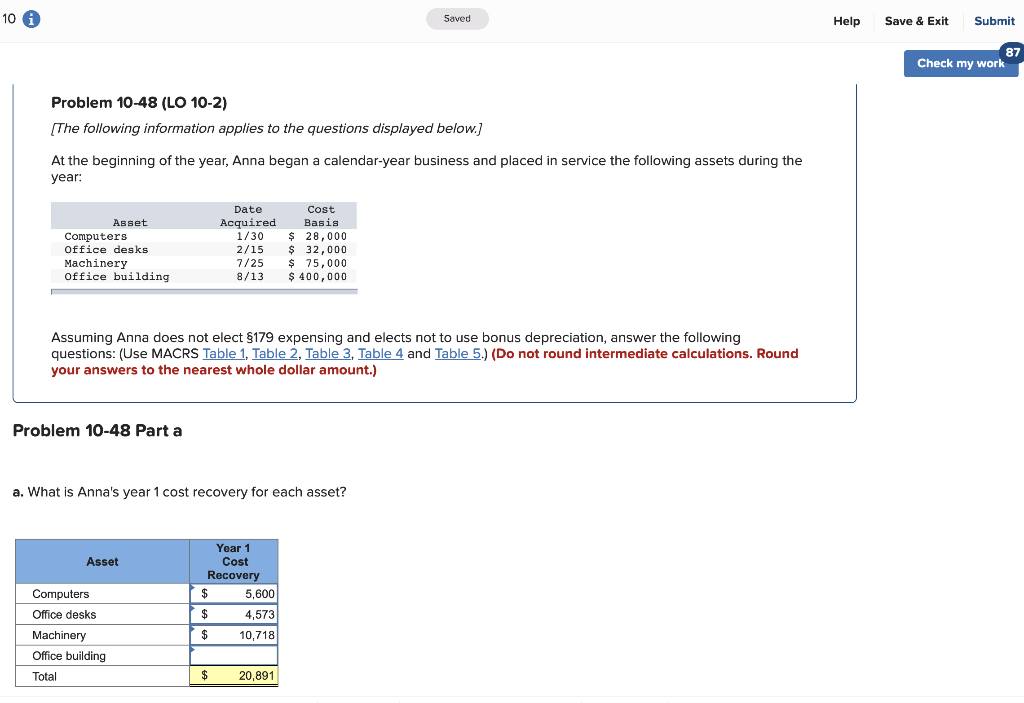

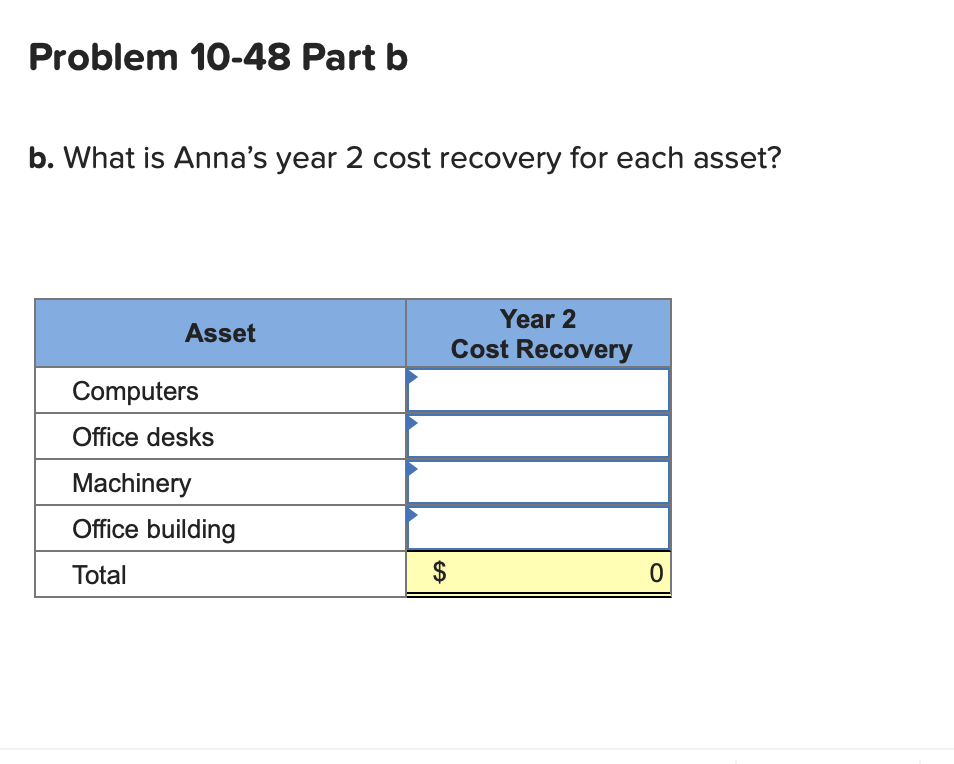

10 A Saved Help Save & Exit Submit 87 Check my work Problem 10-48 (LO 10-2) [The following information applies to the questions displayed below.) At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the year: Asset Computers Office desks Machinery Office building Date Acquired 1/30 2/15 7/25 8/13 Cost Basis $ 28,000 $ 32,000 $ 75,000 $ 400,000 Assuming Anna does not elect $179 expensing and elects not to use bonus depreciation, answer the following questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Problem 10-48 Part a a. What is Anna's year 1 cost recovery for each asset? Asset Computers Office desks Year 1 Cost Recovery $ 5,600 $ 4,573 $ 10,718 Machinery Office building Total $ 20,891 Problem 10-48 Part b b. What is Anna's year 2 cost recovery for each asset? Asset Year 2 Cost Recovery Computers Office desks Machinery Office building Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts