Question: for 3rd answer please round 2 decimal as it asks please. need answer now make sure u answer all 3 answers please thank u Your

for 3rd answer please round 2 decimal as it asks please. need answer now make sure u answer all 3 answers please thank u

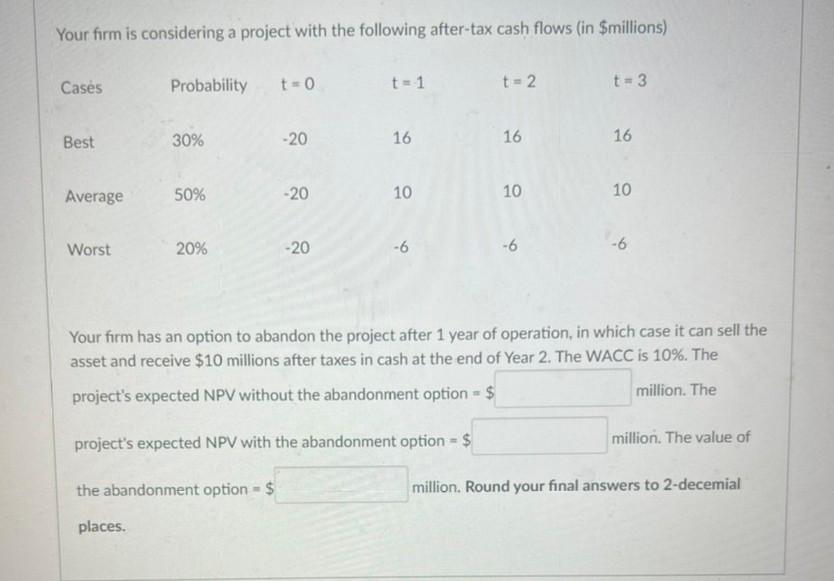

Your form is considering a project with the following after-tax cash flows (in $millions) Cases Probability t=0 t=1 t=2 t=3 Best 30% -20 16 16 16 50% Average -20 10 10 10 Worst 20% -20 -6 -6 -6 Your firm has an option to abandon the project after 1 year of operation, in which case it can sell the asset and receive $10 millions after taxes in cash at the end of Year 2. The WACC is 10%. The project's expected NPV without the abandonment option = $ million. The project's expected NPV with the abandonment option = $ million. The value of the abandonment option - $ million. Round your final answers to 2-decemial places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts