Question: for 5 years Incremental operating cash inflows - Expense reduction Miler Corporation is considering replacing a machine. The replacement will reduce o before depreciation, interest,

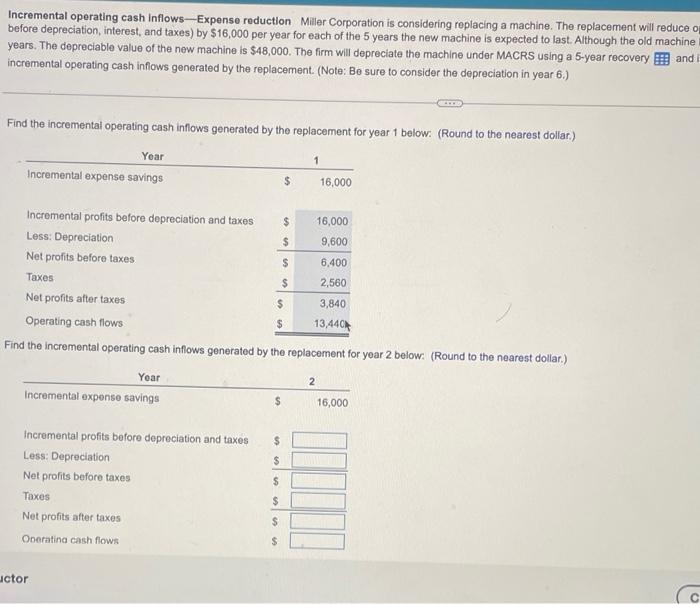

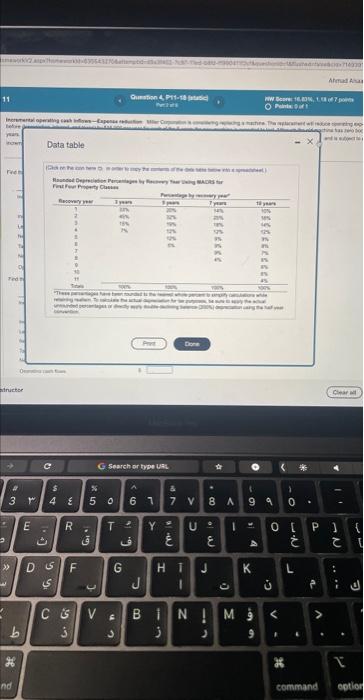

Incremental operating cash inflows - Expense reduction Miler Corporation is considering replacing a machine. The replacement will reduce o before depreciation, interest, and taxes) by $16,000 per year for each of the 5 years the new machine is expected to last. Although the old machine years. The depreciable value of the new machine is $48,000. The firm will depreciate the machine under MACRS using a 5 -year recovery incremental operating cash inflows generated by the replacement. (Note: Bo sure to consider the depreciation in year 6 .) Find the incremental operating cash inflows generated by the replacement for year 1 below: (Round to the nearest dollar.) Find the incremental operating cash inflows generated by the replacement for year 2 below: (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts