Question: for a couplc with two balance sheet. You decide how mlili shown in Table 3.2 dition accurately on a given date. The balance sheet shown

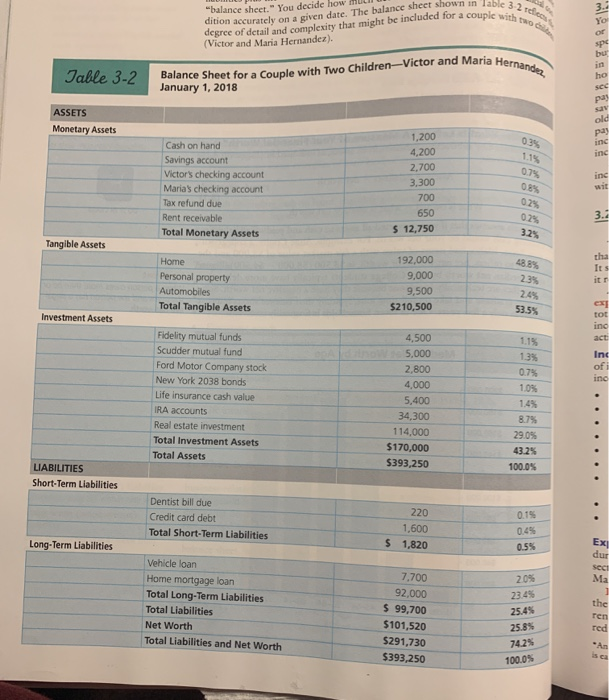

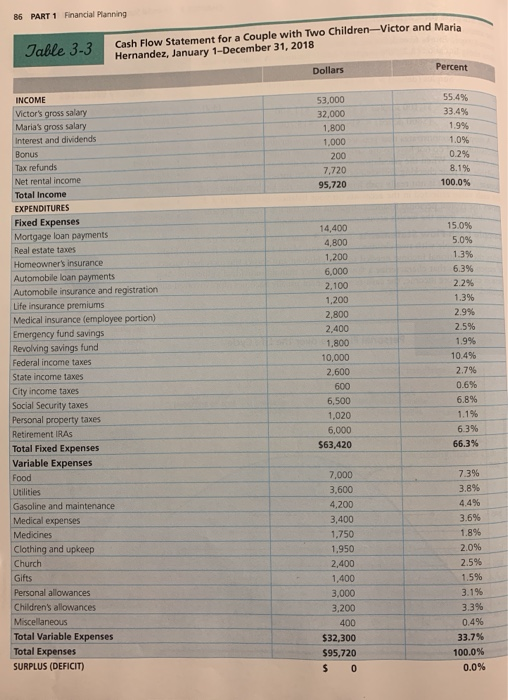

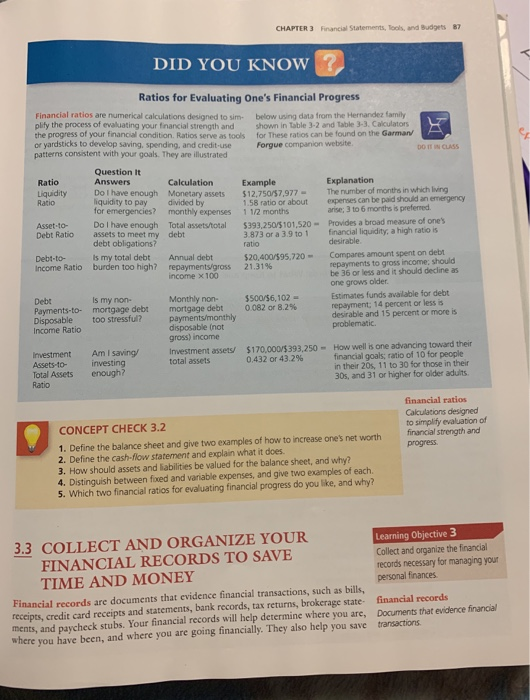

for a couplc with two "balance sheet." You decide how mlili shown in Table 3.2 dition accurately on a given date. The balance sheet shown in lab degree of detail and complexity that might be included for a couple (Victor and Maria Hernandez). dernandez Jable 3-2 Balance Sheet for a couple with Two Children-Victor and Maria Herna January 1, 2018 ASSETS Monetary Assets Cash on hand Savings account Victor's checking account Maria's checking account Tax refund due Rent receivable Total Monetary Assets 1,200 4,200 2,700 3,300 700 650 $ 12,750 Tangible Assets 239 Home Personal property Automobiles Total Tangible Assets 192,000 9,000 9,500 $210,500 24 53.5% Investment Assets of inc Fidelity mutual funds Scudder mutual fund Ford Motor Company stock New York 2038 bonds Life insurance cash value IRA accounts Real estate investment Total Investment Assets Total Assets 4.500 5,000 2.800 4.000 5,400 34,300 114,000 $170,000 $393,250 29.0% 43.25 100.0% LIABILITIES Short-Term Liabilities Dentist bill due Credit card debt Total Short-Term Liabilities 0.155 220 1,600 1,820 Long-Term Liabilities $ 0.55 7,700 Vehicle loan Home mortgage loan Total Long-Term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth 92,000 $ 99,700 $101,520 5291,730 $393,250 20% 23.45 25.45 25.85 74.25 100.0% 86 PART 1 Financial Planning Table 3-3 Cash Flow Statement for a couple with Two Children-Victor and Maria Hernandez, January 1-December 31, 2018 Dollars Percent 53,000 32,000 1,800 1,000 200 7.720 95,720 55.45 33.4% 1.9% 1.0% 02% 8.1% 100.0% 15.0% 5.0% 1.3% 63% 2.24 INCOME Victor's gross salary Maria's gross salary Interest and dividends Bonus Tax refunds Net rental income Total Income EXPENDITURES Fixed Expenses Mortgage loan payments Real estate taxes Homeowner's insurance Automobile loan payments Automobile insurance and registration Life insurance premiums Medical insurance (employee portion) Emergency fund savings Revolving savings fund Federal income taxes State income taxes City income taxes Social Security taxes Personal property taxes Retirement IRAs Total Fixed Expenses Variable Expenses Food Utilities Gasoline and maintenance Medical expenses Medicines Clothing and upkeep Church Gifts Personal allowances Children's allowances Miscellaneous Total Variable Expenses Total Expenses SURPLUS (DEFICIT) 14,400 4,800 1,200 6,000 2,100 1,200 2,800 2,400 1,800 10,000 2,600 600 6,500 1,020 6.000 $63,420 1.39 2.9% 2.5% 1.9% 10.45 2.7% 0.6% 6.8% 1.1% 6.3% 66.3% 7 396 3.8% 4.4% 369 7.000 3,600 4.200 3,400 1.750 1.950 2,400 1,400 3,000 1.8% 20% 2.5% 1.5% 3.1% 33% 3.200 400 $32,300 $95,720 $ 0 33.7% 100.0% 0.05 CHAPTER 3 Financial Statements, tools and Budgets 87 DID YOU KNOW? Ratios for Evaluating One's Financial Progress Financial ratios are numerical calculations designed to sim belowing data from the Hernandez family plify the process of evaluating your financial strength and shown in table 3-2 and table 3-3. Calculators the progress of your financial condition. Ratios serve as tools for These ratios can be found on the Garman or yardsticks to develop Saving, spending and credit use Forgue companion website patterns consistent with your goals. They are illustrated DO IN CUISS Ratio Liquidity Ratio Asset-to- Debt Ratio Question It Answers Calculation Do I have enough Monetary assets liquidity to pay divided by for emergencies? monthly expenses Do I have enough Total asset total assets to meet my debt debt obligations? Is my total debt Annual debt burden too high? repaymentygross income x 100 Example $12.750/57,977 - 1.58 ratio of about 1 1/2 months 5393250/3101.520 - 3.873 or a 3.9 to 1 ratio $20,400/595,720 - 21.31% Explanation The number of months in which living expenses can be paid should an emergency arise: 3 to 6 months is preferred Provides a broad measure of one's financial liquidity, a high ratio is desirable Compares amount spent on debt repayments to gross income, should be 36 or less and it should decline as one grows older. Estimates funds available for debt repayment: 14 percent or less is desirable and 15 percent or more is problematic Debt-to- Income Ratio $500/$6,102 0082 OF 8.2% Debt Is my non- Payments-to- mortgage debt Disposable too stressful? Income Ratio Monthly non- mortgage debt payments/monthly disposable inot gross) income Investment assets total assets Investment Assets to Total Assets Ratio Am I saving/ investing enough? $170.000/$393.250 - How well is one advancing toward their 0432 or 43.2% financial goals: ratio of 10 for people in their 20s, 11 to 30 for those in their 30s, and 31 or higher for older adults financial ratios Calculations designed to simplify evaluation of financial strength and progress CONCEPT CHECK 3.2 1. Define the balance sheet and give two examples of how to increase one's net worth 2. Define the cash-flow statement and explain what it does 3. How should assets and liabilities be valued for the balance sheet, and why? 4. Distinguish between faced and variable expenses, and give two examples of each. 5. Which two financial ratios for evaluating financial progress do you like, and why? 3.3 COLLECT AND ORGANIZE YOUR Learning Objective 3 FINANCIAL RECORDS TO SAVE Collect and organize the financial records necessary for managing your TIME AND MONEY personal finances Financial records are documents that evidence financial transactions, such as bills. receipts, credit card receipts and statements, bank records, tax returns, brokerage state financial records ments, and paycheck stubs. Your financial records will help determine where you are, Documents that evidence financial where you have been, and where you are going financially. They also help you save transactions receipts, credit card T he Your finance coing financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts