Question: For a) I don't know how to plug this into the formula for d1 or how to do the normsdist function to solve for N(d1)

For a) I don't know how to plug this into the formula for d1 or how to do the normsdist function to solve for N(d1) . Can someone please help !

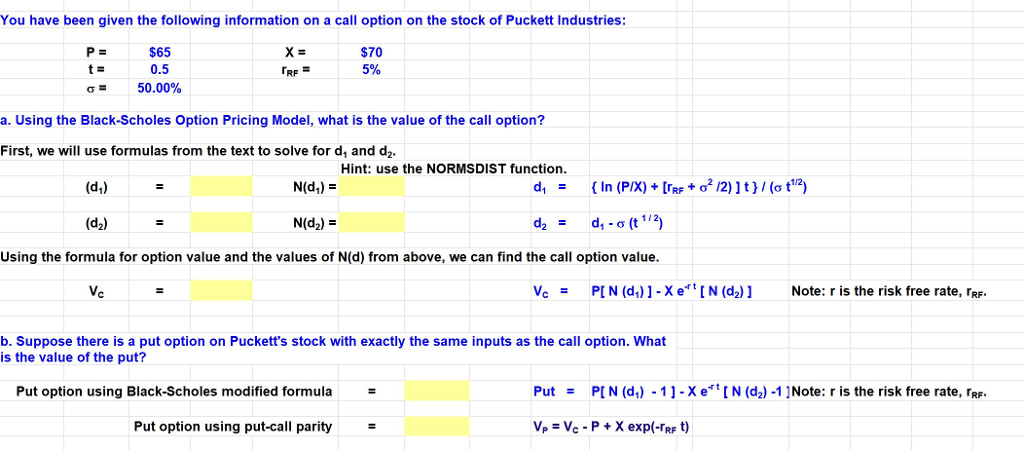

You have been given the following information on a call option on the stock of Puckett Industries: $65 0.5 50.00% $70 5% RF ?- a. Using the Black-Scholes Option Pricing Model, what is the value of the call option? First, we will use formulas from the text to solve for d, and d2. Hint: use the NORMSDIST function. (d1) N(di)- 1/2 (d2) N(d2)- d2d - o (t172) Using the formula for option value and the values of N(d) from above, we can find the call option value VcPIN (d,)1-XeIN (d2) Note: r is the risk free rate, rF b. Suppose there is a put option on Puckett's stock with exactly the same inputs as the call option. What is the value of the put? Put option using Black-Scholes modified formula PutPIN (d,)-1-XeN (d2)1Note: r is the risk free rate, rRF Put option using put-call parity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts