Question: For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following

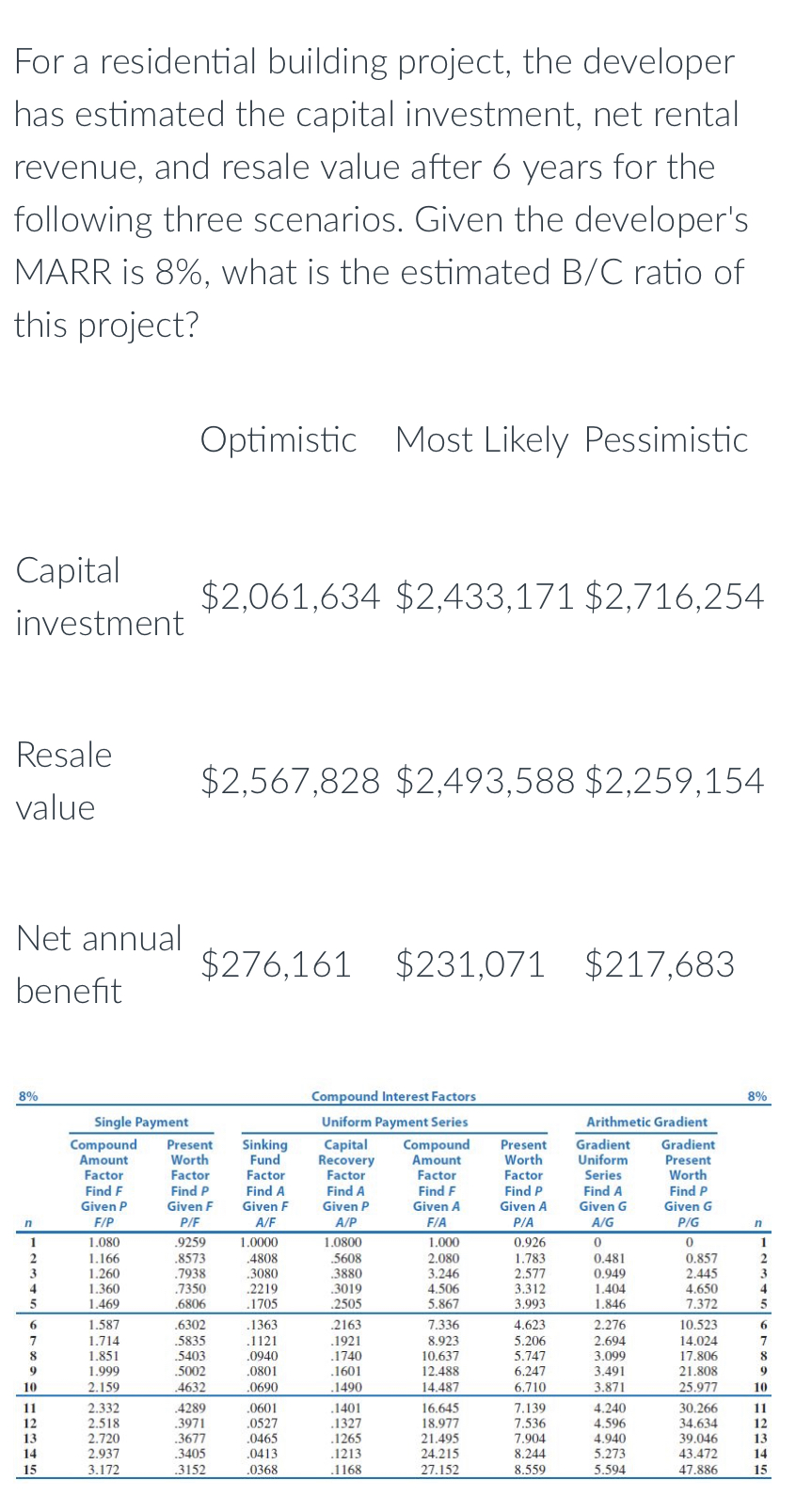

For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following three scenarios. Given the developer's MARR is 8%, what is the estimated B/C ratio of this project? Capital investment Resale value Net annual benefit 8% n 1 2 3 4 5 6 7 8 9 10 |=DBHK| 11 12 13 14 15 Find F Given P F/P 1.080 1.166 1.260 1.360 1.469 1.587 1.714 1.851 1.999 2.159 Optimistic Most Likely Pessimistic Single Payment Compound Present Amount Worth Factor Factor 2.332 2.518 2.720 2.937 3.172 $2,061,634 $2,433,171 $2,716,254 $2,567,828 $2,493,588 $2,259,154 $276,161 $231,071 $231,071 $217,683 Find P Given F P/F .9259 .8573 .7938 7350 .6806 .6302 .5835 5403 .5002 4632 .4289 .3971 .3677 3405 3152 Sinking Fund Factor Find A Given F A/F 1.0000 .4808 .3080 .2219 .1705 .1363 .1121 .0940 .0801 .0690 .0601 .0527 .0465 .0413 .0368 Compound Interest Factors Uniform Payment Series Capital Recovery Factor Find A Given P A/P 1.0800 5608 .3880 .3019 .2505 2163 .1921 .1740 .1601 .1490 .1401 .1327 .1265 .1213 .1168 Compound Amount Factor Find F Given A F/A 1.000 2.080 3.246 4.506 5.867 7.336 8.923 10.637 12.488 14.487 16.645 18.977 21.495 24.215 27.152 Arithmetic Gradient Present Gradient Gradient Worth Uniform Factor Series Find P Given A P/A 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 Find A Given G A/G 0 0.481 0.949 1.404 1.846 2.276 2.694 3.099 3.491 3.871 4.240 4.596 4.940 5.273 5.594 Present Worth Find P Given G P/G 0 0.857 2.445 4.650 7.372 10.523 14.024 17.806 21.808 25.977 30.266 34.634 39.046 43.472 47.886 8% n 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

To calculate the BenefitCost BC ratio we need to find the present value of net benefits and the present value of the capital investment for each scena... View full answer

Get step-by-step solutions from verified subject matter experts