Question: For a stock, you are given that: i) The current stock price is 45. ii) The stock is going to pay a dividend of 1

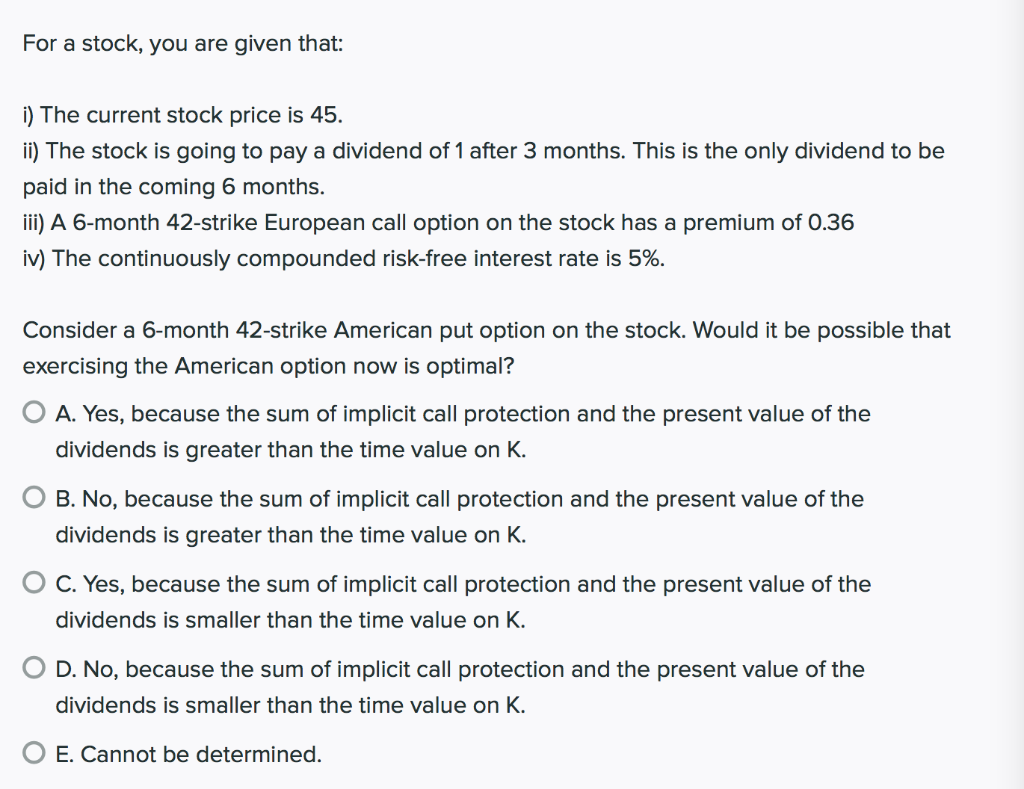

For a stock, you are given that: i) The current stock price is 45. ii) The stock is going to pay a dividend of 1 after 3 months. This is the only dividend to be paid in the coming 6 months. iii) A 6-month 42-strike European call option on the stock has a premium of 0.36 iv) The continuously compounded risk-free interest rate is 5%. Consider a 6-month 42-strike American put option on the stock. Would it be possible that exercising the American option now is optimal? O A. Yes, because the sum of implicit call protection and the present value of the dividends is greater than the time value on K. B. No, because the sum of implicit call protection and the present value of the dividends is greater than the time value on K. O C. Yes, because the sum of implicit call protection and the present value of the dividends is smaller than the time value on K. O D. No, because the sum of implicit call protection and the present value of the dividends is smaller than the time value on K. E. Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts