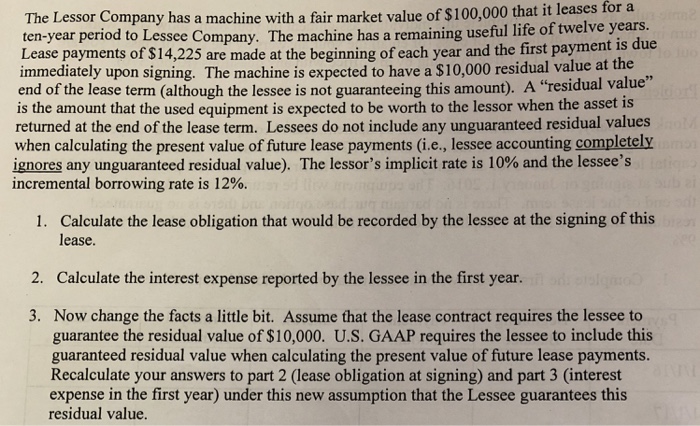

Question: for a The Lessor Company has a machine with a fair market value of $100,000 that it leases ten-year period to Lessee Company. The machine

for a The Lessor Company has a machine with a fair market value of $100,000 that it leases ten-year period to Lessee Company. The machine has a re Lease payments of $14,225 are made at the beginning of each year and the first payment is due immediately upon signing. The machine is expected to have a $10,000 residual value at the end of the lease term (although the lessee is not guaranteeing this amount). A "residual value is the amount that the used equipment is expected to be worth to the lessor when the asset is returned at the end of the lease term. Lessees do not include any unguaranteed residual values when calculating the present value of future lease payments (i.e., lessee accounting completely ignores any unguaranteed residual value). The lessor's implicit rate is 10% and the lessee's incremental borrowing rate is 12%. maining useful life of twelve years. Calculate the lease obligation that would be recorded by the lessee at the signing of this lease. 1. 2. Calculate the interest expense reported by the lessee in the first year. 3. Now change the facts a little bit. Assume that the lease contract requires the lessee to guarantee the residual value of $10,000. U.S. GAAP requires the lessee to include this guaranteed residual value when calculating the present value of future lease payments. Recalculate your answers to part 2 (lease obligation at signing) and part 3 (interest expense in the first year) under this new assumption that the Lessee guarantees this residual value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts