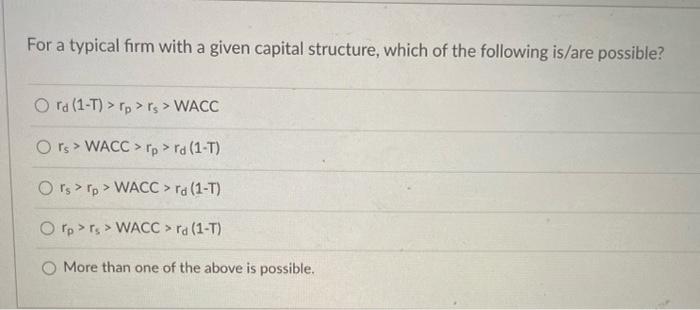

Question: For a typical firm with a given capital structure, which of the following is/are possible? Ora (1-T) > Tp >rs > WACC Ors > WACC

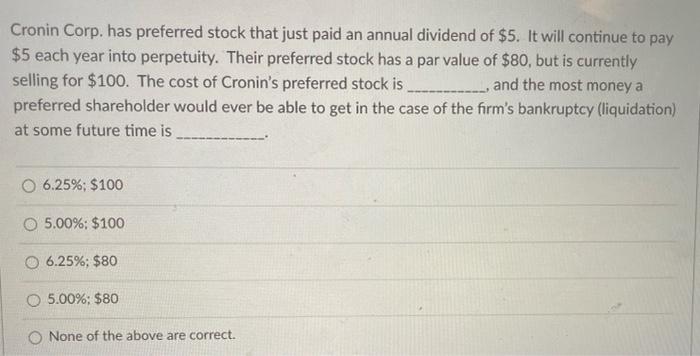

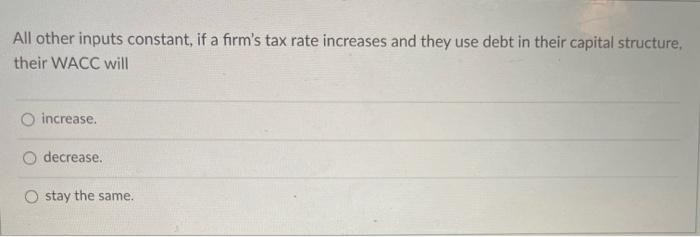

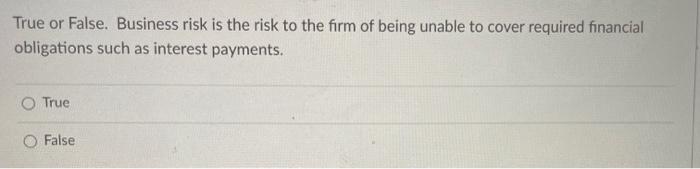

For a typical firm with a given capital structure, which of the following is/are possible? Ora (1-T) > Tp >rs > WACC Ors > WACC > rp >ra (1-T) Ors >rp > WACC > ra (1-T) > Orp>rs > WACC > ra (1-T) More than one of the above is possible, Cronin Corp. has preferred stock that just paid an annual dividend of $5. It will continue to pay $5 each year into perpetuity. Their preferred stock has a par value of $80, but is currently selling for $100. The cost of Cronin's preferred stock is - and the most money a preferred shareholder would ever be able to get in the case of the firm's bankruptcy (liquidation) at some future time is 6.25%; $100 O 5.00%; $100 6.25%; $80 O 5.00%; $80 None of the above are correct. All other inputs constant, if a firm's tax rate increases and they use debt in their capital structure, their WACC will increase decrease. stay the same. True or False. Business risk is the risk to the form of being unable to cover required financial obligations such as interest payments. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts