Question: For all exercises, clearly and logically show your work (numbers AND units). Round all answers to two decimal places. 1. (1.5 points) Mary is single.

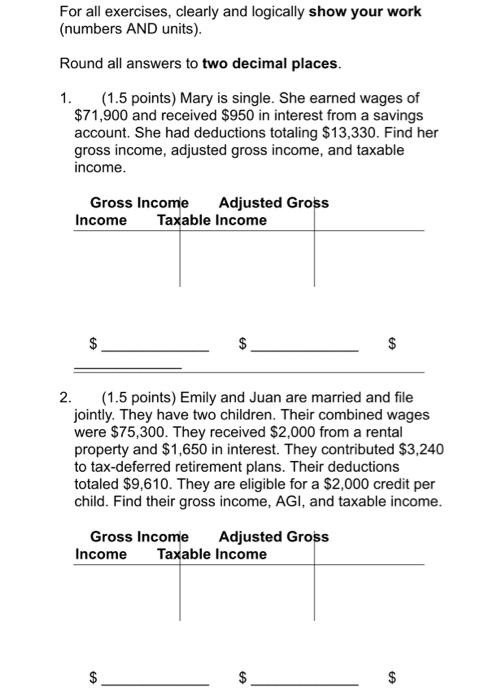

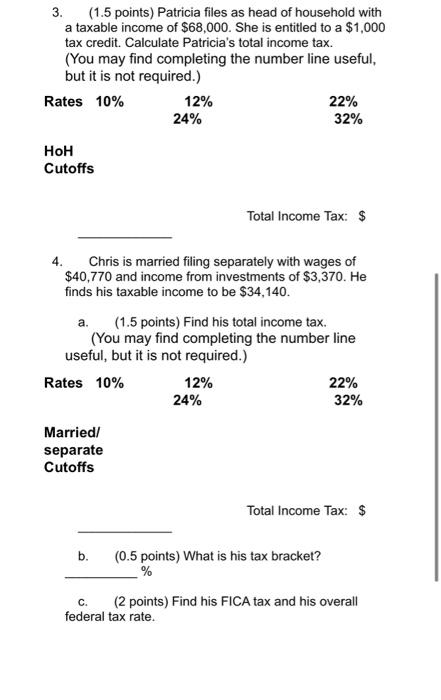

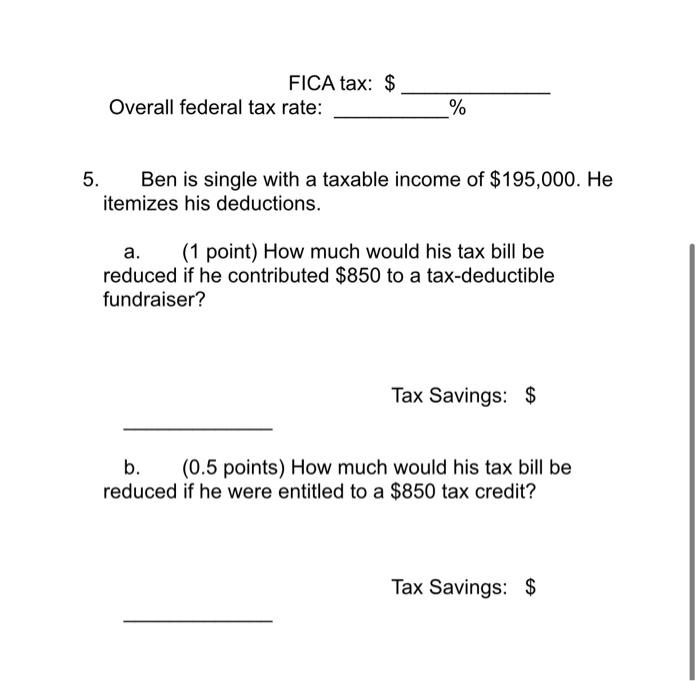

For all exercises, clearly and logically show your work (numbers AND units). Round all answers to two decimal places. 1. (1.5 points) Mary is single. She earned wages of $71,900 and received $950 in interest from a savings account. She had deductions totaling $13,330. Find her gross income, adjusted gross income, and taxable income. Gross Income Adjusted Gross Income Taxable income $ $ 2. (1.5 points) Emily and Juan are married and file jointly. They have two children. Their combined wages were $75,300. They received $2,000 from a rental property and $1,650 in interest. They contributed $3,240 to tax-deferred retirement plans. Their deductions totaled $9.610. They are eligible for a $2,000 credit per child. Find their gross income, AGI, and taxable income. Gross Income Adjusted Gross Income Taxable income $ $ $ 3. (1.5 points) Patricia files as head of household with a taxable income of $68,000. She is entitled to a $1,000 tax credit. Calculate Patricia's total income tax. (You may find completing the number line useful, but it is not required.) Rates 10% 12% 22% 24% 32% HoH Cutoffs Total Income Tax: $ 4. Chris is married filing separately with wages of $40,770 and income from investments of $3,370. He finds his taxable income to be $34,140. a. (1.5 points) Find his total income tax. (You may find completing the number line useful, but it is not required.) Rates 10% 12% 22% 24% 32% Married separate Cutoffs Total Income Tax: $ b. (0.5 points) What is his tax bracket? % C. (2 points) Find his FICA tax and his overall federal tax rate. FICA tax: $ Overall federal tax rate: % 5. Ben is single with a taxable income of $195,000. He itemizes his deductions. a. (1 point) How much would his tax bill be reduced if he contributed $850 to a tax-deductible fundraiser? Tax Savings: $ b. . (0.5 points) How much would his tax bill be reduced if he were entitled to a $850 tax credit? Tax Savings: $ For all exercises, clearly and logically show your work (numbers AND units). Round all answers to two decimal places. 1. (1.5 points) Mary is single. She earned wages of $71,900 and received $950 in interest from a savings account. She had deductions totaling $13,330. Find her gross income, adjusted gross income, and taxable income. Gross Income Adjusted Gross Income Taxable income $ $ 2. (1.5 points) Emily and Juan are married and file jointly. They have two children. Their combined wages were $75,300. They received $2,000 from a rental property and $1,650 in interest. They contributed $3,240 to tax-deferred retirement plans. Their deductions totaled $9.610. They are eligible for a $2,000 credit per child. Find their gross income, AGI, and taxable income. Gross Income Adjusted Gross Income Taxable income $ $ $ 3. (1.5 points) Patricia files as head of household with a taxable income of $68,000. She is entitled to a $1,000 tax credit. Calculate Patricia's total income tax. (You may find completing the number line useful, but it is not required.) Rates 10% 12% 22% 24% 32% HoH Cutoffs Total Income Tax: $ 4. Chris is married filing separately with wages of $40,770 and income from investments of $3,370. He finds his taxable income to be $34,140. a. (1.5 points) Find his total income tax. (You may find completing the number line useful, but it is not required.) Rates 10% 12% 22% 24% 32% Married separate Cutoffs Total Income Tax: $ b. (0.5 points) What is his tax bracket? % C. (2 points) Find his FICA tax and his overall federal tax rate. FICA tax: $ Overall federal tax rate: % 5. Ben is single with a taxable income of $195,000. He itemizes his deductions. a. (1 point) How much would his tax bill be reduced if he contributed $850 to a tax-deductible fundraiser? Tax Savings: $ b. . (0.5 points) How much would his tax bill be reduced if he were entitled to a $850 tax credit? Tax Savings: $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts