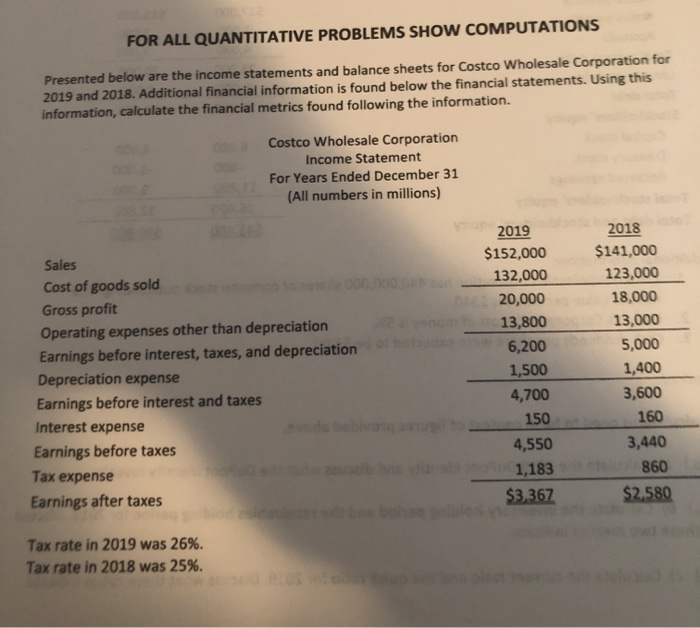

Question: FOR ALL QUANTITATIVE PROBLEMS SHOW COMPUTATIONS Presented below are the income statements and balance sheets for Costco Wholesale Corporation for 2019 and 2018. Additional financial

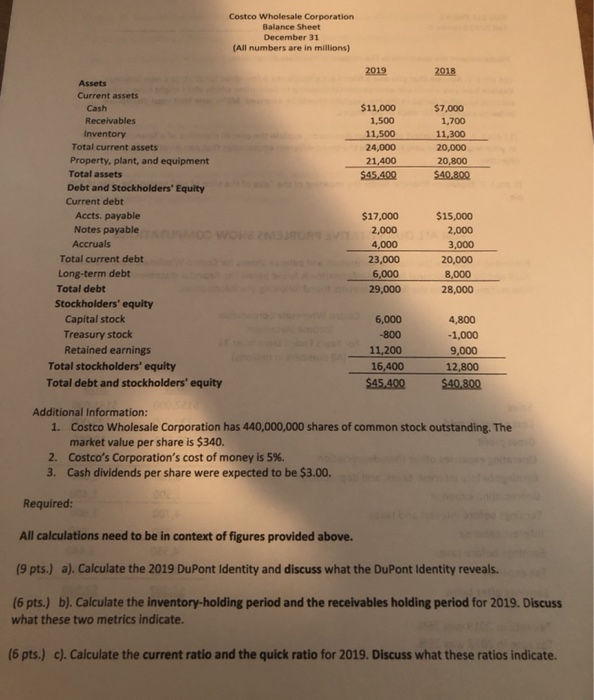

FOR ALL QUANTITATIVE PROBLEMS SHOW COMPUTATIONS Presented below are the income statements and balance sheets for Costco Wholesale Corporation for 2019 and 2018. Additional financial information is found below the financial statements. Using this information, calculate the financial metrics found following the information. Costco Wholesale Corporation Income Statement For Years Ended December 31 (All numbers in millions) Sales Cost of goods sold Gross profit Operating expenses other than depreciation Earnings before interest, taxes, and depreciation Depreciation expense Earnings before interest and taxes Interest expense Earnings before taxes Tax expense Earnings after taxes 2019 $152,000 132,000 20,000 13,800 6,200 1,500 4,700 150 4,550 1,183 $3,367 2018 $141,000 123,000 18,000 13,000 5,000 1,400 3,600 160 3,440 860 $2.580 Tax rate in 2019 was 26%. Tax rate in 2018 was 25%. Costco Wholesale Corporation Balance Sheet December 31 (All numbers are in millions) 2019 2018 $11,000 1,500 11,500 24,000 21,400 $45.400 $7,000 1,700 11,300 20,000 20,800 $40.800 Assets Current assets Cash Receivables Inventory Total current assets Property, plant, and equipment Total assets Debt and Stockholders' Equity Current debt Accts. payable Notes payable WOHNSON Accruals Total current debt Long-term debt Total debt Stockholders' equity Capital stock Treasury stock Retained earnings Total stockholders' equity Total debt and stockholders' equity $17,000 2,000 4,000 23,000 6,000 29,000 $15,000 2,000 3,000 20,000 8,000 28,000 6,000 -800 11,200 16,400 $45,400 4,800 -1,000 9,000 12,800 $40.800 Additional Information: 1. Costco Wholesale Corporation has 440,000,000 shares of common stock outstanding. The market value per share is $340. 2. Costco's Corporation's cost of money is 5%. 3. Cash dividends per share were expected to be $3.00. Required: All calculations need to be in context of figures provided above. (9 pts.) a). Calculate the 2019 DuPont Identity and discuss what the DuPont Identity reveals. (6 pts.) b). Calculate the inventory-holding period and the receivables holding period for 2019. Discuss what these two metrics indicate. (6 pts.) c). Calculate the current ratio and the quick ratio for 2019. Discuss what these ratios indicate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts