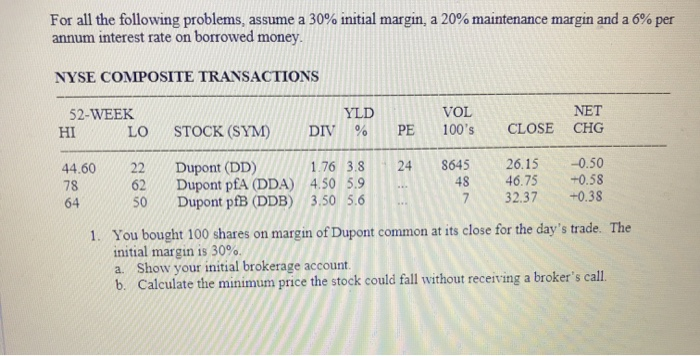

Question: For all the following problems, assume a 30% initial margin, a 20% maintenance margin and a 6% per annum interest rate on borrowed money. NYSE

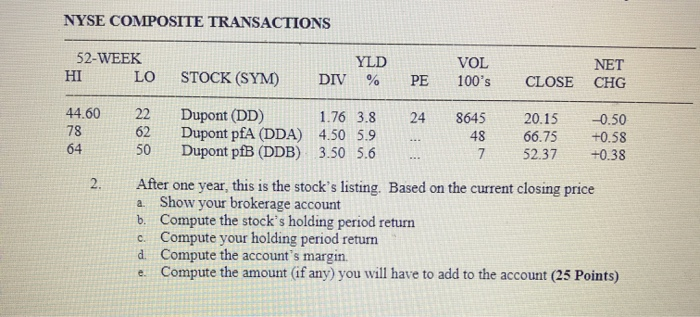

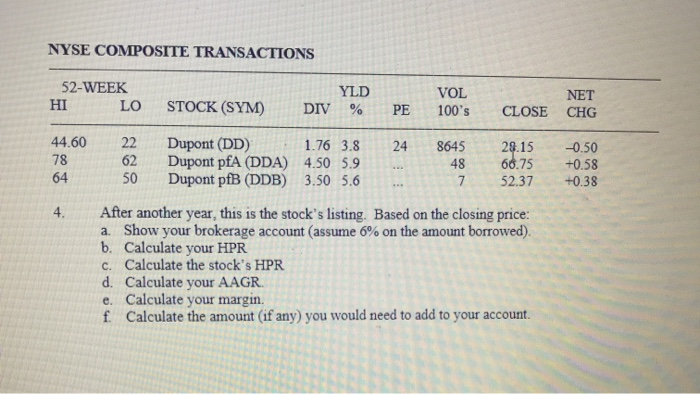

For all the following problems, assume a 30% initial margin, a 20% maintenance margin and a 6% per annum interest rate on borrowed money. NYSE COMPOSITE TRANSACTIONS 52-WEEK HI LO STOCK (SYM) DIV YLD % PE VOL 100's NET CLOSE CHG 24 8645 44.60 78 22 62 50 Dupont (DD) 1.76 3.8 Dupont pfA (DDA) 4.50 5.9 Dupont pfB (DDB) 3.50 5.6 48 26.15 46.75 32.37 -0.50 +0.58 +0.38 1. You bought 100 shares on margin of Dupont common at its close for the day's trade. The initial margin is 30%. a. Show your initial brokerage account. b. Calculate the minimum price the stock could fall without receiving a broker's call. NYSE COMPOSITE TRANSACTIONS 52-WEEK HI L O STOCK (SYM) DIV YLD % PE VOL 100's NET CLOSE CHG 44.60 24 22 62 50 Dupont (DD) 1.76 3.8 Dupont pfA (DDA) 4.50 5.9 Dupont pfB (DDB) 3.50 5.6 8645 48 2 0.15 66.75 52.37 -0.50 +0.58 +0.38 2. After one year, this is the stock's listing. Based on the current closing price a Show your brokerage account b. Compute the stock's holding period return c. Compute your holding period return d Compute the account's margin. e Compute the amount (if any) you will have to add to the account (25 Points) NYSE COMPOSITE TRANSACTIONS 52-WEEK HI L O STOCK (SYM) DIV YLD % PE VOL 100' s NET CLOSE CHG 24 8645 44.60 78 64 22 62 50 Dupont (DD) 1.76 3.8 Dupont pfA (DDA) 4.50 5.9 Dupont pfB (DDB) 3.50 5.6 28.15 60.75 52.37 -0.50 +0.58 +0.38 ... After another year, this is the stock's listing. Based on the closing price: a. Show your brokerage account (assume 6% on the amount borrowed). b. Calculate your HPR c. Calculate the stock's HPR d. Calculate your AAGR. e. Calculate your margin f. Calculate the amount (if any) you would need to add to your account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts