Question: For an S-CORP.. pleaseeeee Specifically, the following critical elements must be addressed: A. Prepare the appropriate schedule(s) and tax form(s) for the recommended business entity.

For an S-CORP.. pleaseeeee

Specifically, the following critical elements must be addressed:

A. Prepare the appropriate schedule(s) and tax form(s) for the recommended business entity.

B. Prepare the appropriate pages of Form 1040 including all relevant tax schedules and forms reflecting taxable income based on your calculations and the disposition of assets.

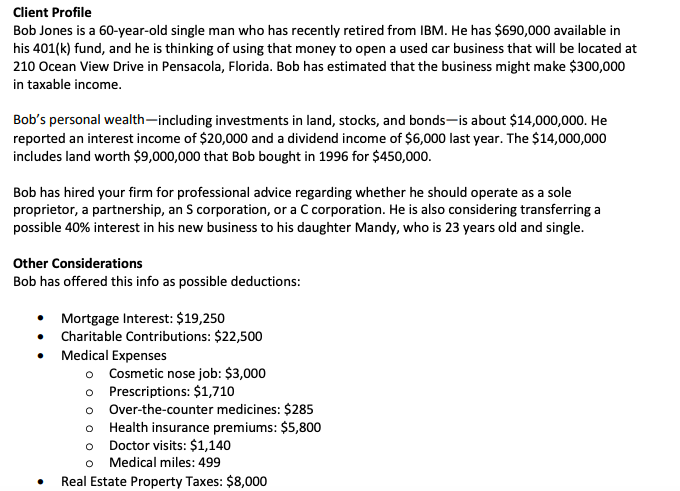

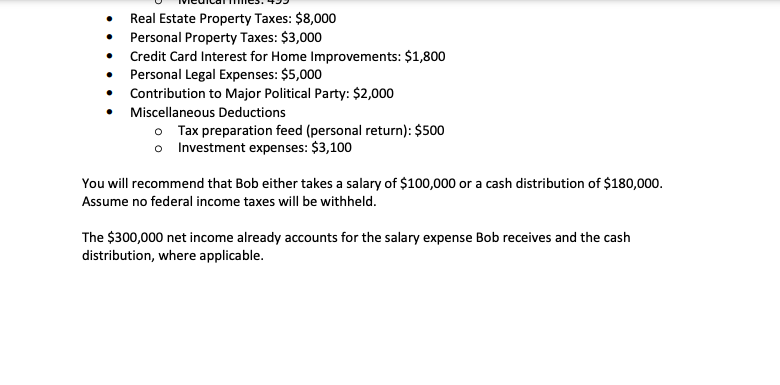

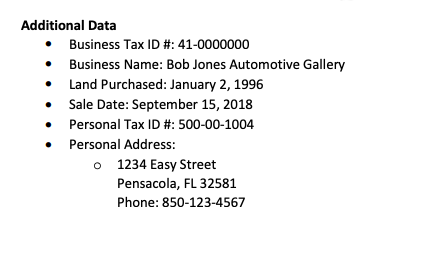

Client Profile Bob Jones is a 60-year-old single man who has recently retired from IBM. He has $690,000 available in his 401(k) fund, and he is thinking of using that money to open a used car business that will be located at 210 Ocean View Drive in Pensacola, Florida. Bob has estimated that the business might make $300,000 in taxable income. Bob's personal wealth-including investments in land, stocks, and bonds-is about $14,000,000. He reported an interest income of $20,000 and a dividend income of $6,000 last year. The $14,000,000 includes land worth $9,000,000 that Bob bought in 1996 for $450,000. Bob has hired your firm for professional advice regarding whether he should operate as a sole proprietor, a partnership, an S corporation, or a C corporation. He is also considering transferring a possible 40% interest in his new business to his daughter Mandy, who is 23 years old and single. Other Considerations Bob has offered this info as possible deductions: - Mortgage Interest: $19,250 - Charitable Contributions: $22,500 - Medical Expenses - Cosmetic nose job: $3,000 - Prescriptions: $1,710 - Over-the-counter medicines: \$285 - Health insurance premiums: $5,800 - Doctor visits: \$1,140 - Medical miles: 499 - Real Estate.Property Taxes: \$8.000 - Real Estate Property Taxes: \$8,000 - Personal Property Taxes: $3,000 - Credit Card Interest for Home Improvements: $1,800 - Personal Legal Expenses: \$5,000 - Contribution to Major Political Party: \$2,000 - Miscellaneous Deductions - Tax preparation feed (personal return): $500 - Investment expenses: $3,100 You will recommend that Bob either takes a salary of $100,000 or a cash distribution of $180,000. Assume no federal income taxes will be withheld. The $300,000 net income already accounts for the salary expense Bob receives and the cash distribution, where applicable. Additional Data - Business Tax ID #: 41-0000000 - Business Name: Bob Jones Automotive Gallery - Land Purchased: January 2, 1996 - Sale Date: September 15, 2018 - Personal Tax ID #: 500-00-1004 - Personal Address: - 1234 Easy Street Pensacola, FL 32581 Phone: 850-123-4567

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts