Question: for assignment #2 from Chapter 9, we will focus on Net Present Value (NPV). Company ABC needs to choose between 2 mutually exclusive projects (mutually

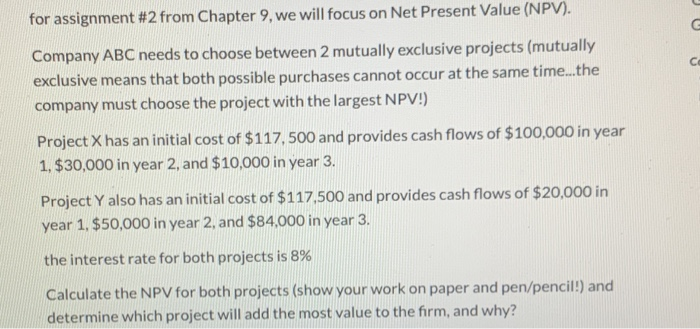

for assignment #2 from Chapter 9, we will focus on Net Present Value (NPV). Company ABC needs to choose between 2 mutually exclusive projects (mutually exclusive means that both possible purchases cannot occur at the same time...the company must choose the project with the largest NPV!) Project X has an initial cost of $117,500 and provides cash flows of $100,000 in year 1, $30,000 in year 2, and $10,000 in year 3. Project Y also has an initial cost of $117,500 and provides cash flows of $20,000 in year 1, $50,000 in year 2, and $84,000 in year 3. the interest rate for both projects is 8% Calculate the NPV for both projects (show your work on paper and pen/pencil!) and determine which project will add the most value to the firm, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts