Question: For Bears Enterprises, what is the total equity valuation using the growing dividend methodology? Question 26 options: $1.2 billion $300 million $120 million $1.5 billion

For Bears Enterprises, what is the total equity valuation using the growing dividend methodology?

Question 26 options:

|

| $1.2 billion |

|

| $300 million |

|

| $120 million |

|

| $1.5 billion |

|

| $1.32 billion |

Question 27 (3 points)

For Bears Enterprises, the equity valuation using Book Value is? Round to the nearest million and use the $ symbol.....for example, $238.7 million should be answered as $239.

Question 27 options:

Question 28 (3 points)

For Bears Enterprises, what is the equity value using the Liquidation value methodology?

Question 28 options:

|

| $50 million |

|

| $275 million |

|

| $900 million |

|

| $600 million |

|

| $150 million |

|

| $300 million |

Question 29 (5 points)

For Bears Enterprises, what is the equity valuation using the market value methodology?

Round to the nearest $ million...write your answer in the form of $354 (do not use "million" or "mm" or "000,000".

Question 29 options:

Question 30 (3 points)

For Bears Enterprises, what is the equity value using the PE methodology?

Question 30 options:

|

| $800mm |

|

| $900mm |

|

| $277.8 million |

|

| $450mm |

|

| $150mm |

Question 31 (4 points)

For Bears Enterprises, what is the equity valuation using the EBITDA multiple methodology?

Question 31 options:

|

| $204.7 million |

|

| $354.7 million |

|

| $254.7 million |

|

| $400mm |

|

| $900 million |

|

| $578.8mm |

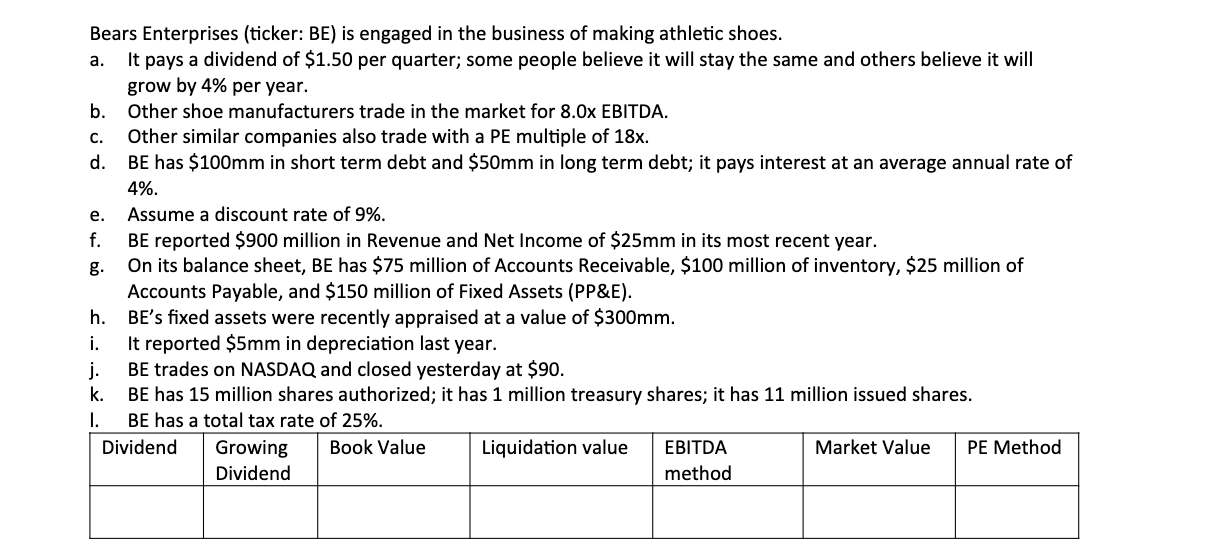

Bears Enterprises (ticker: BE) is engaged in the business of making athletic shoes. a. It pays a dividend of $1.50 per quarter; some people believe it will stay the same and others believe it will grow by 4% per year. b. Other shoe manufacturers trade in the market for 8.0x EBITDA. c. Other similar companies also trade with a PE multiple of 18x. d. BE has $100mm in short term debt and $50mm in long term debt; it pays interest at an average annual rate of 4%. e. Assume a discount rate of 9%. f. BE reported $900 million in Revenue and Net Income of $25mm in its most recent year. g On its balance sheet, BE has $75 million of Accounts Receivable, $100 million of inventory, $25 million of Accounts Payable, and $150 million of Fixed Assets (PP&E). h. BE's fixed assets were recently appraised at a value of $300mm. i. It reported $5mm in depreciation last year. j. BE trades on NASDAQ and closed yesterday at $90. k. BE has 15 million shares authorized; it has 1 million treasury shares; it has 11 million issued shares. I. BE has a total tax rate of 25%. Dividend Growing Book Value Liquidation value EBITDA Market Value PE Method Dividend method Bears Enterprises (ticker: BE) is engaged in the business of making athletic shoes. a. It pays a dividend of $1.50 per quarter; some people believe it will stay the same and others believe it will grow by 4% per year. b. Other shoe manufacturers trade in the market for 8.0x EBITDA. c. Other similar companies also trade with a PE multiple of 18x. d. BE has $100mm in short term debt and $50mm in long term debt; it pays interest at an average annual rate of 4%. e. Assume a discount rate of 9%. f. BE reported $900 million in Revenue and Net Income of $25mm in its most recent year. g On its balance sheet, BE has $75 million of Accounts Receivable, $100 million of inventory, $25 million of Accounts Payable, and $150 million of Fixed Assets (PP&E). h. BE's fixed assets were recently appraised at a value of $300mm. i. It reported $5mm in depreciation last year. j. BE trades on NASDAQ and closed yesterday at $90. k. BE has 15 million shares authorized; it has 1 million treasury shares; it has 11 million issued shares. I. BE has a total tax rate of 25%. Dividend Growing Book Value Liquidation value EBITDA Market Value PE Method Dividend method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts