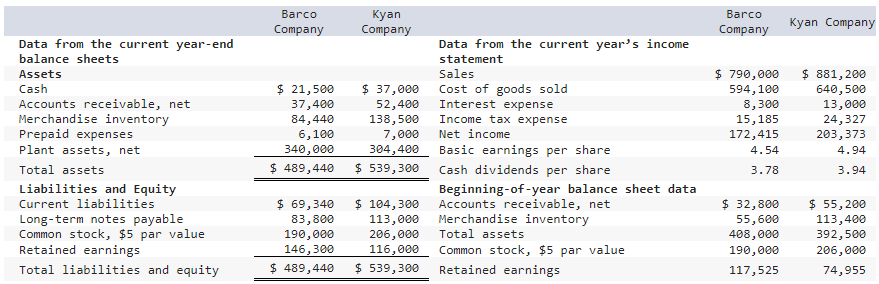

Question: For both companies compute the ( a ) profit margin ratio, ( b ) total asset turnover, ( c ) return on total assets, and

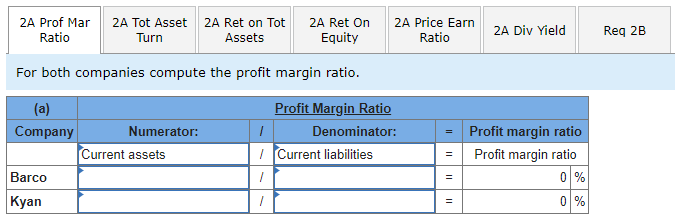

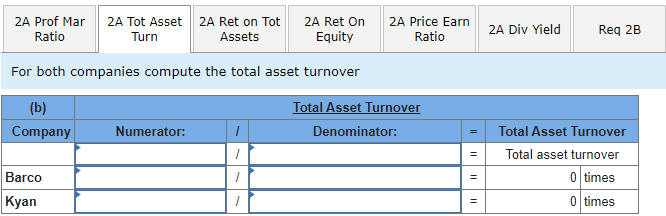

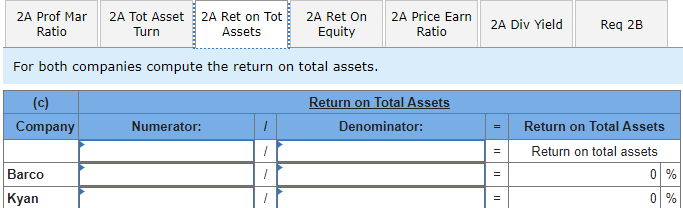

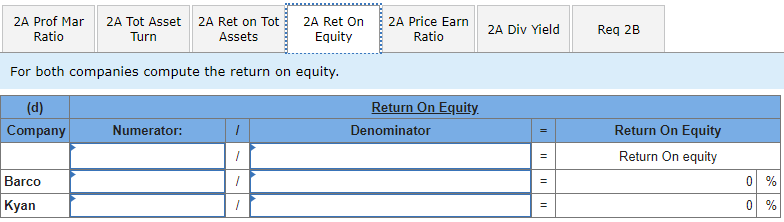

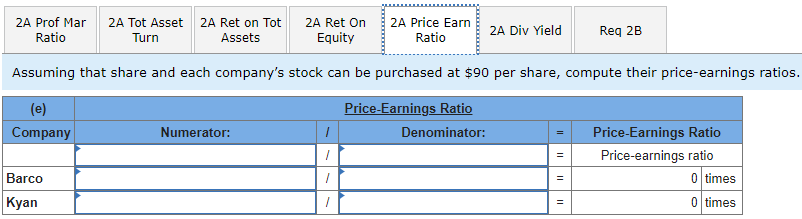

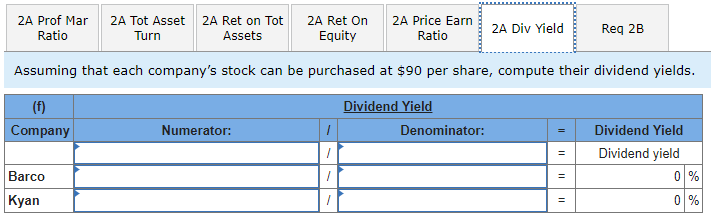

For both companies compute the (a) profit margin ratio, (b) total asset turnover, (c) return on total assets, and (d) return on equity. Assuming that each companys stock can be purchased at $90 per share, compute their (e) price-earnings ratios and (f) dividend yields.

Identify which companys stock you would recommend as the better investment.

Please us the templates below. Thank you!!

\begin{tabular}{|c|c|c|c|c|c|} \hline & \begin{tabular}{l} Barco \\ Company \end{tabular} & \begin{tabular}{l} Kyan \\ Company \end{tabular} & & \begin{tabular}{l} Barco \\ Company \end{tabular} & Kyan Company \\ \hline \begin{tabular}{l} Data from the current year-end \\ balance sheets \end{tabular} & & & \begin{tabular}{l} Data from the current year's income \\ statement \end{tabular} & & \\ \hline Assets & & & Sales & $790,000 & $881,200 \\ \hline Cash & $21,500 & $37,000 & Cost of goods sold & 594,100 & 640,500 \\ \hline Accounts receivable, net & 37,400 & 52,400 & Interest expense & 8,300 & 13,000 \\ \hline Merchandise inventory & 84,440 & 138,500 & Income tax expense & 15,185 & 24,327 \\ \hline Prepaid expenses & 6,100 & 7,000 & Net income & 172,415 & 203,373 \\ \hline Plant assets, net & 340,000 & 304,400 & Basic earnings per share & 4.54 & 4.94 \\ \hline Total assets & $489,440 & $539,300 & Cash dividends per share & 3.78 & 3.94 \\ \hline Liabilities and Equity & & & Beginning-of-year balance sheet data & & \\ \hline Current liabilities & $69,340 & $104,300 & Accounts receivable, net & $32,800 & $55,200 \\ \hline Long-term notes payable & 83,800 & 113,000 & Merchandise inventory & 55,600 & 113,400 \\ \hline Common stock, $5 par value & 190,000 & 206,000 & Total assets & 408,000 & 392,500 \\ \hline Retained earnings & 146,300 & 116,000 & Common stock, \$5 par value & 190,000 & 206,000 \\ \hline Total liabilities and equity & $489,440 & $539,300 & Retained earnings & 117,525 & 74,955 \\ \hline \end{tabular} For both companies compute the profit margin ratio. For both companies compute the total asset turnover For both companies compute the return on total assets. For both companies compute the return on equity. Assuming that share and each company's stock can be purchased at $90 per share, compute their price-earnings Assuming that each company's stock can be purchased at $90 per share, compute their dividend yields. dentify which company's stock you would recommend as the better investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts