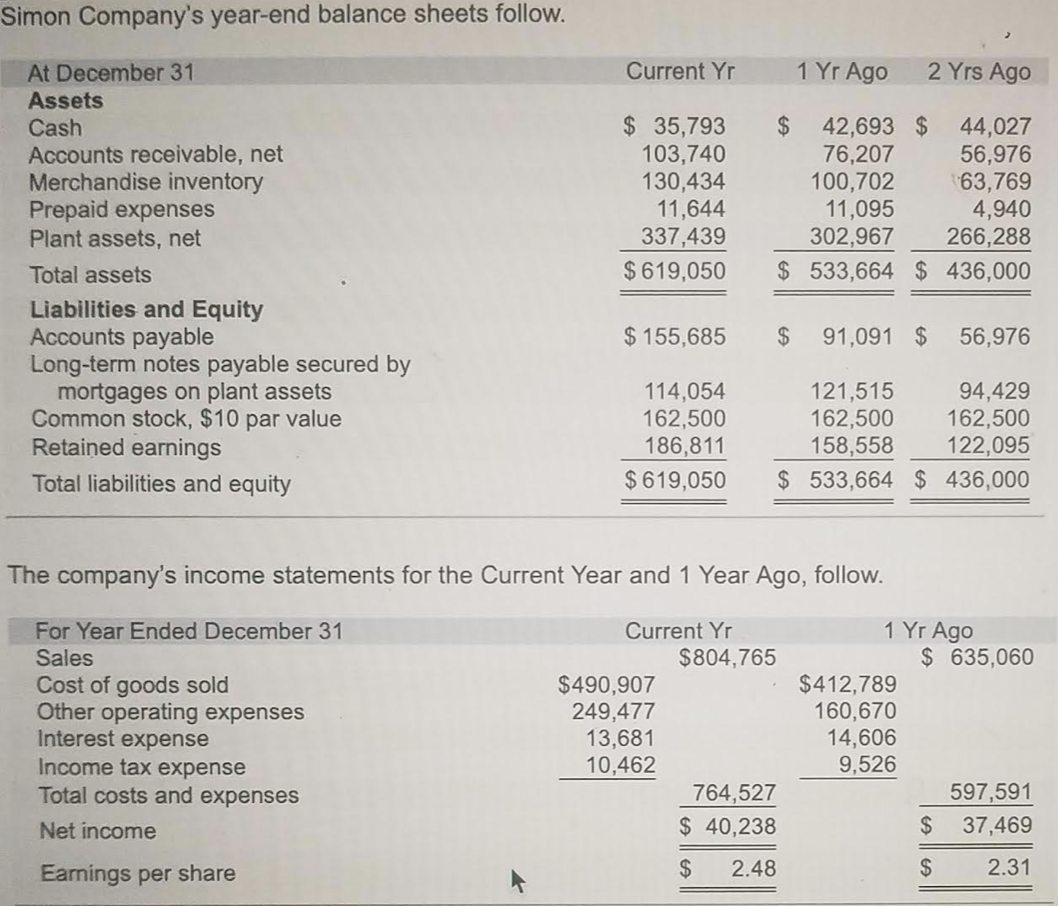

Question: For both the current year and 1 year ago, compute the following ratio 1. total debt ratio of the recent two years 2. debt-to-equity ratio

For both the current year and 1 year ago, compute the following ratio

1. total debt ratio of the recent two years

2. debt-to-equity ratio of the recent 2 years

3 times interest earned of the recent 2 years

4. based on times interest earned, is the company more or less risky for creditors in current year vs. 1 year ago?

Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 35,793 103,740 130,434 11,644 337,439 $ 619,050 $ 42,693 $ 44,027 76,207 56,976 100,702 63,769 11,095 4,940 302,967 266,288 $ 533,664 $ 436,000 $ 155,685 $ 91,091 $ 56,976 114,054 162,500 186,811 $ 619,050 121,515 94,429 162,500 162,500 158,558 122,095 $ 533,664 $ 436,000 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $804,765 $490,907 249,477 13,681 10,462 764,527 $ 40,238 1 Yr Ago $ 635,060 $412,789 160,670 14,606 9,526 597,591 $ 37,469 | Earnings per share $ 2.48 $ 2.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts