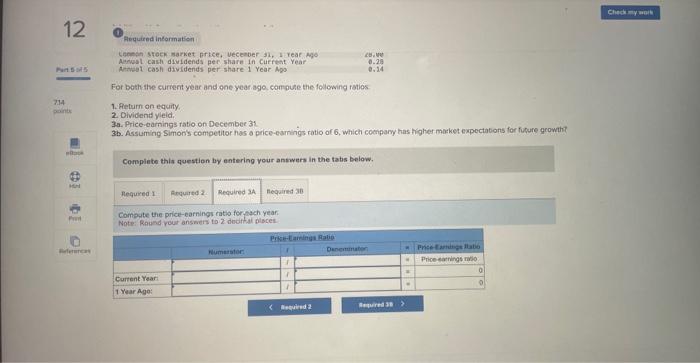

Question: For both the current year and one year ago, compute the following rasios: 1. Return on equity. 2. Dividend yield. 30. Price-earnings ratio on December

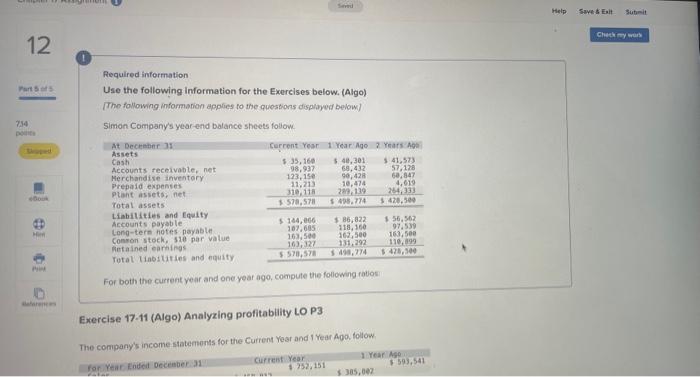

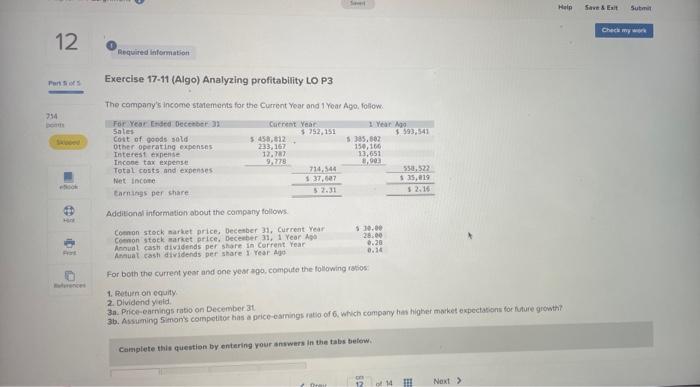

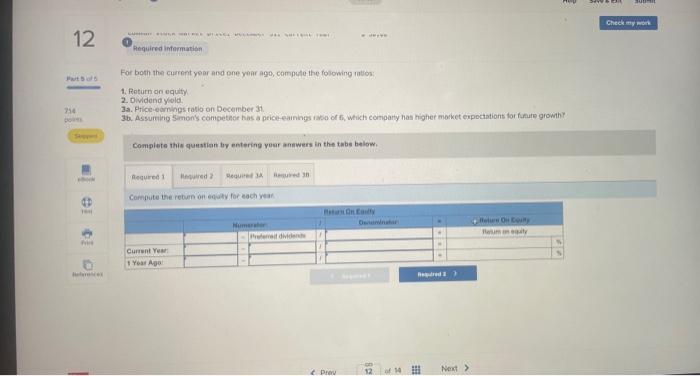

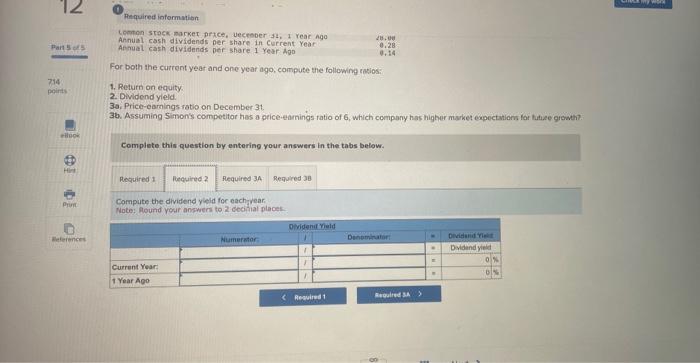

For both the current year and one year ago, compute the following rasios: 1. Return on equity. 2. Dividend yield. 30. Price-earnings ratio on December 31 . 36. Assuming Simon's competitor has a price-earnings ratio of 6 , which company has higher maket expectations for tutuee groweh? Complete this question by entering your answers in the tabs below. Compute the dividend yleid foc eechyrear. Note: lound your ancwers to 2 ecciatial places. Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] Simon Company's year-end balance sheets foliow. For both the current year and one year ago, compute the following ratiosi Exercise 17.11 (Algo) Analyzing profitablity LO P3 The combany's income statements for the Current Year and I Year Apo, follow. For both the current year and one year ago, compule the folowing ration: 1. Return an equity 2. Dividend yold. 3a. Price ocinhes ratio on December 31 Complete this question by entering yoar annwers in the tabs below. Compute the rebuen on equiv for each weak For beth the current year and one year ago, compuse the following fotios. 1. Return on equily. 2. Dividents yleid. 3a. Price-earnings ratio on December 31 3b. Assuming Simon's competitor has a price-earnings ratio of 6 , which coenpany has higher makiket expectabions for fucure growtht Complete this question by entering your answers in the tabs below. Compute the price-earnings ratio foryach year: Note: Raund vour answers to 2 dedifal olscel. Exercise \\( 17-11 \\) (Algo) Analyzing profitability LO P3 The campany's income staremants for the Current Year and 1 Yoar Ago, follow. Additonal information about the company follows. For both the current yosr and one year apo, compite the following ratios 1. Returnon equity 2. Dividend yleid 3. Price-earnings rabio on December 31 Ceniplete this question by entering your answers in the tabs betow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts