Question: For C++ in 2017 Visual Studio. It should be in harder version, so that it allows the calculation to be repeated as often as the

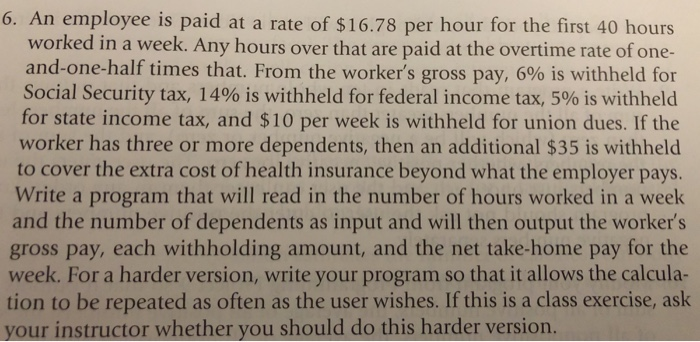

6. An employee is paid at a rate of $16.78 per hour for the first 40 hours worked in a week. Any hours over that are paid at the overtime rate of one- and-one-half times that. From the worker's gross pay, 6% is withheld for Social Security tax, 14% is withheld for federal income tax, 5% is withheld for state income tax, and $10 per week is withheld for union dues. If the worker has three or more dependents, then an additional $35 is withheld to cover the extra cost of health insurance beyond what the employer pays. Write a program that will read in the number of hours worked in a week and the number of dependents as input and will then output the worker's gross pay, each withholding amount, and the net take-home pay for the week. For a harder version, write your program so that it allows the calcula- tion to be repeated as often as the user wishes. If this is a class exercise, ask your instructor whether you should do this harder version

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts