Question: For canada 2 4 - 2 5 taxation rules. Please use tax rules for canada. Please refer to pics . Instructions Submit to: The Individual

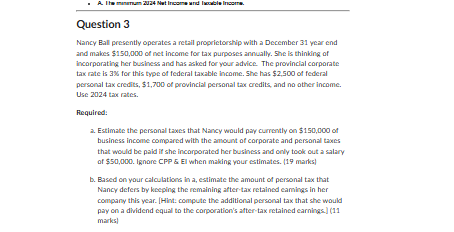

For canada taxation rules. Please use tax rules for canada. Please refer to pics Instructions Submit to: The Individual Assignment submission folder. Submission folders can be accessed by selecting Course Tools and then Assignments on the course navigation bar. Description This assignment comprises of three questions. Students are required to calculate the overall tax liability for a corporation from net income to overall liability after dividend refund; calculate net and taxable income for another corporation and compare the salary versus dividend scenario for a taxpayer considering incorporating their sole proprietorship business. All the steps you saw in your studies during weeks to will be recalled completing this assignment. Some of your level learning regarding capital cost allowance will also be recalled. Specific requirements are noted but students are expected to show workings where an amount was not identified in the requirements but was necessary to arrive at another answer specified. You should organize you solution so a clear flow of your steps and calculations are seen and understood. Students may use table format to organize their work. Rationale This assignment will evaluate the following Course Learning Outcomes: CLO: Calculate taxable income and federal tax payable for the corporation CL: Determine the proper compensation plan for a shareholdermanager Directions Using the case details provided below, calculate the requirements noted at the end of each case. This assignment is to be your own work and completed based on the resources provided in your learning for weeks The assignment should be completed using a word or excel file which should be submitted in the individual assignment folder. Guidelines on AI Use The assignment should be completed without the use of AI How Your Assignment Will be Graded Grades are indicated for each of the requirements identified. The assignment is being marked out of points; pay attention to the allocation of points for each of the requirements.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock