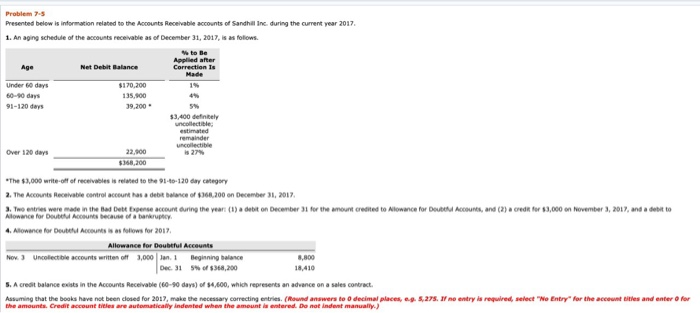

Question: for clear numbers Problem 7-5 Presented below is information relabed to the Accounts Receivable accounts of Sandhill Inc during the curent year 2017. 1. An

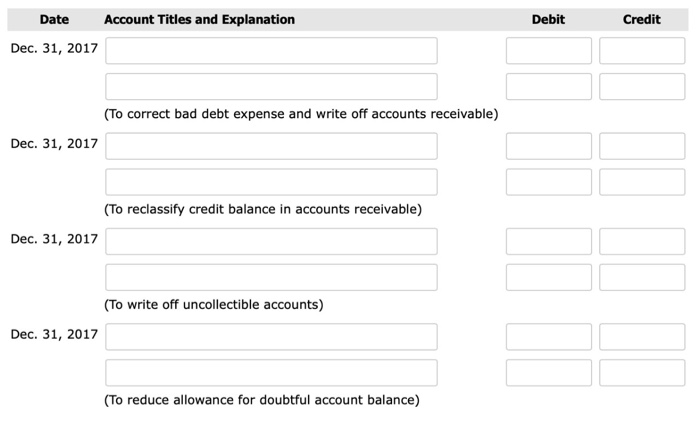

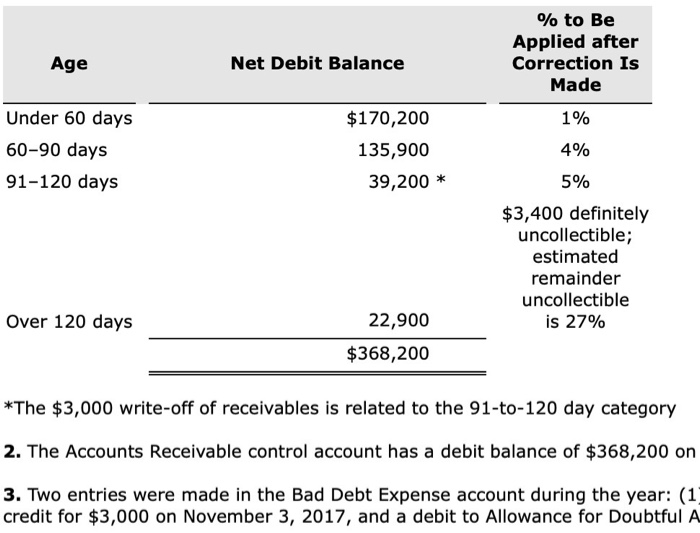

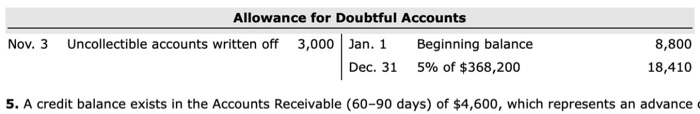

Problem 7-5 Presented below is information relabed to the Accounts Receivable accounts of Sandhill Inc during the curent year 2017. 1. An aging schedule of the accounts receivable as of December 31, 2017, is as folows. to Be Applied after Correction Is Net Debit Balance Age Made $170.200 Under 60 days 1% 60-90 days 135,900 4% 91-120 days 39.200 S% 3,400 definitely uncollectible, estimated remainder uncollectible is 27 % 22,900 Over 120 days $368,200 The $3,000 write-off of receivables is related to the 91-t0-120 day category 2. The Accounts Receivable control account has a debit balance of $368,200 on December 31, 2017 .Two entries were made in the Bad Dett Expense account during the year: (1) a detbit on December 31 for the amount credited to Alowance for Doute Accounts, and (2)a credt for $3,000 on hovember 3, 2017, and a debit to Alowance for Douted Accounts because of a bankruptcy 4. Allowance for Deuted Accounts is as foliows for 2017 Allowance for Doubtful Accounts Nov. 3 Uncollectible accounts written off 3,000 Jan. 1 Beginning balance 8,800 Dec. 31 5% of $368,200 18,410 s.A credit balance exists in the Accounts Receivable (60-90 days) of $4,600, which represents an advance on a sales contract. Assuming that the books have not been closed for 2017, make the necessary correcting entries. (Round answers to 0 decimal places, ep. 5,27s. 1H no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automaticaly indented when the amount is entered. Do not indent manualy.) Account Titles and Explanation Debit Credit Date Dec. 31, 2017 (To correct bad debt expense and write off accounts receivable) Dec. 31, 2017 (To reclassify credit balance in accounts receiva ble) Dec. 31, 2017 (To write off uncollectible accounts) Dec. 31, 2017 (To reduce allowance for doubtful account balance) % to Be Applied after Correction Is Made Net Debit Balance Age Under 60 days $170,200 1% 60-90 days 4% 135,900 91-120 days 39,200 * 5% $3,400 definitely uncollectible; estimated remainder uncollectible Over 120 days 22,900 is 27% $368,200 *The $3,000 write-off of receivables is related to the 91-to-120 day category 2. The Accounts Receivable control account has a debit balance of $368,200 on 3. Two entries were made in the Bad Debt Expense account during the year: (1) credit for $3,000 on November 3, 2017, and a debit to Allowance for Doubtful A Allowance for Doubtful Accounts Uncollectible accounts written off 3,000| Jan. 1 Nov. 3 Beginning balance 8,800 5% of $368,200 Dec. 31 18,410 5. A credit balance exists in the Accounts Receivable (60-90 days) of $4,600, which represents an advance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts