Question: For Collins's Costly Cosmetics, LLP., the analyst Derek, using monthly EXCESS returns over the past 7 years, has estimated the Single Factor model, finding the

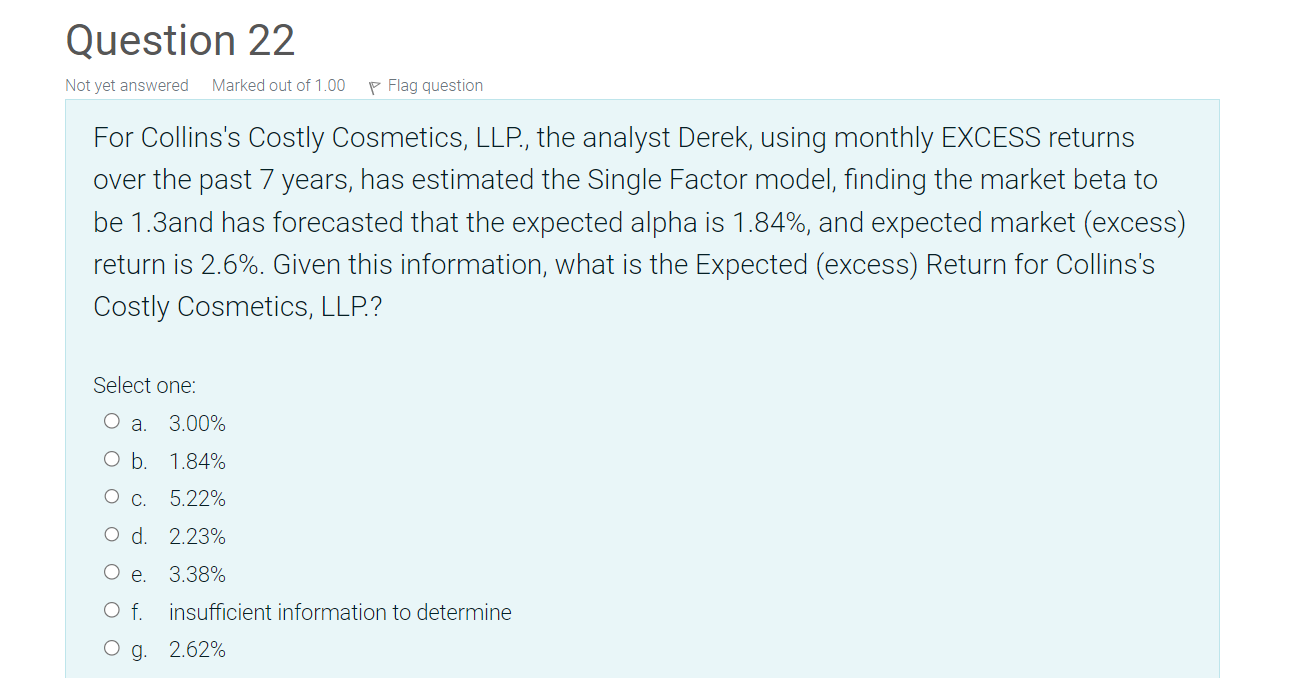

For Collins's Costly Cosmetics, LLP., the analyst Derek, using monthly EXCESS returns over the past 7 years, has estimated the Single Factor model, finding the market beta to be 1.3and has forecasted that the expected alpha is 1.84\%, and expected market (excess) return is 2.6%. Given this information, what is the Expected (excess) Return for Collins's Costly Cosmetics, LLP.? Select one: a. 3.00% b. 1.84% c. 5.22% d. 2.23% e. 3.38% f. insufficient information to determine g. 2.62%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock