Question: For deferred tax, please add a FTA column between carrying amount and FDA when making the Deferred tax worksheet if there is any, thank you.

For deferred tax, please add a FTA column between carrying amount and FDA when making the Deferred tax worksheet if there is any, thank you.

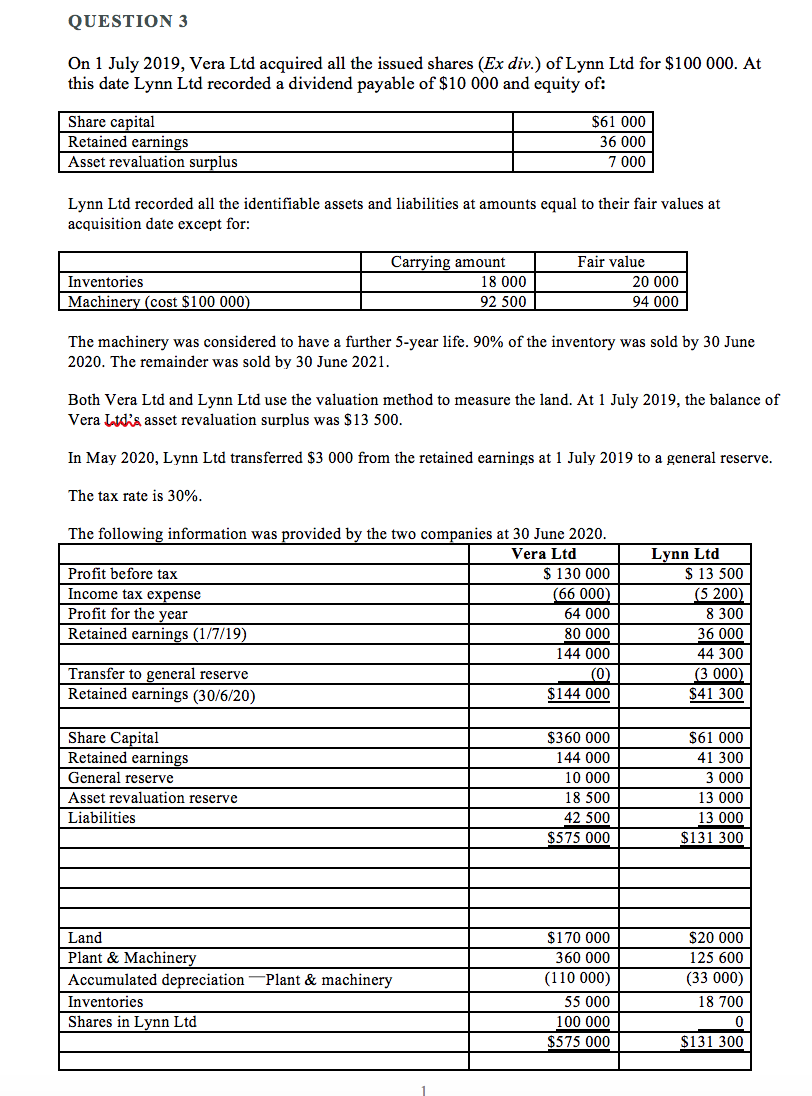

QUESTION 3 On 1 July 2019, Vera Ltd acquired all the issued shares (Ex div.) of Lynn Ltd for $100 000. At this date Lynn Ltd recorded a dividend payable of $10 000 and equity of: Share capital $61 000 Retained earnings 36 000 Asset revaluation surplus 7 000 Lynn Ltd recorded all the identifiable assets and liabilities at amounts equal to their fair values at acquisition date except for: Carrying amount Fair value Inventories 18 000 20 000 Machinery (cost $100 000) 92 500 94 000 The machinery was considered to have a further 5-year life. 90% of the inventory was sold by 30 June 2020. The remainder was sold by 30 June 2021. Both Vera Lid and Lynn Lid use the valuation method to measure the land. At 1 July 2019, the balance of Vera Lotd's asset revaluation surplus was $13 500. In May 2020, Lynn Ltd transferred $3 000 from the retained earnings at 1 July 2019 to a general reserve. The tax rate is 30%. The following information was provided by the two companies at 30 June 2020 Vera Ltd Lynn Ltd Profit before tax $ 130 000 $ 13 500 Income tax expense 66 000) (5 200) Profit for the year 4 000 3 300 Retained earnings (1/7/19) 80 000 36 000 144 000 44 300 Transfer to general reserve 0) 3 000) Retained earnings (30/6/20) $144 000 $41 300 Share Capital $360 000 $61 000 Retained earnings 144 000 41 300 General reserve 10 000 3 000 Asset revaluation reserve 8 500 13 000 Liabilities 42 500 13 000 $575 000 $131 300 Land $170 000 $20 000 Plant & Machinery 360 000 125 600 Accumulated depreciation -Plant & machinery (110 000) (33 000) Inventories 55 000 18 700 Shares in Lynn Ltd 100 000 $575 000 $131 300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts