Question: For discussion: Answer the following. 1. Define and identify the components of: a. Operating cycle b. Cash conversion cycle 2. What is the impact of

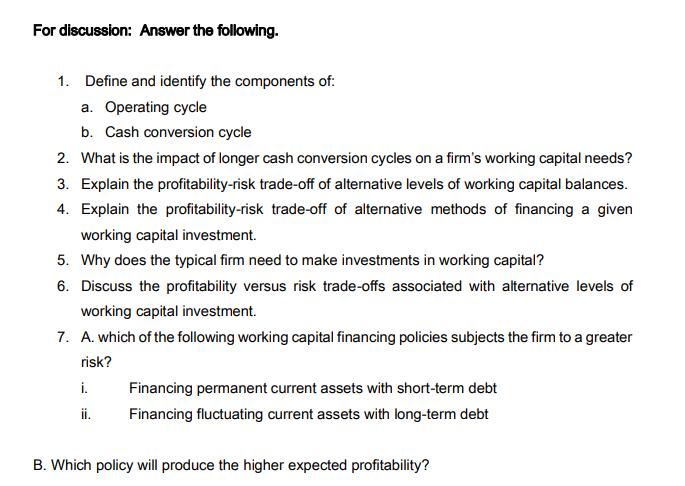

For discussion: Answer the following. 1. Define and identify the components of: a. Operating cycle b. Cash conversion cycle 2. What is the impact of longer cash conversion cycles on a firm's working capital needs? 3. Explain the profitability-risk trade-off of alternative levels of working capital balances. 4. Explain the profitability-risk trade-off of alternative methods of financing a given working capital investment. 5. Why does the typical firm need to make investments in working capital? 6. Discuss the profitability versus risk trade-offs associated with alternative levels of working capital investment 7. A. which of the following working capital financing policies subjects the firm to a greater risk? i. Financing permanent current assets with short-term debt ii. Financing fluctuating current assets with long-term debt B. Which policy will produce the higher expected profitability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts