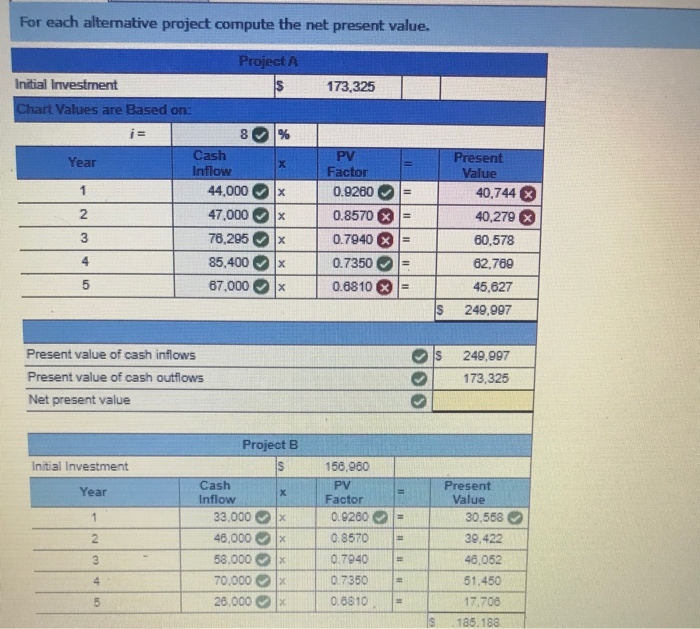

Question: For each alternative project compute the net present value. 173,325 PV Project A Initial Investment Chart Values are Based on: 8 % Cash Year Inflow

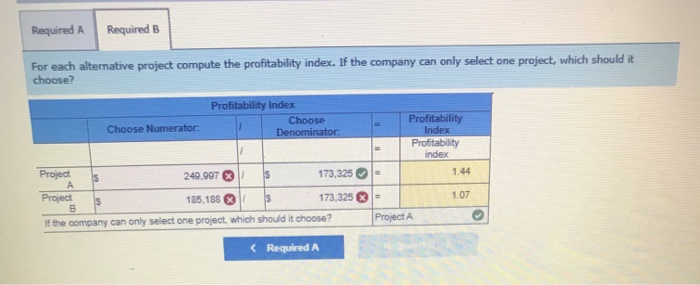

For each alternative project compute the net present value. 173,325 PV Project A Initial Investment Chart Values are Based on: 8 % Cash Year Inflow 44,000 X 47.000 78.295 x 85,400x 87.000 x WN Factor 0.9260 0.8570 0.7940 0.7350 0.6810 = = = Present Value 40,744 x 40,279 60,578 62,769 45,627 249,997 = $ s Present value of cash inflows Present value of cash outflows Net present value 240,997 173,325 Initial Investment Year Project B $ Cash Inflow 33.000 46,000 58.000 70,000 26,000 156,960 PV Factor 0.9260- 0.8570 0.7940 0.7350 0.6810 Present Value 30,558 39.422 46,052 51,450 17,706 185,188 $ Required A Required B For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Profitability Index Choose Denominator: Choose Numerator: Project 240,9973 173,325 Proiect 185,188 X 173,325 If the company can only select one project, which should it choose? Profitability Index Profitability index - 1.44 - 107 Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts