Question: For each case A, B, C, and D. Prepare entries to record the transactions using goodwill method. Show your calculations. Ahmed and Salim establish a

For each case A, B, C, and D. Prepare entries to record the transactions using goodwill method. Show your calculations.

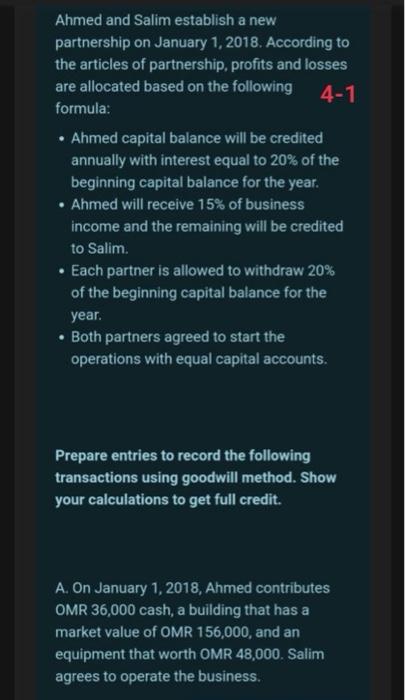

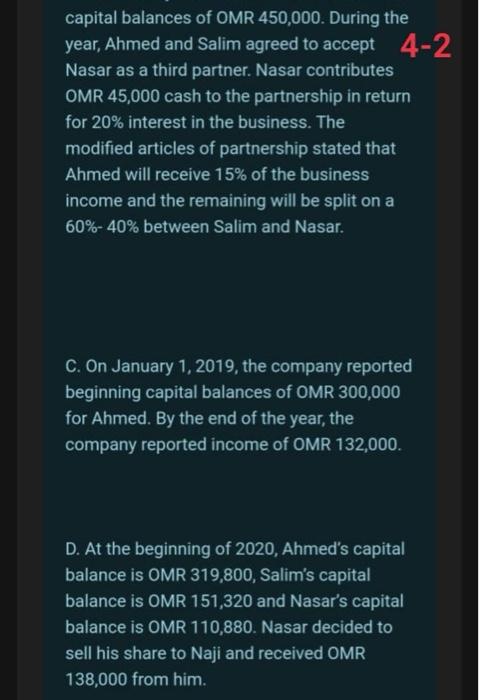

Ahmed and Salim establish a new partnership on January 1, 2018. According to the articles of partnership, profits and losses are allocated based on the following formula: - Ahmed capital balance will be credited annually with interest equal to 20% of the beginning capital balance for the year. - Ahmed will receive 15% of business income and the remaining will be credited to Salim. - Each partner is allowed to withdraw 20% of the beginning capital balance for the year. - Both partners agreed to start the operations with equal capital accounts. Prepare entries to record the following transactions using goodwill method. Show your calculations to get full credit. A. On January 1, 2018, Ahmed contributes OMR 36,000 cash, a building that has a market value of OMR 156,000, and an equipment that worth OMR 48,000 . Salim agrees to operate the business. capital balances of OMR 450,000 . During the year, Ahmed and Salim agreed to accept 4-2 Nasar as a third partner. Nasar contributes OMR 45,000 cash to the partnership in return for 20% interest in the business. The modified articles of partnership stated that Ahmed will receive 15% of the business income and the remaining will be split on a 60%40% between Salim and Nasar. C. On January 1, 2019, the company reported beginning capital balances of OMR 300,000 for Ahmed. By the end of the year, the company reported income of OMR 132,000. D. At the beginning of 2020, Ahmed's capital balance is OMR 319,800 , Salim's capital balance is OMR 151,320 and Nasar's capital balance is OMR 110,880 . Nasar decided to sell his share to Naji and received OMR 138,000 from him

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts