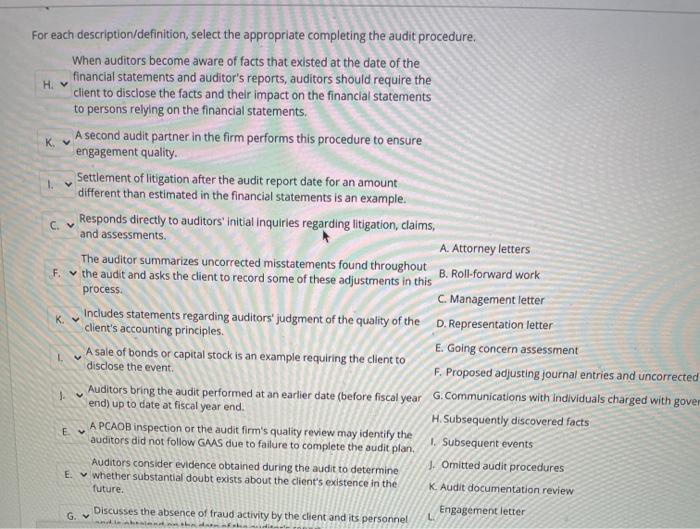

Question: For each description/definition, select the appropriate completing the audit procedure, When auditors become aware of facts that existed at the date of the financial statements

For each description/definition, select the appropriate completing the audit procedure, When auditors become aware of facts that existed at the date of the financial statements and auditor's reports, auditors should require the H. client to disclose the facts and their impact on the financial statements to persons relying on the financial statements, A second audit partner in the firm performs this procedure to ensure K. v engagement quality. Settlement of litigation after the audit report date for an amount 1. different than estimated in the financial statements is an example. Responds directly to auditors initial inquiries regarding litigation, claims, C. v and assessments A. Attorney letters The auditor summarizes uncorrected misstatements found throughout B. Roll-forward work F. the audit and asks the client to record some of these adjustments in this process. C. Management letter Includes statements regarding auditors' judgment of the quality of the D. Representation letter K. v client's accounting principles. E. Going concern assessment A sale of bonds or capital stock is an example requiring the client to disclose the event. F. Proposed adjusting journal entries and uncorrected Auditors bring the audit performed at an earlier date (before fiscal year G. Communications with individuals charged with gover end) up to date at fiscal year end. H. Subsequently discovered facts A PCAOB inspection or the audit firm's quality review may identify the auditors did not follow GAAS due to failure to complete the audit plan. 1. Subsequent events Auditors consider evidence obtained during the audit to determine J. Omitted audit procedures Ev whether substantial doubt exists about the client's existence in the K. Audit documentation review future. Discusses the absence of fraud activity by the client and its personnel Engagement letter G. v E A. For each description/definition, select the appropriate completing the audit procedure, When auditors become aware of facts that existed at the date of the financial statements and auditor's reports, auditors should require the H. client to disclose the facts and their impact on the financial statements to persons relying on the financial statements, A second audit partner in the firm performs this procedure to ensure K. v engagement quality. Settlement of litigation after the audit report date for an amount 1. different than estimated in the financial statements is an example. Responds directly to auditors initial inquiries regarding litigation, claims, C. v and assessments A. Attorney letters The auditor summarizes uncorrected misstatements found throughout B. Roll-forward work F. the audit and asks the client to record some of these adjustments in this process. C. Management letter Includes statements regarding auditors' judgment of the quality of the D. Representation letter K. v client's accounting principles. E. Going concern assessment A sale of bonds or capital stock is an example requiring the client to disclose the event. F. Proposed adjusting journal entries and uncorrected Auditors bring the audit performed at an earlier date (before fiscal year G. Communications with individuals charged with gover end) up to date at fiscal year end. H. Subsequently discovered facts A PCAOB inspection or the audit firm's quality review may identify the auditors did not follow GAAS due to failure to complete the audit plan. 1. Subsequent events Auditors consider evidence obtained during the audit to determine J. Omitted audit procedures Ev whether substantial doubt exists about the client's existence in the K. Audit documentation review future. Discusses the absence of fraud activity by the client and its personnel Engagement letter G. v E A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts