Question: For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding. 1: Thomas Fortuna (married; 4 federal

For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding.

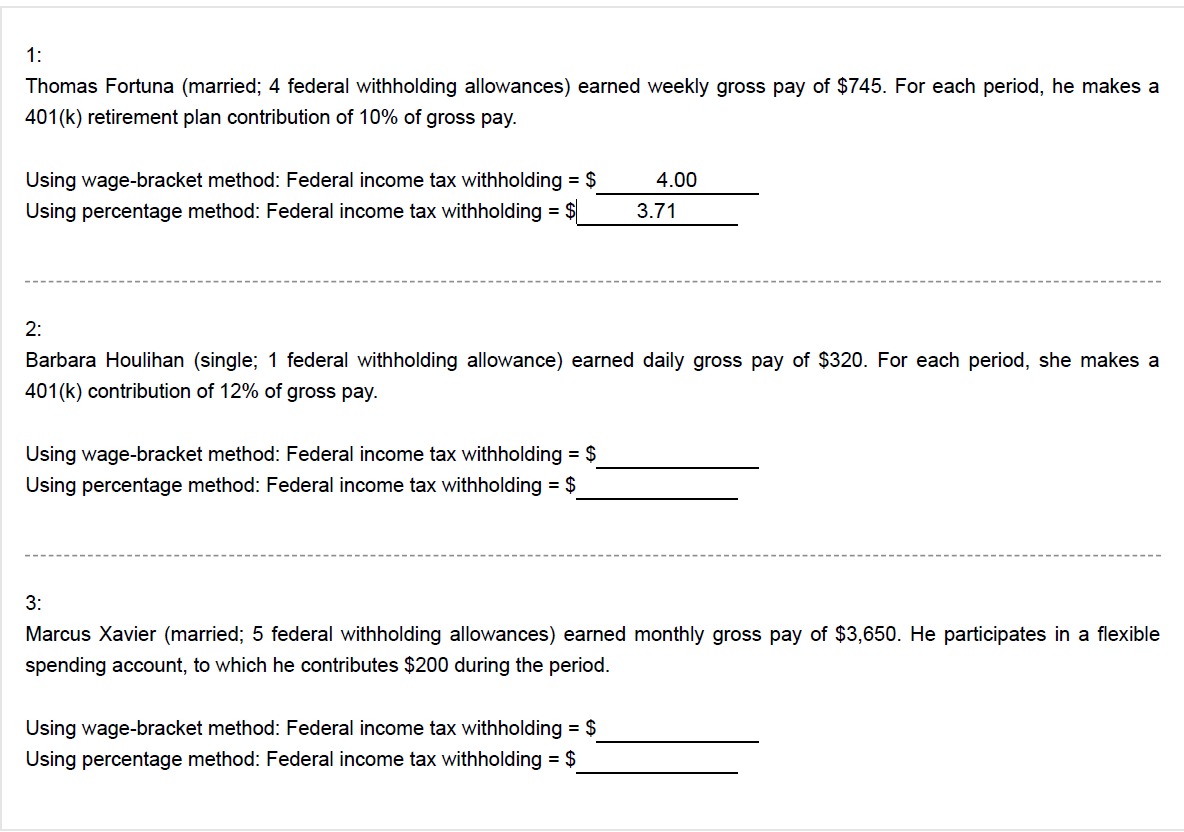

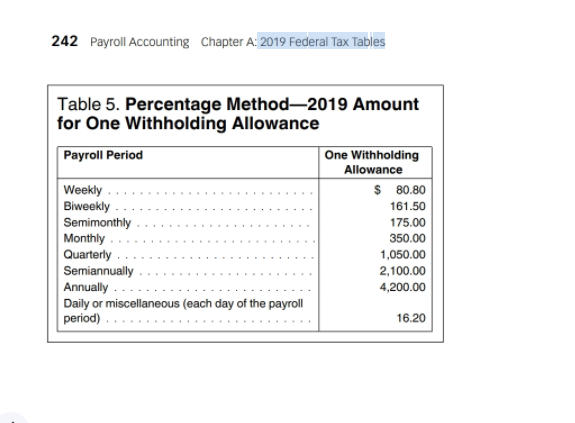

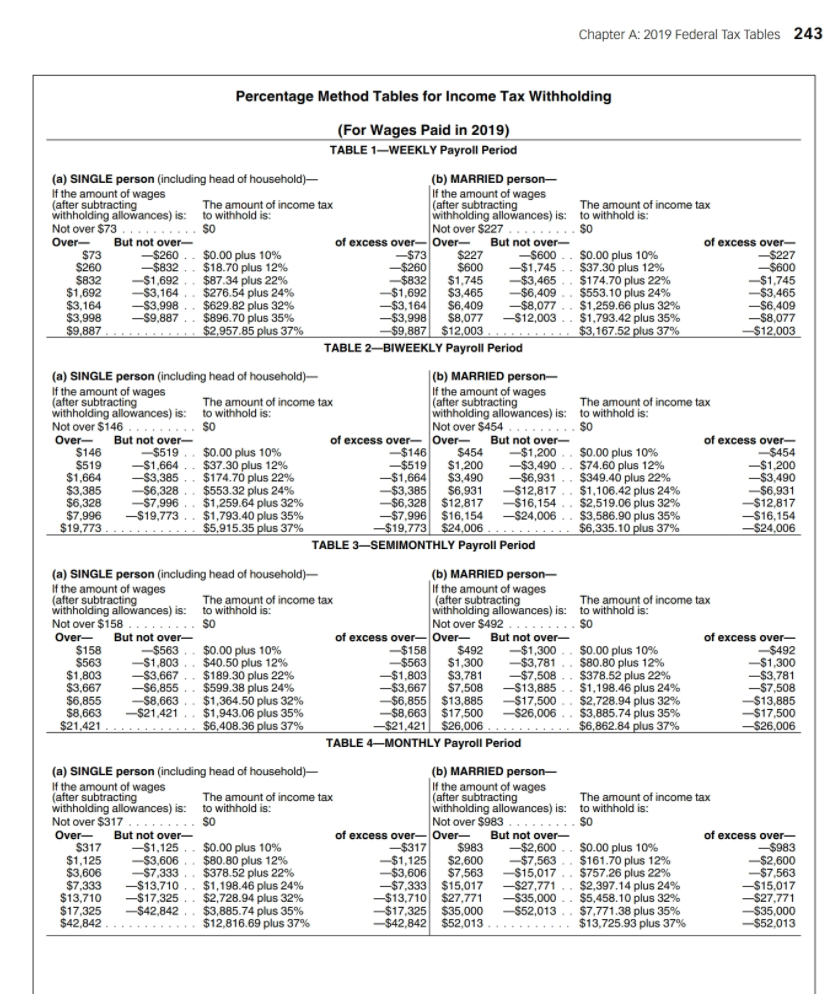

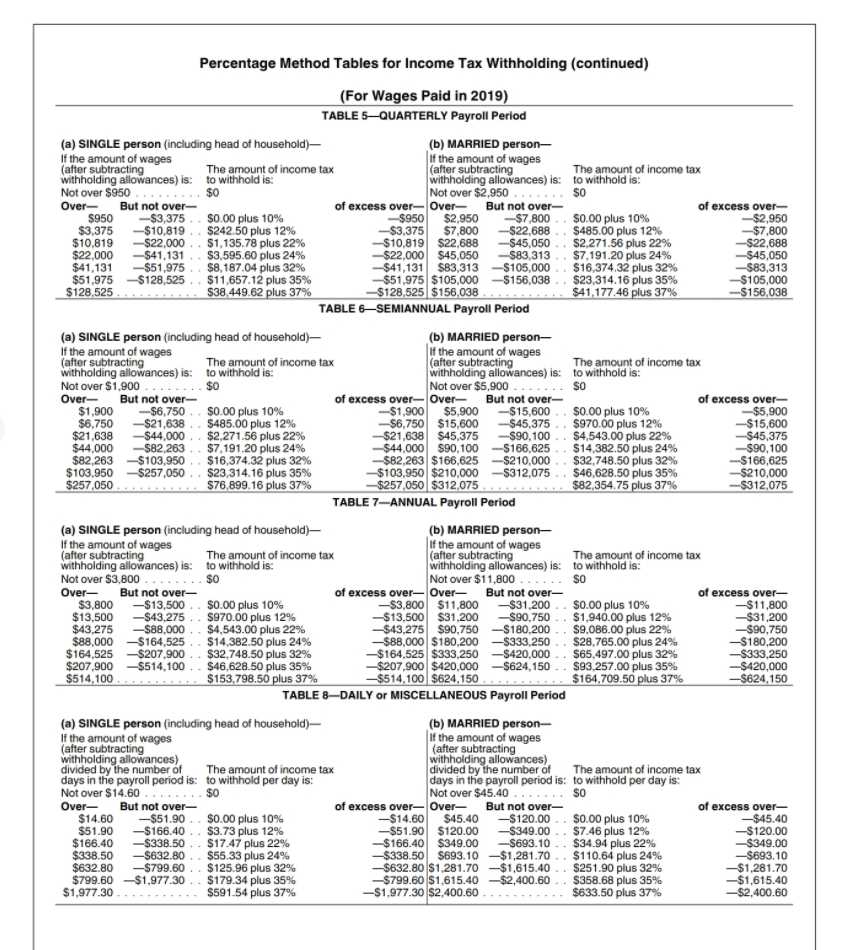

1: Thomas Fortuna (married; 4 federal withholding allowances) earned weekly gross pay of $745. For each period, he makes a 401(k) retirement plan contribution of 10% of gross pay. 4.00 Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 3.71 2: Barbara Houlihan (single; 1 federal withholding allowance) earned daily gross pay of $320. For each period, she makes a 401(k) contribution of 12% of gross pay. Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 3: Marcus Xavier (married; 5 federal withholding allowances) earned monthly gross pay of $3,650. He participates in a flexible spending account, to which he contributes $200 during the period. Using wage bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 242 Payroll Accounting Chapter A: 2019 Federal Tax Tables Table 5. Percentage Method2019 Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $ 80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually.. 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 Chapter A: 2019 Federal Tax Tables 243 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period ....... So (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $73 $0 Not over $227 SO Over But not over of excess over-Over But not over- of excess over- $73 -$260. $0.00 plus 10% -$73 $227 -$600. $0.00 plus 10% -$227 $260 -$832 $18.70 plus 12% -$260 $600 -$1,745 .. $37.30 plus 12% -$600 $832 $1,692 $87.34 plus 22% -$832 $1,745 -$3,465 $174.70 plus 22% -$1,745 $1,692 -$3,164 $276.54 plus 24% -$1,692 $3,465 -$6,409 .. $553.10 plus 24% -$3,465 $3,164 -$3.998 $629.82 plus 32% -$3,164 $6,409 -$8,077 $1,259.66 plus 32% -$6,409 $3.998 -$9,887 $896.70 plus 35% -$3,998 $8,077 -$12,003 $1,793.42 plus 35% -$8,077 $9,887 $2,957.85 plus 37% -$9,887 $12,003 $3,167.52 plus 37% -$ $12,003 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $146 SO Not over $454 SO Over But not over- of excess over-Over But not over- of excess over- $146 -$519 $0.00 plus 10% -$146 $454 -$1,200 $0.00 plus 10% -$454 $519 -$1,664 $37.30 plus 12% -$519 $1,200 -$3,490 $74.60 plus 12% -$1,200 $1,664 -$3,385 $174.70 plus 22% -$1,664 $3,490 -$6,931 $349.40 plus 22% -$3,490 $3,385 -$6.328 $553.32 plus 24% - $3,385 $6,931 -$12,817 $1,106.42 plus 24% -$6,931 $6,328 -$7,996 $1,259.64 plus 32% - $6,328 $12,817 -$16,154 $2,519.06 plus 32% -$12,817 $7,996 -$19,773 $1,793.40 plus 35% -$7,996 $16,154 -$24,006 $3,586.90 plus 35% -S16,154 $19.773 $5,915.35 plus 37% -$19,773 $24,006 ....... ... $6,335.10 plus 37% - $24,006 TABLE 3-SEMIMONTHLY Payroll Period .......SO (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $158 $ Not over $492 ....... SO Over But not over of excess over-Over But not over- of excess over- $158 -$563 $0.00 plus 10% -$158 $492 -$1,300 $0.00 plus 10% -$492 $563 -$1,803 $40.50 plus 12% -$563 $1,300 -$3,781 $80.80 plus 12% -$1,300 $1,803 --$3,667 . $189.30 plus 22% -$1,803 $3,781 -$7,508 $378.52 plus 22% -$3,781 $3,667 -S6,855 . $599.38 plus 24% -$3,667 $7.508 -$13,885 . . $1,198.46 plus 24% -$7,508 $6,855 -$8,663 $1,364.50 plus 32% - $6,855 $13,885 -$17,500 $2,728.94 plus 32% $13.885 $8,663 -$21,421 $1,943.06 plus 35% -$8,663 $17.500 - -$26,006 $3,885.74 plus 35% -$17.500 $21,421 $6,408.36 plus 37% -$21,421 $26.006 - $6,862.84 plus 37% - $26,006 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $317 SO Not over $983 $0 Over But not over- of excess over-Over But not over- of excess over- $317 -$1,125 .. $0.00 plus 10% -$317 $983 -$2,600 $0.00 plus 10% -$983 $1,125 -$3,606 $80.80 plus 12% -$1,125 $2,600 -$7,563 $161.70 plus 12% -$2,600 $3,606 $7,333 $378.52 plus 22% -$3,606 $7,563 -$15,017 .. $757.26 plus 22% -$7,563 $7,333 -$13,710 . . $1,198.46 plus 24% -$7,333 $15.017 -$27,771 $2,397.14 plus 24% -$15,017 $13.710 -$17,325 $2,728.94 plus 32% - -$13,710 $27.771 -$35,000 $5,458.10 plus 32% -$27.771 $17,325 -S42,842 $3,885.74 plus 35% -$17,325 $35,000 -$52,013 .. $7,771.38 plus 35% -$35,000 $42,842 $12,816.69 plus 37% -$42,842 $52,013 $13,725.93 plus 37% -$52,013 Percentage Method Tables for Income Tax Withholding (continued) (For Wages Paid in 2019) TABLE 5QUARTERLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $950 $0 Not over $2,950 $0 Over- But not over- of excess over-Over But not over- of excess over- $950 -$3,375 $0.00 plus 10% -$950 $2,950 -$7,800 $0.00 plus 10% -$2,950 $3,375 -$10,819 $242.50 plus 12% -$3,375 $7,800 -$22,688. $485.00 plus 12% -$7,800 $10,819 -$22,000 $1,135.78 plus 22% -$10,819 $22,688 -S45,050 $2,271.56 plus 22% -$22,688 $22.000 -$41,131 $3,595.60 plus 24% - $22,000 $45,050 -$83,313 $7,191.20 plus 24% - $45,050 $41,131 -$51,975 $8,187.04 plus 32% -$41,131 $83,313 -$105,000 $16,374.32 plus 32% - $83,313 $51.975 $128,525 $11,657.12 plus 35% -$51,975 $105,000-$156,038 $23,314.16 plus 35% -$105,000 $128,525 $38,449.62 plus 37% -- $128,525 $156,038 $41,177.46 plus 37% -$156,038 TABLE 6-SEMIANNUAL Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $1,900 $0 Not over $5,900 SO Over But not over- of excess over-Over But not over- of excess over- $1,900 -$6,750 $0.00 plus 10% -$1,900 $5,900 -$15,600.. $0.00 plus 10% -$5,900 $6,750 -$21,638 $485.00 plus 12% - $6,750 $15,600 -$45,375 $970.00 plus 12% -$15,600 $21,638 -$44,000 $2,271.56 plus 22% -$21,638 $45,375 -$90,100.. $4,543.00 plus 22% -$45,375 $44,000 $82,263 $7,191.20 plus 24% -$44,000 $90,100 $166,625 $14,382.50 plus 24% -$90,100 $82,263 $103,950 $16,374.32 plus 32% $82,263 $166,625 $210,000 $32,748.50 plus 32% $166,625 $103,950 $257,050 $23,314.16 plus 35% $103,950 $210,000 -$312.075 $46,628,50 plus 35% S210,000 $257,050 $76,899.16 plus 37% $257,050 $312,075 $82,354.75 plus 37% $312,075 TABLE 7ANNUAL Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $3,800 $0 Not over $11,800 SO Over But not over- of excess over-Over But not over- of excess over- $3,800 -$13,500 $0.00 plus 10% -$3,800 $11,800 -$31,200 $0.00 plus 10% -$11,800 $13,500 -$43,275 $970.00 plus 12% -$13,500 $31,200 -$90,750 $1,940.00 plus 12% -$31,200 $43,275 -$88,000 $4,543.00 plus 22% -$43,275 $90,750 -$180,200 $9,086.00 plus 22% -$90,750 $88,000 $164,525 . . $14,382.50 plus 24% -$88,000 $180,200 -$333,250 . . $28,765.00 plus 24% -S180,200 $164,525 $207,900 $32,748.50 plus 32% $164,525 $333,250 -$420,000 $65,497.00 plus 32% $333,250 $207,900 -$514,100 $46.628.50 plus 35% $207,900 $420,000 -S624,150 $93.257.00 plus 35% $420,000 $514,100 $153,798.50 plus 37% $514,100 $624,150 $164,709.50 plus 37% --S624,150 TABLE 8DAILY or MISCELLANEOUS Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting (after subtracting withholding allowances) withholding allowances) divided by the number of The amount of income tax divided by the number of The amount of income tax days in the payroll period is: to withhold per day is: days in the payroll period is: to withhold per day is: Not over $14.60 $0 Not over $45.40 SO Over But not over- of excess over-Over But not over- of excess over- $14.60 -$51.90.. $0.00 plus 10% -$14.60 $45.40 -$120.00 $0.00 plus 10% -$45.40 $51.90 -$166.40 $3.73 plus 12% -$51.90 $120.00 -$349.00 $7.46 plus 12% -$120.00 $166.40 -$338.50 $17.47 plus 22% - $166.40 $349.00 -S693.10 .. $34.94 plus 22% -$349.00 $338.50 $632.80 $55.33 plus 24% $338.50 $693.10 $1,281.70 $110.64 plus 24% -$693.10 $632.80 -$799.60 $125.96 plus 32% -$632.80 $1,281.70 -$1,615.40 $251.90 plus 32% - $1,281.70 $799.60 $1,977.30 $179.34 plus 35% -$799.60 $1.615.40 $2,400.60 $358.68 plus 35% - $1,615.40 $1,977.30 $591.54 plus 37% -$1,977.30 $2,400.60 $633.50 plus 37% -$2,400.60 1: Thomas Fortuna (married; 4 federal withholding allowances) earned weekly gross pay of $745. For each period, he makes a 401(k) retirement plan contribution of 10% of gross pay. 4.00 Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 3.71 2: Barbara Houlihan (single; 1 federal withholding allowance) earned daily gross pay of $320. For each period, she makes a 401(k) contribution of 12% of gross pay. Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 3: Marcus Xavier (married; 5 federal withholding allowances) earned monthly gross pay of $3,650. He participates in a flexible spending account, to which he contributes $200 during the period. Using wage bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 242 Payroll Accounting Chapter A: 2019 Federal Tax Tables Table 5. Percentage Method2019 Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly $ 80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually.. 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 Chapter A: 2019 Federal Tax Tables 243 Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period ....... So (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $73 $0 Not over $227 SO Over But not over of excess over-Over But not over- of excess over- $73 -$260. $0.00 plus 10% -$73 $227 -$600. $0.00 plus 10% -$227 $260 -$832 $18.70 plus 12% -$260 $600 -$1,745 .. $37.30 plus 12% -$600 $832 $1,692 $87.34 plus 22% -$832 $1,745 -$3,465 $174.70 plus 22% -$1,745 $1,692 -$3,164 $276.54 plus 24% -$1,692 $3,465 -$6,409 .. $553.10 plus 24% -$3,465 $3,164 -$3.998 $629.82 plus 32% -$3,164 $6,409 -$8,077 $1,259.66 plus 32% -$6,409 $3.998 -$9,887 $896.70 plus 35% -$3,998 $8,077 -$12,003 $1,793.42 plus 35% -$8,077 $9,887 $2,957.85 plus 37% -$9,887 $12,003 $3,167.52 plus 37% -$ $12,003 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $146 SO Not over $454 SO Over But not over- of excess over-Over But not over- of excess over- $146 -$519 $0.00 plus 10% -$146 $454 -$1,200 $0.00 plus 10% -$454 $519 -$1,664 $37.30 plus 12% -$519 $1,200 -$3,490 $74.60 plus 12% -$1,200 $1,664 -$3,385 $174.70 plus 22% -$1,664 $3,490 -$6,931 $349.40 plus 22% -$3,490 $3,385 -$6.328 $553.32 plus 24% - $3,385 $6,931 -$12,817 $1,106.42 plus 24% -$6,931 $6,328 -$7,996 $1,259.64 plus 32% - $6,328 $12,817 -$16,154 $2,519.06 plus 32% -$12,817 $7,996 -$19,773 $1,793.40 plus 35% -$7,996 $16,154 -$24,006 $3,586.90 plus 35% -S16,154 $19.773 $5,915.35 plus 37% -$19,773 $24,006 ....... ... $6,335.10 plus 37% - $24,006 TABLE 3-SEMIMONTHLY Payroll Period .......SO (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $158 $ Not over $492 ....... SO Over But not over of excess over-Over But not over- of excess over- $158 -$563 $0.00 plus 10% -$158 $492 -$1,300 $0.00 plus 10% -$492 $563 -$1,803 $40.50 plus 12% -$563 $1,300 -$3,781 $80.80 plus 12% -$1,300 $1,803 --$3,667 . $189.30 plus 22% -$1,803 $3,781 -$7,508 $378.52 plus 22% -$3,781 $3,667 -S6,855 . $599.38 plus 24% -$3,667 $7.508 -$13,885 . . $1,198.46 plus 24% -$7,508 $6,855 -$8,663 $1,364.50 plus 32% - $6,855 $13,885 -$17,500 $2,728.94 plus 32% $13.885 $8,663 -$21,421 $1,943.06 plus 35% -$8,663 $17.500 - -$26,006 $3,885.74 plus 35% -$17.500 $21,421 $6,408.36 plus 37% -$21,421 $26.006 - $6,862.84 plus 37% - $26,006 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $317 SO Not over $983 $0 Over But not over- of excess over-Over But not over- of excess over- $317 -$1,125 .. $0.00 plus 10% -$317 $983 -$2,600 $0.00 plus 10% -$983 $1,125 -$3,606 $80.80 plus 12% -$1,125 $2,600 -$7,563 $161.70 plus 12% -$2,600 $3,606 $7,333 $378.52 plus 22% -$3,606 $7,563 -$15,017 .. $757.26 plus 22% -$7,563 $7,333 -$13,710 . . $1,198.46 plus 24% -$7,333 $15.017 -$27,771 $2,397.14 plus 24% -$15,017 $13.710 -$17,325 $2,728.94 plus 32% - -$13,710 $27.771 -$35,000 $5,458.10 plus 32% -$27.771 $17,325 -S42,842 $3,885.74 plus 35% -$17,325 $35,000 -$52,013 .. $7,771.38 plus 35% -$35,000 $42,842 $12,816.69 plus 37% -$42,842 $52,013 $13,725.93 plus 37% -$52,013 Percentage Method Tables for Income Tax Withholding (continued) (For Wages Paid in 2019) TABLE 5QUARTERLY Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $950 $0 Not over $2,950 $0 Over- But not over- of excess over-Over But not over- of excess over- $950 -$3,375 $0.00 plus 10% -$950 $2,950 -$7,800 $0.00 plus 10% -$2,950 $3,375 -$10,819 $242.50 plus 12% -$3,375 $7,800 -$22,688. $485.00 plus 12% -$7,800 $10,819 -$22,000 $1,135.78 plus 22% -$10,819 $22,688 -S45,050 $2,271.56 plus 22% -$22,688 $22.000 -$41,131 $3,595.60 plus 24% - $22,000 $45,050 -$83,313 $7,191.20 plus 24% - $45,050 $41,131 -$51,975 $8,187.04 plus 32% -$41,131 $83,313 -$105,000 $16,374.32 plus 32% - $83,313 $51.975 $128,525 $11,657.12 plus 35% -$51,975 $105,000-$156,038 $23,314.16 plus 35% -$105,000 $128,525 $38,449.62 plus 37% -- $128,525 $156,038 $41,177.46 plus 37% -$156,038 TABLE 6-SEMIANNUAL Payroll Period (a) SINGLE person (including head of household) (6) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $1,900 $0 Not over $5,900 SO Over But not over- of excess over-Over But not over- of excess over- $1,900 -$6,750 $0.00 plus 10% -$1,900 $5,900 -$15,600.. $0.00 plus 10% -$5,900 $6,750 -$21,638 $485.00 plus 12% - $6,750 $15,600 -$45,375 $970.00 plus 12% -$15,600 $21,638 -$44,000 $2,271.56 plus 22% -$21,638 $45,375 -$90,100.. $4,543.00 plus 22% -$45,375 $44,000 $82,263 $7,191.20 plus 24% -$44,000 $90,100 $166,625 $14,382.50 plus 24% -$90,100 $82,263 $103,950 $16,374.32 plus 32% $82,263 $166,625 $210,000 $32,748.50 plus 32% $166,625 $103,950 $257,050 $23,314.16 plus 35% $103,950 $210,000 -$312.075 $46,628,50 plus 35% S210,000 $257,050 $76,899.16 plus 37% $257,050 $312,075 $82,354.75 plus 37% $312,075 TABLE 7ANNUAL Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $3,800 $0 Not over $11,800 SO Over But not over- of excess over-Over But not over- of excess over- $3,800 -$13,500 $0.00 plus 10% -$3,800 $11,800 -$31,200 $0.00 plus 10% -$11,800 $13,500 -$43,275 $970.00 plus 12% -$13,500 $31,200 -$90,750 $1,940.00 plus 12% -$31,200 $43,275 -$88,000 $4,543.00 plus 22% -$43,275 $90,750 -$180,200 $9,086.00 plus 22% -$90,750 $88,000 $164,525 . . $14,382.50 plus 24% -$88,000 $180,200 -$333,250 . . $28,765.00 plus 24% -S180,200 $164,525 $207,900 $32,748.50 plus 32% $164,525 $333,250 -$420,000 $65,497.00 plus 32% $333,250 $207,900 -$514,100 $46.628.50 plus 35% $207,900 $420,000 -S624,150 $93.257.00 plus 35% $420,000 $514,100 $153,798.50 plus 37% $514,100 $624,150 $164,709.50 plus 37% --S624,150 TABLE 8DAILY or MISCELLANEOUS Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting (after subtracting withholding allowances) withholding allowances) divided by the number of The amount of income tax divided by the number of The amount of income tax days in the payroll period is: to withhold per day is: days in the payroll period is: to withhold per day is: Not over $14.60 $0 Not over $45.40 SO Over But not over- of excess over-Over But not over- of excess over- $14.60 -$51.90.. $0.00 plus 10% -$14.60 $45.40 -$120.00 $0.00 plus 10% -$45.40 $51.90 -$166.40 $3.73 plus 12% -$51.90 $120.00 -$349.00 $7.46 plus 12% -$120.00 $166.40 -$338.50 $17.47 plus 22% - $166.40 $349.00 -S693.10 .. $34.94 plus 22% -$349.00 $338.50 $632.80 $55.33 plus 24% $338.50 $693.10 $1,281.70 $110.64 plus 24% -$693.10 $632.80 -$799.60 $125.96 plus 32% -$632.80 $1,281.70 -$1,615.40 $251.90 plus 32% - $1,281.70 $799.60 $1,977.30 $179.34 plus 35% -$799.60 $1.615.40 $2,400.60 $358.68 plus 35% - $1,615.40 $1,977.30 $591.54 plus 37% -$1,977.30 $2,400.60 $633.50 plus 37% -$2,400.60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts