Question: For each item below, indicate whether it involves: (1) (2) (3) (a) (b) Use the appropriate number to indicate your answer for each. (c) (d)

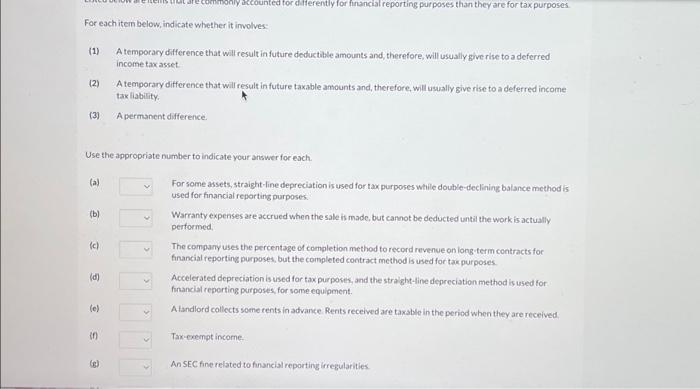

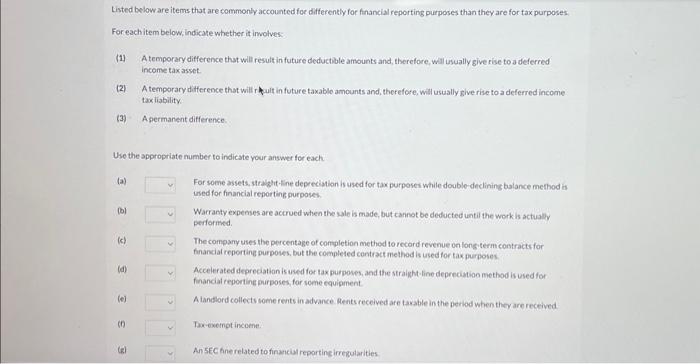

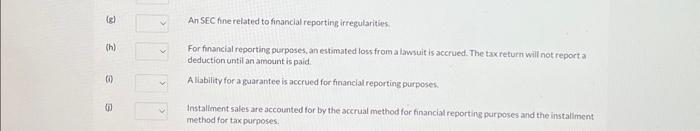

Listed below are items that are commonly accounted foe differently for financial reporting purposes than they are for tax purposes. For eachitem below, indicate whether it inwolves: (1) A temporary difference that will result in future deductible amounts and, therefore, wall usually give rise to a deferred income tax asset. (2) A temporary difference that will r thult in future taxablo amounts and, therefore, will usually sive rise to a deferred income taxliability. (3) - Apermanent difference. Use the appropriate number to indicate your answer for each (a) (b) (c) (d) (e) (n) For some assets, stralght-fine deprecistion is used for tax purposes while doublo-declining balance method is ised for financial reporting purposes. Wacranty expenses are accrued when the sale is made, but cannot be deducted until the work is actually performed. The company thes the percentage of conpletion methed to record revenue on longiterm contractsfor finandal reporting purposes, but the completed contract method is used for tax purpoies. Accelerated depreciation is uned for tax purposes, and the straight-line depreciation method is used for financial reportine purposes, for some equipment. Alandiord collects some rents in advance. Aents received are taxable in the perlod when they are received. Dx-exempt incoene. An SEC fine related to financial reportincirregularities. For each item below, indicate whether it involves: (1) A temporary difference that will result in future deductible amounts and, therefore, will usually give rise to a deferred income taxasset. (2) A temporary difference that will result in future taxable amounts and, therefore, will usually sive rise to a deferred income tak liability. (3) Apermanent difference. Use the appropriate number to indicate your answer for each. (a) (b) (c) (d) (c) (f) (g) For some assets, straight-line depreciation is used for tax purposes while double-declining balance method is used for financial reporting purposes. Warranty expenses are accrued when the sale is made, but cannot be deducted until the work is actually performed. The compary uses the percentage of completion method to record revenve on long-term contracts for financial reporting purposes, but the completed contract method is used for tak purposes. Accelerated depreciation is used for tax purposes, and the straight-line depreciation method is used for financial reporting purposes, for some equipment. A tandlord collects some rents in advance. Rents received are taxable in the period when they are received. Tax-erempt income. An SEC fine related to financial reporting irregularities. (8) AnSEC fine related to financlal reporting ifregularities. (h) For financial reporting purposes, an estimated loss from a lawsuit is accrued. The tax return will not report a deduction until an amount is paid. (i) A liability for a guarantee is accrued for finandial reporting purposes. (1) Installiment sales are accounted for by the accrual method for financial reporting purposes and the installiment method for tax purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts