Question: Charlie's Hamburgers is considering adding hotdogs to its menu. The hotdogs require purchasing cooking equipment on sale for $126,000. The asset has a 6-year

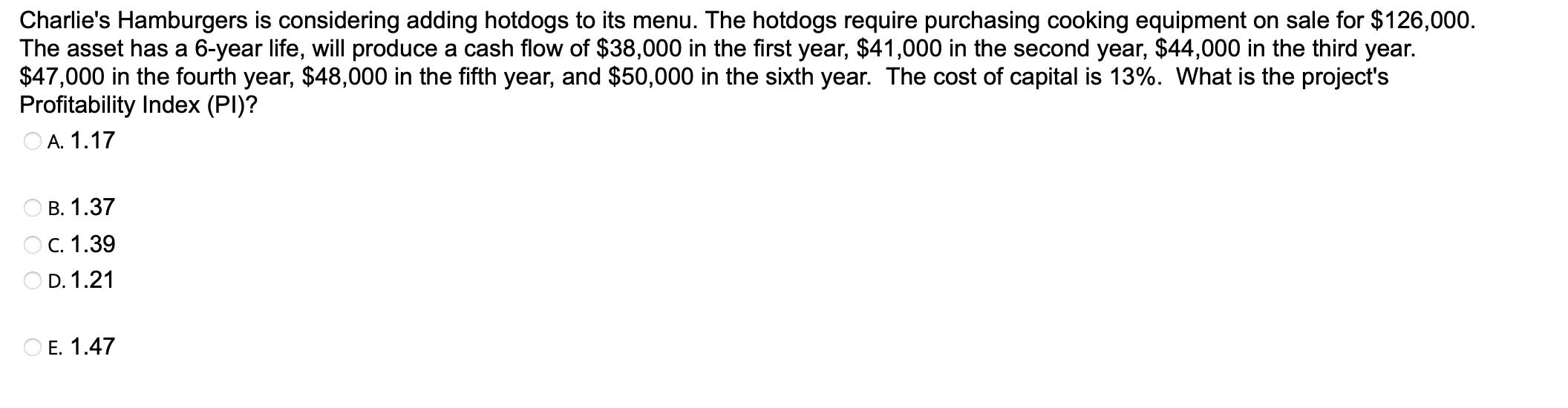

Charlie's Hamburgers is considering adding hotdogs to its menu. The hotdogs require purchasing cooking equipment on sale for $126,000. The asset has a 6-year life, will produce a cash flow of $38,000 in the first year, $41,000 in the second year, $44,000 in the third year. $47,000 in the fourth year, $48,000 in the fifth year, and $50,000 in the sixth year. The cost of capital is 13%. What is the project's Profitability Index (PI)? A. 1.17 B. 1.37 C. 1.39 D. 1.21 E. 1.47

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Answer Calculation of Profitability Index PI for the pr... View full answer

Get step-by-step solutions from verified subject matter experts