Question: For each of the three depreciation methods - Straight-line, Units-of- activity, & Double-declining balance - state their biggest advantage, biggest disadvantage, how this method affects

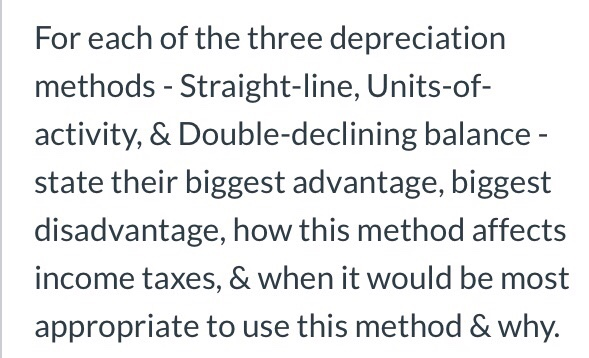

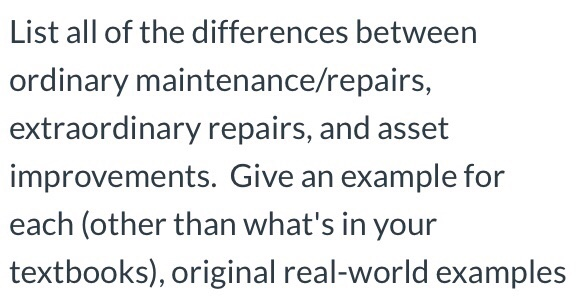

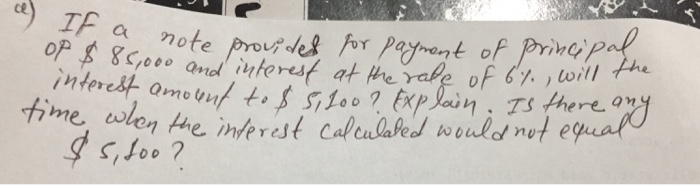

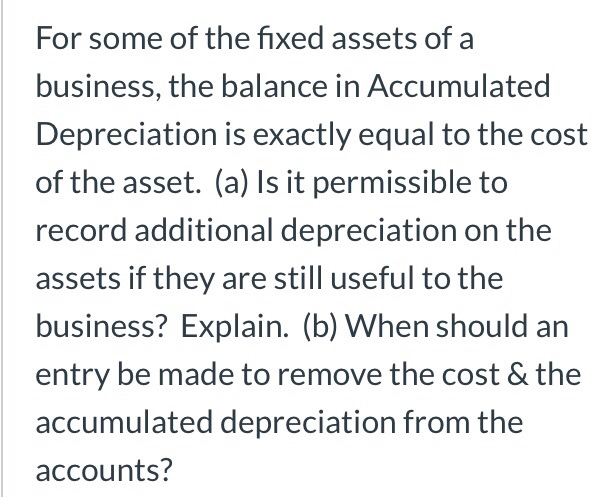

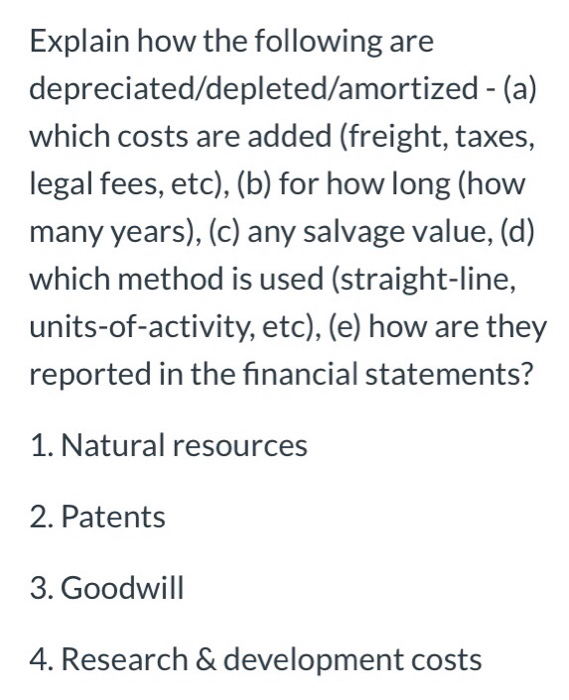

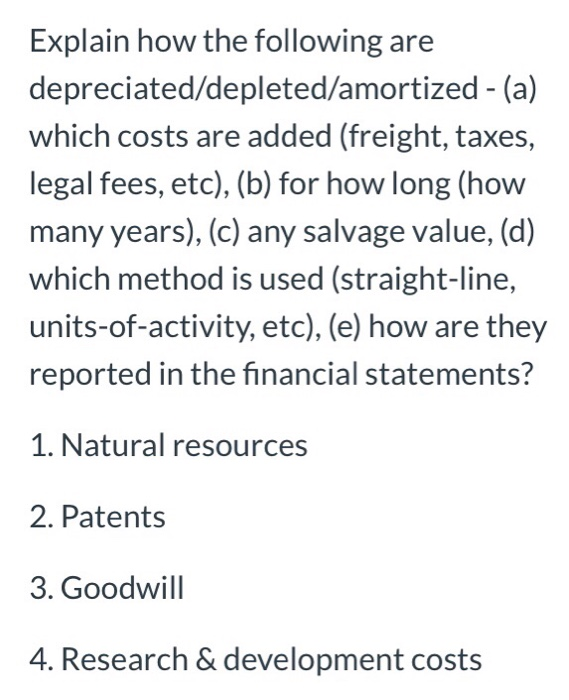

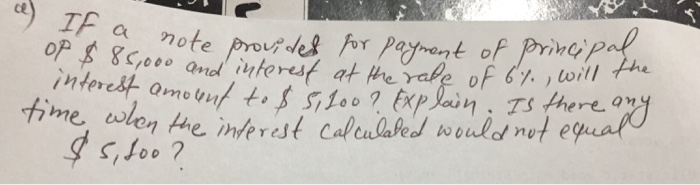

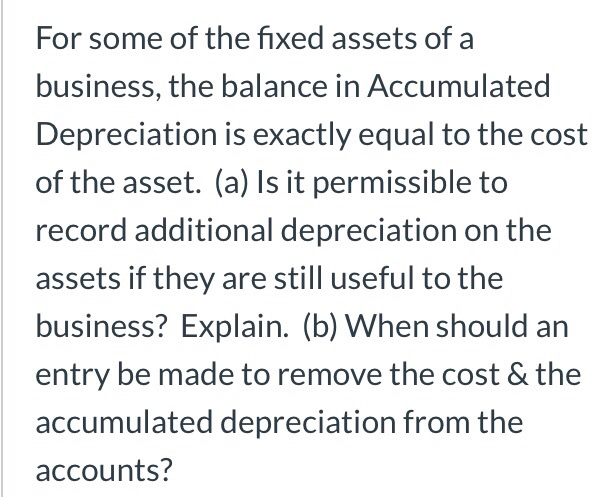

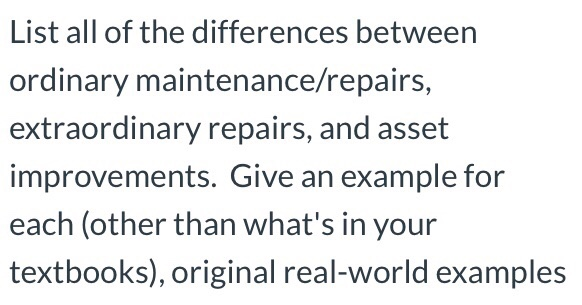

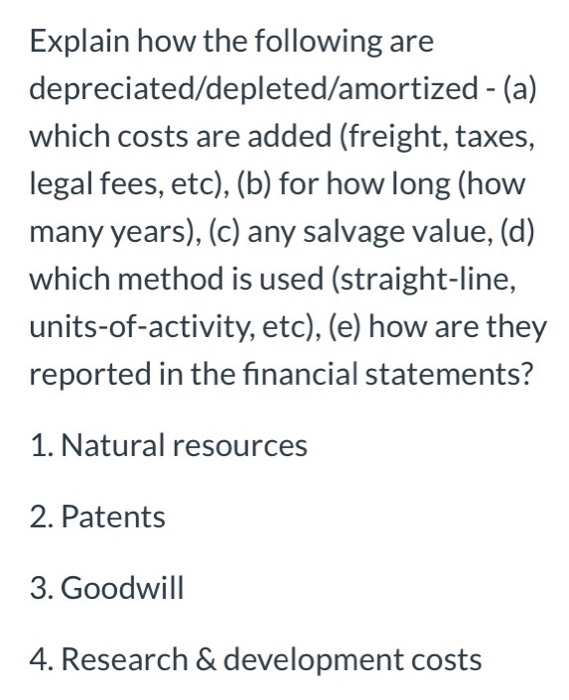

For each of the three depreciation methods - Straight-line, Units-of- activity, & Double-declining balance - state their biggest advantage, biggest disadvantage, how this method affects income taxes, & when it would be most appropriate to use this method & why. List all of the differences between ordinary maintenance/repairs, extraordinary repairs, and asset improvements. Give an example for each (other than what's in your textbooks), original real-world examples For some of the fixed assets of a business, the balance in Accumulated Depreciation is exactly equal to the cost of the asset. (a) Is it permissible to record additional depreciation on the assets if they are still useful to the business? Explain. (b) When should an entry be made to remove the cost & the accumulated depreciation from the accounts? Explain how the following are depreciated/depleted/amortized - (a) which costs are added (freight, taxes, legal fees, etc), (b) for how long (how many years), (c) any salvage value, (d) which method is used (straight-line, units-of-activity, etc), (e) how are they reported in the financial statements? 1. Natural resources 2. Patents 3. Goodwill 4. Research & development costs Explain how the following are depreciated/depleted/amortized - (a) which costs are added (freight, taxes, legal fees, etc), (b) for how long (how many years), (c) any salvage value, (d) which method is used (straight-line, units-of-activity, etc), (e) how are they reported in the financial statements? 1. Natural resources 2. Patents 3. Goodwill 4. Research & development costs d) If a note pro note provided for payment of principal of $85,000 and interest at the rate of 6%, will te interest amount to $5,100 ? Explain. Is there any time when the interest calculated would not equal $5,2007 For some of the fixed assets of a business, the balance in Accumulated Depreciation is exactly equal to the cost of the asset. (a) Is it permissible to record additional depreciation on the assets if they are still useful to the business? Explain. (b) When should an entry be made to remove the cost & the accumulated depreciation from the accounts? List all of the differences between ordinary maintenance/repairs, extraordinary repairs, and asset improvements. Give an example for each (other than what's in your textbooks), original real-world examples Explain how the following are depreciated/depleted/amortized - (a) which costs are added (freight, taxes, legal fees, etc), (b) for how long (how many years), (c) any salvage value, (d) which method is used (straight-line, units-of-activity, etc), (e) how are they reported in the financial statements? 1. Natural resources 2. Patents 3. Goodwill 4. Research & development costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts