Question: For each scenario below, run a return attribution analysis for buying 1 - , 2 - and 3 - year Strips, and break down the

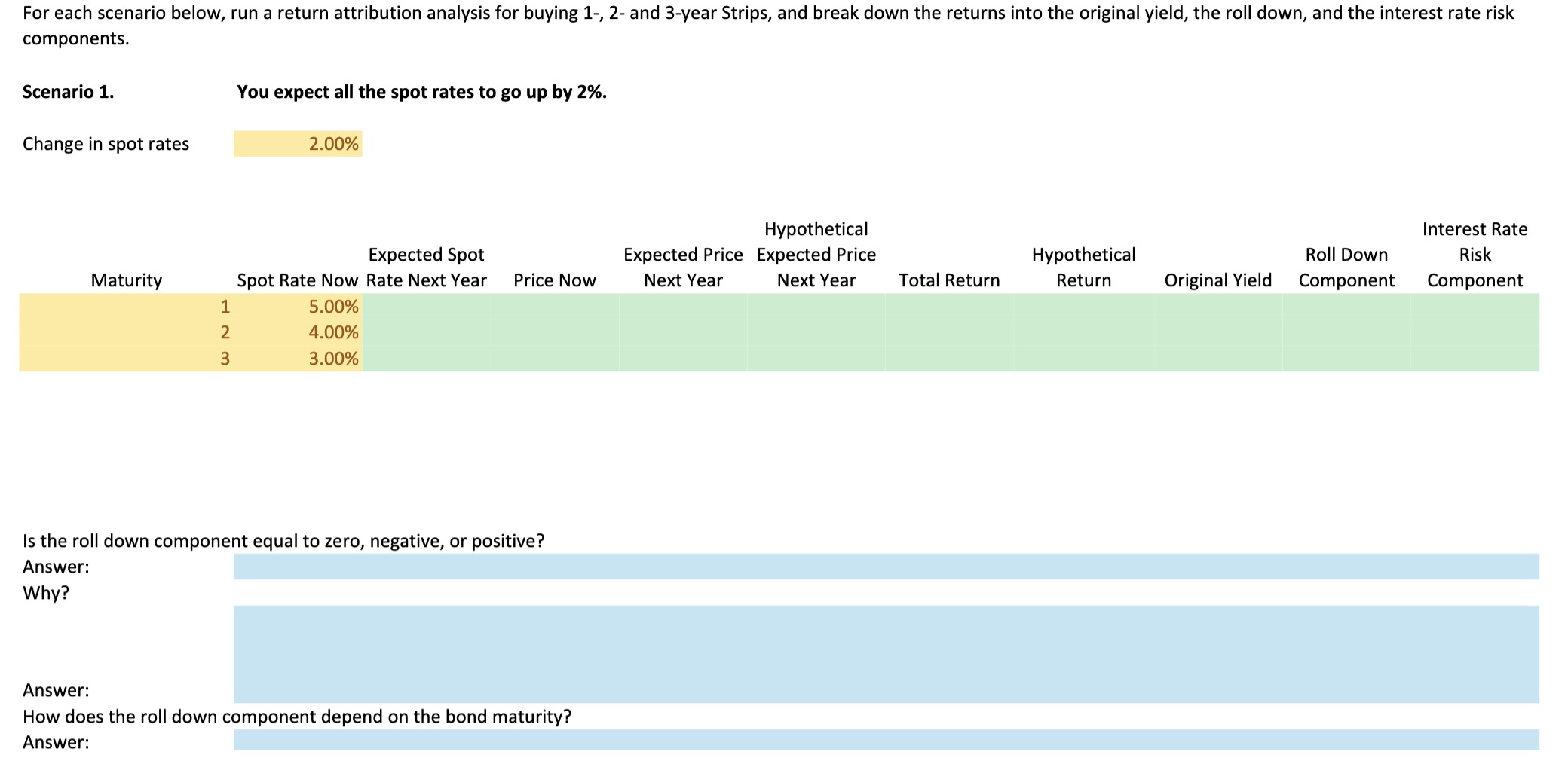

For each scenario below, run a return attribution analysis for buying and year Strips, and break down the returns into the original yield, the roll down, and the interest rate risk components.

Scenario

You expect all the spot rates to go up by mathbf

Change in spot rates

Is the roll down component equal to zero, negative, or positive?

Answer:

Why?

Answer:

How does the roll down component depend on the bond maturity?

Answer: Is the roll down component equal to zero, negative, or positive?

Answer:

Why?

Answer:

How does the roll down component depend on the bond maturity?

Answer:

Is the interest rate risk component equal to zero, negative, or positive?

Answer:

Why?

Answer:

How does the interest rate risk component depend on the bond maturity?

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock