Question: For each scenario use this chart: 1. Scenario 1: It is March 1. A farmer expects to have 60,000 bushels of oats. Cash price offered

For each scenario use this chart:

1. Scenario 1: It is March 1. A farmer expects to have 60,000 bushels of oats. Cash price offered for August delivery is $4.50/bu and futures price today is $5.35/bu. The farmer decides to hedge 50% of his crop. The expected basis for his area in late August is -$0.50.

On August 25, the farmer offsets his futures contracts for $5.04/bu and sells his oats to a local elevator for $4.64/bu. Complete the table.

2. Scenario 2: It is October 15. An elevator is looking to hedge the entire purchase 15,000 bushels of corn in March. On Oct 15, the March futures price was $5.72. Expected basis for March is -$0.60.

On March 10, the actual cash price was $4.15 and the futures price was $4.70. Complete the table.

3. You will complete the table three different ways (on 3 separate tables) and then compare.

Scenario 3: Currently (May 1) the September soybean futures are trading at $12.17/bu. You normally pay $0.80 under futures for soybeans from your supplier. You place the hedge to protect the purchase price for the 15,000 bushels of soybeans you will be buying in August. Come August 1, the basis is as expected, and you exit the futures market at a price of $12.42. Complete the table.

4. Scenario 4: Same as scenario 3 EXCEPT the basis weakened by 10 cents. Complete the table.

5. Scenario 5: Same as scenario 3 EXCEPT the basis strengthened by 10 cents. Complete the table.

6. Scenario 6: Youre a cow-calf producer planning sales of 50,000 lbs of feeder cattle to a feedlot. Its July 1 today and youre planning to sell in October. The current futures price for October is $182.00 and your expected basis is +$2.00. On October 10, you exit the futures market at a price of $202.00 and your basis was -$1.00. Complete the table.

7. Scenario 7: You own a crush facility that needs to buy 100,000 bushels of soybeans in March. Its currently January 5 and you decide to hedge 20% of March demand and get a March futures price of $13.81. Expected basis is -$0.60. Now its March 5 and you offset your trades for a price of $13.65. The actual basis is also -$0.60. Complete the table.

8. Scenario 8: Its June 1 and youre a soybean farmer planning for harvest. Youre really happy with the current November futures price (its $13.25). Average basis around harvest is -$0.90 in your area. You hedge of your planned 50,000 bushel harvest. When you go to exit the futures market Nov 30 and sell your beans to the local facility, you find that the futures price fell to $12.65 and the quoted cash price is $11.81. Complete the table.

9. T or F: Lets say Watertown, SD has an average basis of -$1.10 at harvest for soybeans. On the day a farmer enters the futures market, he sells a contract for $12.50. If actual basis is identical to the expected basis at harvest (and ignoring additional costs), whether the futures price falls by $5.00 or rises by $10.00, this farmer will receive a net price of $11.40.

10. Using the info from #9 (about Watertown), if the basis was 15 cents weaker than expected (everything is the same), the farmers net price will be ______.

- 15 cents lower

- 15 cents higher

- No change

- Not enough information

11. For an ethanol plant hedging an upcoming corn purchase, a basis 15 cents stronger than expected will result in a net price _________, which _____ the plant.

- 15 cents lower; helps

- 15 cents higher; helps

- 15 cents lower; hurts

- 15 cents higher; hurts

- No change

12. NO table. You can still get the answer- use the EASY WAY. It is June 15th. A farmer enters the futures price at $7.10. He expects basis to be -$0.30 at harvest. At harvest, he exits the futures market at $6.90 and actual basis was -$0.35. Find his real net price.

13. A farmer stored at harvest on Oct. 31st and plans to store until March 1st. The cash price at harvest was $6.80 (October futures was $7.30 and basis was -$0.50). The March futures price back in October when the farmer enters the futures market is $7.50 and expected March basis is -$0.35

The farmer stored until March 1st. He exited the futures market at $7.45 and actual basis was -$0.30.

The total storage costs would need to be below _____ per bushel to make this storage hedge profitable.

If storage costs were below ____ per bushel per month, this storage hedge would be profitable.

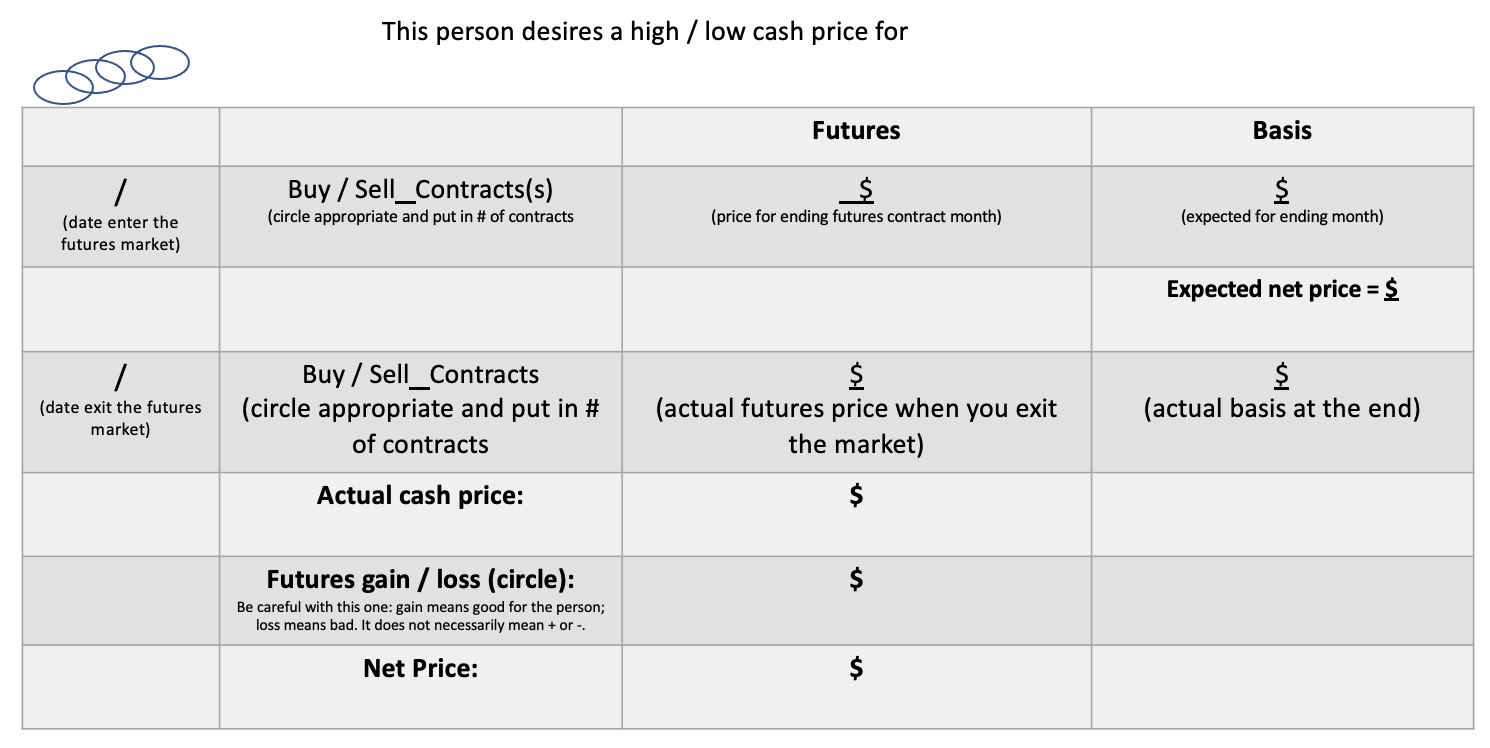

This person desires a high / low cash price for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts