Question: For each security classification (i.e., Trading, AFS, HTM), if necessary, determine the unrealized gain or loss to be recognized during June 2021 and propose adjusting

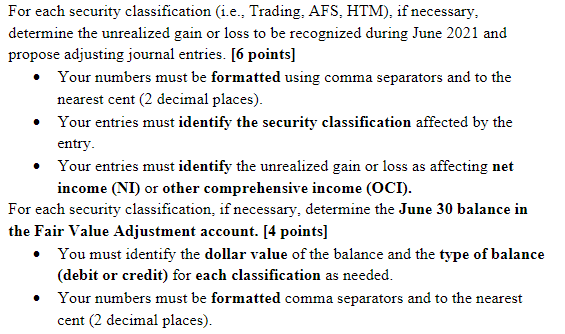

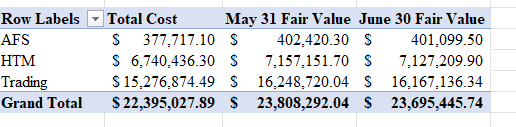

For each security classification (i.e., Trading, AFS, HTM), if necessary, determine the unrealized gain or loss to be recognized during June 2021 and propose adjusting journal entries. [6 points] Your numbers must be formatted using comma separators and to the nearest cent (2 decimal places). Your entries must identify the security classification affected by the entry. Your entries must identify the unrealized gain or loss as affecting net income (NI) or other comprehensive income (OCI). For each security classification, if necessary, determine the June 30 balance in the Fair Value Adjustment account. [4 points] You must identify the dollar value of the balance and the type of balance (debit or credit) for each classification as needed. Your numbers must be formatted comma separators and to the nearest cent (2 decimal places). Row Labels AFS HTM Trading Grand Total Total Cost May 31 Fair Value June 30 Fair Value $ 377.717.10 $ 402,420.30 $ 401,099.50 $ 6,740.436.30 S 7.157.151.70 $ 7.127,209.90 $ 15,276,874.49 $ 16,248.720.04 $ 16.167.136.34 $ 22,395,027.89 $ 23,808,292.04 $ 23,695,445.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts