Question: For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Step 1: Determine what the

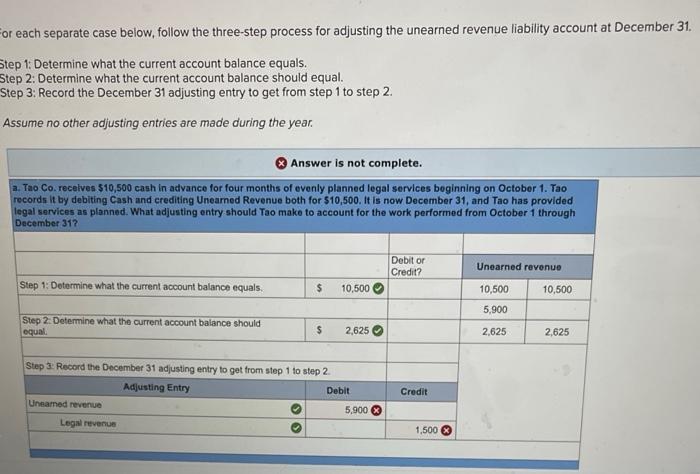

For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year. Answer is not complete. a. Tao Co. receives $10,500 cash in advance for four months of evenly planned legal services beginning on October 1. Tao records it by debiting Cash and crediting Unearned Revenue both for $10,500. It is now December 31, and Tao has provided legal services as planned. What adjusting entry should Tao make to account for the work performed from October 1 through December 31? Debit or Credit? Unearned revenue Step 1: Determine what the current account balance equals. $ 10,500 10,500 10,500 5,900 Step 2: Determine what the current account balance should equal $ 2,625 2,625 2,625 Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Uneamed revenue Legal revenue Adjusting Entry Debit Credit 5,900 1,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts