Question: For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Assume no other adjusting entries

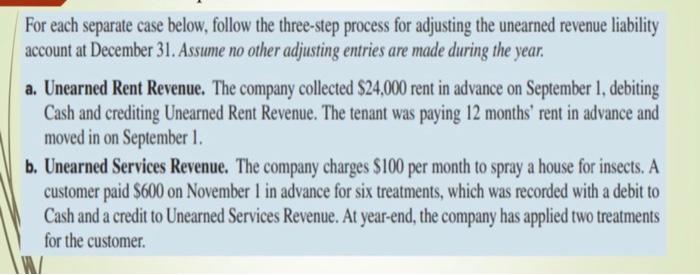

For each separate case below, follow the three-step process for adjusting the unearned revenue liability account at December 31. Assume no other adjusting entries are made during the year. a. Unearned Rent Revenue. The company collected $24,000 rent in advance on September 1, debiting Cash and crediting Unearned Rent Revenue. The tenant was paying 12 months' rent in advance and moved in on September 1. b. Unearned Services Revenue. The company charges $100 per month to spray a house for insects. A customer paid $600 on November 1 in advance for six treatments, which was recorded with a debit to Cash and a credit to Unearned Services Revenue. At year-end, the company has applied two treatments for the customer.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts