Question: For each separate case, record the necessary adjusting entry. a. On July 1, Lopez Company paid $1,300 for six months of insurance coverage. No adjustments

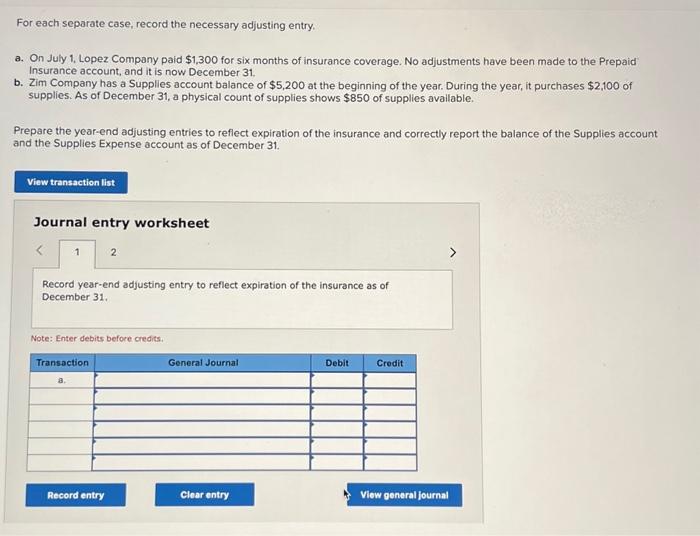

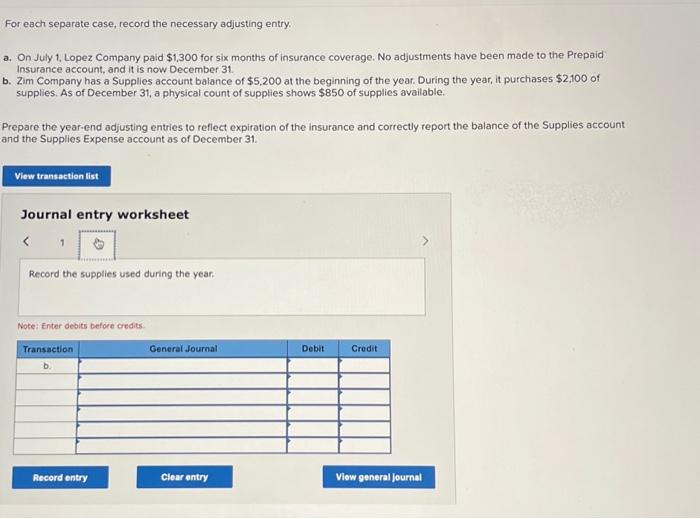

For each separate case, record the necessary adjusting entry. a. On July 1, Lopez Company paid $1,300 for six months of insurance coverage. No adjustments have been made to the Prepaid Insurance account, and it is now December 31 b. Zim Company has a Supplles account balance of $5,200 at the beginning of the year. During the year, it purchases $2,100 of supplies. As of December 31 , a physical count of supplies shows $850 of supplies avallable. Prepare the year-end adjusting entries to reflect expiration of the insurance and correctly report the balance of the Supplies account and the Supplies Expense account as of December 31. Journal entry worksheet Record year-end adjusting entry to reflect expiration of the insurance as of December 31 . Note: Enter debits before credits. For each separate case, record the necessary adjusting entry. a. On July 1, Lopez Company paid $1,300 for six months of insurance coverage. No adjustments have been made to the Prepaid Insurance account, and it is now December 31. b. Zim Company has a Supplies account balance of $5,200 at the beginning of the year. During the year, it purchases $2,100 of supplies. As of December 31, a physical count of supplies shows $850 of supplies available. Prepare the year-end adjusting entries to reflect expiration of the insurance and correctly report the balance of the Supplies account and the Supplies Expense account as of December 31. Journal entry worksheet Note: Enter deoits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts