Question: For each situation (1-5), select the most applicable AICPA rule of conduct and whether there is a violation or no violation of the rule (A-

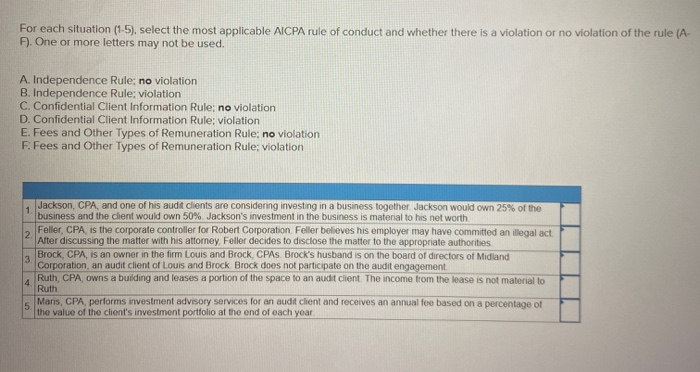

For each situation (1-5), select the most applicable AICPA rule of conduct and whether there is a violation or no violation of the rule (A- F). One or more letters may not be used A. Independence Rule: no violation B. Independence Rule: violation C. Confidential Client Information Rule; no violation D. Confidential Client Information Rule: violation E. Fees and Other Types of Remuneration Rule: no violation F. Fees and Other Types of Remuneration Rule: violation 1 2 3 Jackson, CPA, and one of his audit clients are considering investing in a business together Jackson would own 25% of the business and the client would own 50%. Jackson's investment in the business is material to his net worth Feller, CPA, is the corporate controller for Robert Corporation Feller believes his employ may have committed an illegal act After discussing the matter with his attorney Feller decides to disclose the matter to the appropriate authorities Brock, CPA, is an owner in the firm Louis and Brock, CPAs. Brock's husband is on the board of directors of Midland Corporation, an audit client of Louis and Brock Brock does not participate on the audit engagement Ruth, CPA, owns a building and leases a portion of the space to an audit client. The income from the lease is not material to Ruth Maris, CPA, performs investment advisory services for an audit chent and receives an annual fee based on a percentage of the value of the client's investment portfolio at the end of each year 4 5 For each situation (1-5), select the most applicable AICPA rule of conduct and whether there is a violation or no violation of the rule (A- F). One or more letters may not be used A. Independence Rule: no violation B. Independence Rule: violation C. Confidential Client Information Rule; no violation D. Confidential Client Information Rule: violation E. Fees and Other Types of Remuneration Rule: no violation F. Fees and Other Types of Remuneration Rule: violation 1 2 3 Jackson, CPA, and one of his audit clients are considering investing in a business together Jackson would own 25% of the business and the client would own 50%. Jackson's investment in the business is material to his net worth Feller, CPA, is the corporate controller for Robert Corporation Feller believes his employ may have committed an illegal act After discussing the matter with his attorney Feller decides to disclose the matter to the appropriate authorities Brock, CPA, is an owner in the firm Louis and Brock, CPAs. Brock's husband is on the board of directors of Midland Corporation, an audit client of Louis and Brock Brock does not participate on the audit engagement Ruth, CPA, owns a building and leases a portion of the space to an audit client. The income from the lease is not material to Ruth Maris, CPA, performs investment advisory services for an audit chent and receives an annual fee based on a percentage of the value of the client's investment portfolio at the end of each year 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts