Question: For each situation below, record the ADJUSTING ENTRY required at December 31, 2020 in the records of Jacko's Design, Inc., prior to the company's preparation

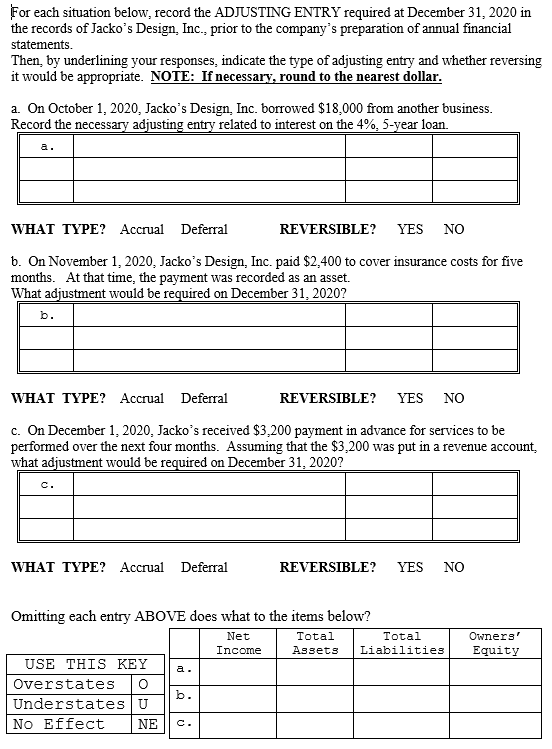

For each situation below, record the ADJUSTING ENTRY required at December 31, 2020 in the records of Jacko's Design, Inc., prior to the company's preparation of annual financial statements. Then, by underlining your responses, indicate the type of adjusting entry and whether reversing it would be appropriate. NOTE: If necessary, round to the nearest dollar. a. On October 1, 2020, Jacko's Design, Inc. borrowed $18,000 from another business. Record the necessary adjusting entry related to interest on the 4%, 5-year loan. WHAT TYPE? Accrual Deferral REVERSIBLE? YES NO b. On November 1, 2020. Jacko's Design, Inc. paid $2,400 to cover insurance costs for five months. At that time, the payment was recorded as an asset. What adjustment would be required on December 31, 2020? WHAT TYPE? Accrual Deferral REVERSIBLE? YES NO c. On December 1, 2020. Jacko's received $3,200 payment in advance for services to be performed over the next four months. Assuming that the $3.200 was put in a revenue account, what adjustment would be required on December 31, 2020? c. WHAT TYPE? Accrual Deferral REVERSIBLE? YES NO Omitting each entry ABOVE does what to the items below? Net Total Total Liabilities Income Assets Owners' Equity a. USE THIS KEY Overstates O Understates U NO Effect NE b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts