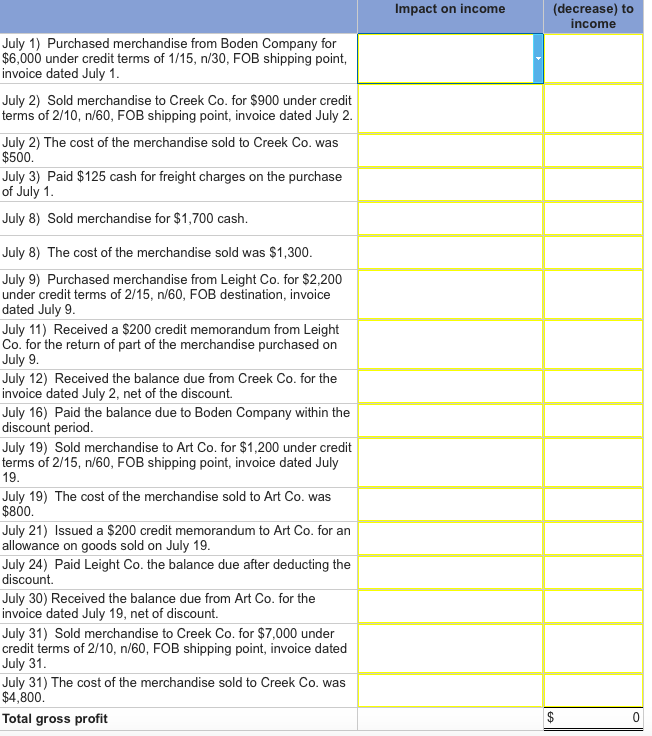

Question: For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any. Input decreases to

For each transaction, indicate the impact each item had on income and the dollar amount of the change in income, if any. Input decreases to net income as negative values. Upon completion, compare the gross profit with the amount reported on the partial income statement.

Impact on income (decrease) to income July 1) Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1 July 2) Sold merchandise to Creek Co. for $900 under credit terms of 2/10n/60, FOB shipping point, invoice dated July 2. July 2) The cost of the merchandise sold to Creek Co. was $500 July 3) Paid $125 cash for freight charges on the purchase of July 1 July 8) Sold merchandise for $1,700 cash July 8) The cost of the merchandise sold was $1,300 July 9) Purchased merchandise from Leight Co. for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9 July 11) Received a $200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9 July 12) Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. July 16) Paid the balance due to Boden Company within the discount period July 19) Sold merchandise to Art Co. for $1,200 under credit terms of 2/15n/60, FOB shipping point, invoice dated July 19 July 19) The cost of the merchandise sold to Art Co. was $800 July 21) Issued a $200 credit memorandum to Art Co. for an allowance on goods sold on July 19 July 24) Paid Leight Co. the balance due after deducting the discount. July 30) Received the balance due from Art Co. for the invoice dated July 19, net of discount. July 31) Sold merchandise to Creek Co. for $7,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31 July 31) The cost of the merchandise sold to Creek Co. was $4,800 Total gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts