Question: For educational assistance programs, an employee can exclude up to $ 5 , 2 5 0 per year of employer assistance towards the employee's education?

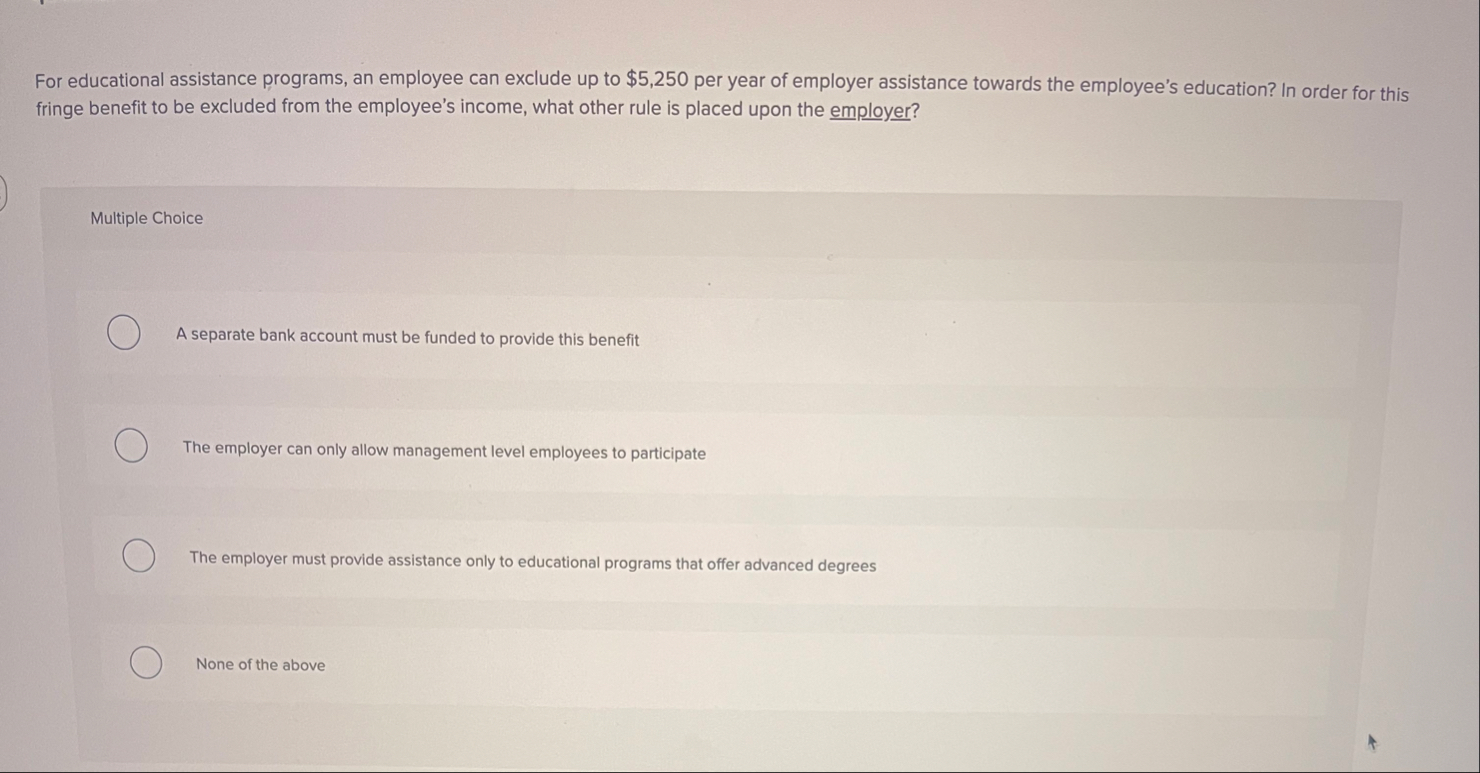

For educational assistance programs, an employee can exclude up to $ per year of employer assistance towards the employee's education? In order for this fringe benefit to be excluded from the employee's income, what other rule is placed upon the employer?

Multiple Choice

A separate bank account must be funded to provide this benefit

The employer can only allow management level employees to participate

The employer must provide assistance only to educational programs that offer advanced degrees

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock