Question: For example, if you were to pay $995 for a T-b maturing in 90 days with a face value of $1,000, the percentage yield

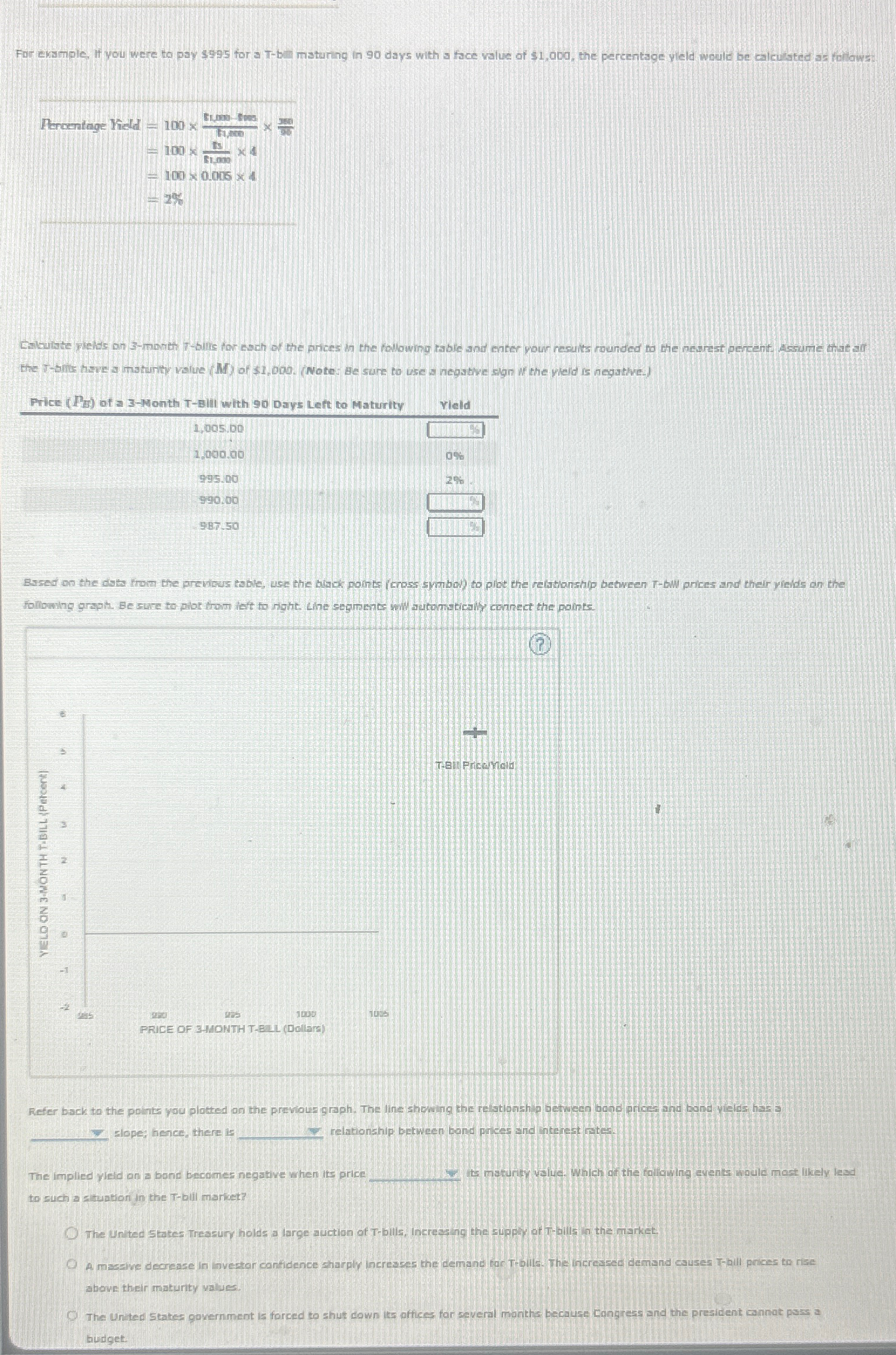

For example, if you were to pay $995 for a T-b maturing in 90 days with a face value of $1,000, the percentage yield would be calculated as follows: Percentage Yield = 100 x 100 x 100 x 0.005x4 2% Calculate Fields on 3-month T-bifts for each of the prices in the following table and enter your results rounded to the nearest percent. Assume that aff the T-blits have a maturity value (M) of $1,000. (Note: Be sure to use a negative sign the yield is negative.) Price (Pg) of a 3-Month T-Bill with 90 Days Left to Maturity 1,005.00 1.000.00 Yield 995.00 990.00 987.50 10% 2% Based on the data from the previous table, use the black points (cross symbol) to plot the relationship between T-bw prices and their yields on the following graph. Be sure to piot from left to right. Line segments www.automatically connect the points YIELD ON 3-MONTH T-BILL (Percent) 1005 PRICE OF 3-MONTH T-BILL (Dollars) T-B Price Mold Refer back to the points you plotted on the previous graph. The line showing the relationship between bond prices and bond yields has a clope; hence, there is relationship between band prices and interest rates. The implied yield on a bond becomes negative when its price to such a situation in the T-bill market? had its maturity value. Which of the following events would most likely lead The United States Treasury holds a large auction of T-bills, Increasing the supply of T-bills in the market. A massive decrease in investor confidence sharply increases the demand for T-bills. The increased demand causes T-bill prices to rise above their maturity values. The United States government is forced to shut down its offices for several months because Congress and the president cannot pass a budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts