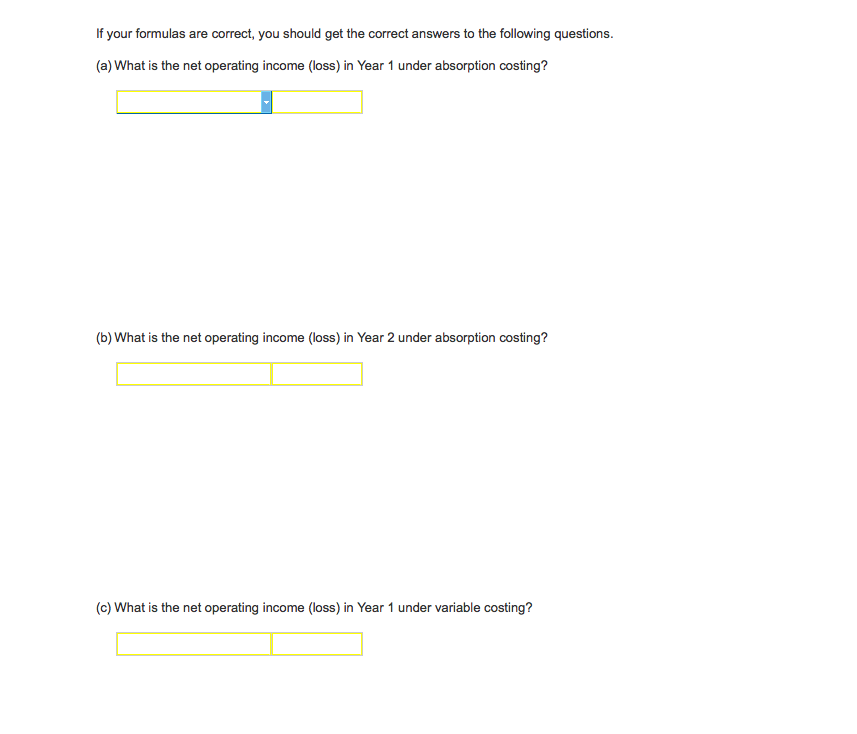

Question: For example, in cell B26 enter the formula = B17. After entering formulas in all of the cells that contained question marks, verify that the

| For example, in cell B26 enter the formula "= B17". |

| After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the numbers in Review Problem 1. |

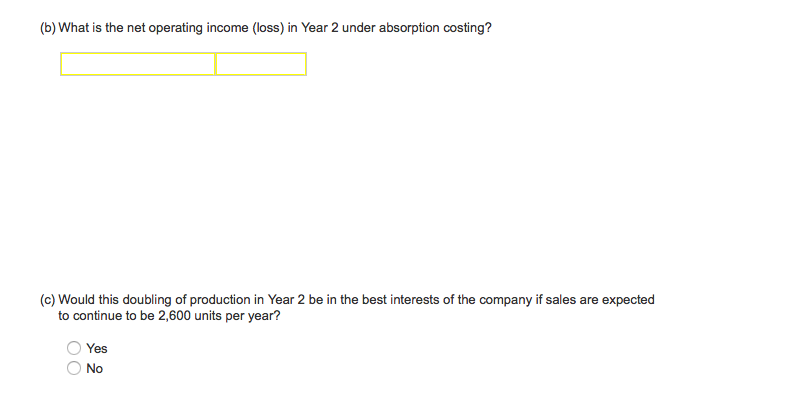

| The LIFO inventory flow assumption is used throughout the problem. |

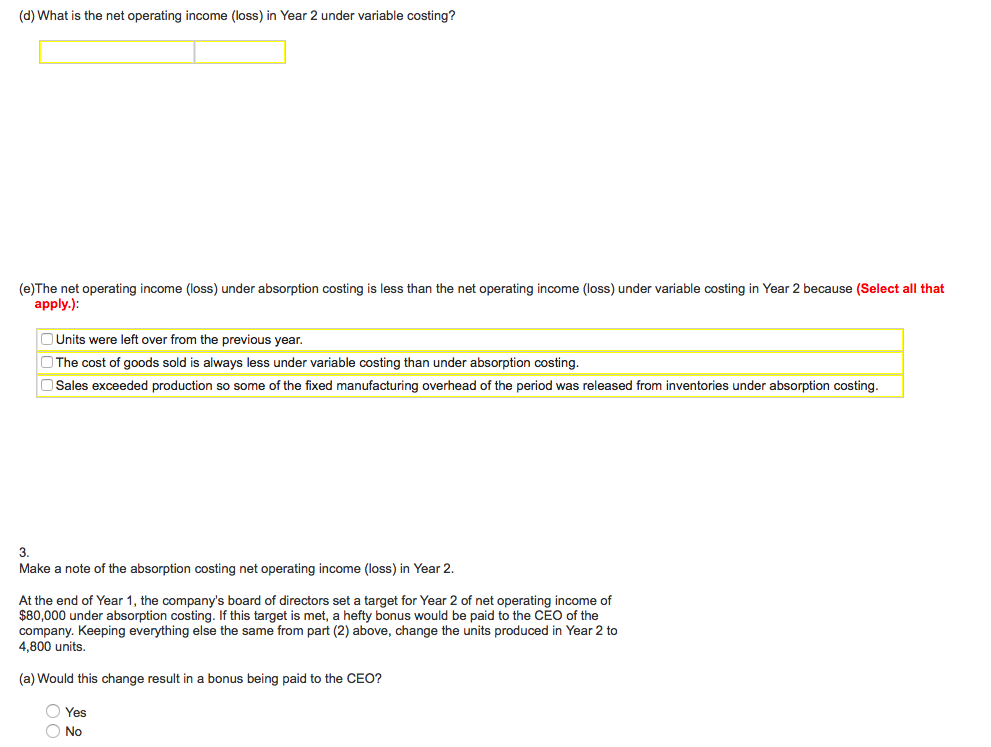

| Check your worksheet by changing the units sold in the Data to 6,000 for Year 2. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isnt, check cell C41. The formula in this cell should be =IF(C26 |

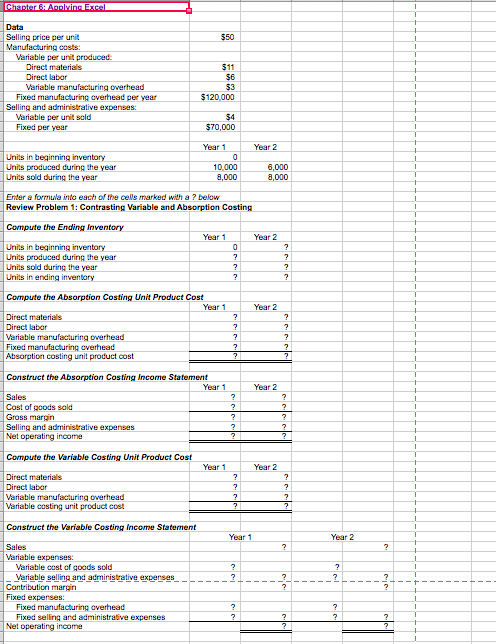

Selling price per unit ariable per unit produced Direct materials ariable marufacturing overhead Fixed manufacturing overhead per year $120,000 Selling and administrative expenses: ariable per unit sold Fixed per year $70,000 Year 1 Uniits in beqining inventory Units produced during the year Uniits sold during the year 6,000 Enter formula into each of the cells marked with a ? below Review Problem 1: Contrasting Variable and Absorption Costing Compute the Ending Inventory Uniits in beginning inventory Units produced during the year Uniits sold during the year Units in ending Compute the Absorption Costing Unit Product Cost Year Direct materials Direct labor ariable manufacturing overhead Fixed manufacturing overhead Absorption costing unit product cost Construct the Absorption Costing Income Statemennt Cost of goods Gross margn Selling and administrative expenses Net operating income Compute the Variable Costing Unit Product Cost Direct materials Direct labor ariable manufacturing overhead ariable costing unit product cost Construct the Variable Costing Income Staterment Year 1 Year Variable expenses: ariable cost of goods sold Variable selling and admiristrative expenses 2 Contribution margin Fixed experses: Fixed selling and administrative expenses Net operatirg income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts