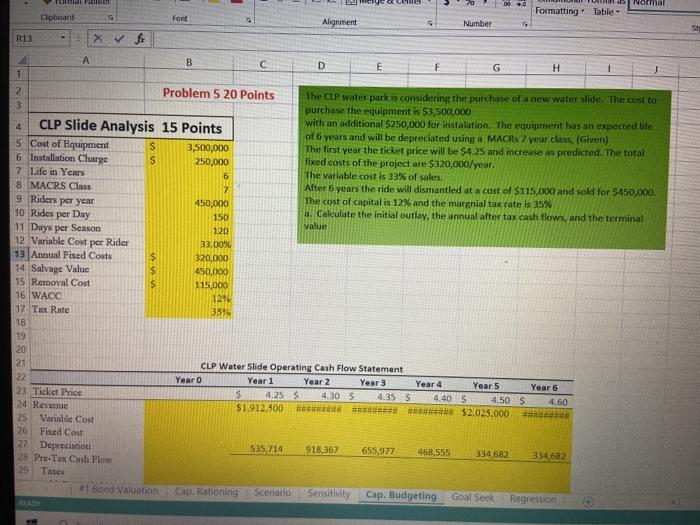

Question: For FC 04.0 Normal Formatting. Table Clipboard . Font Alignment Number R13 1x fr A B D E H 1 2 Problem 5 20 Points

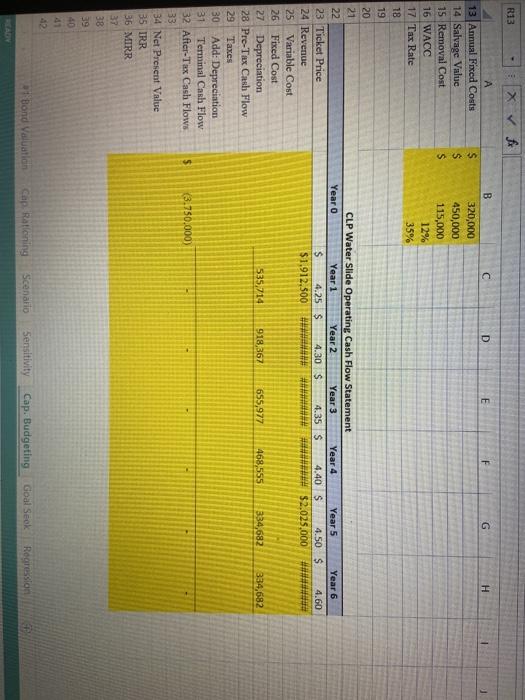

For FC 04.0 Normal Formatting. Table Clipboard . Font Alignment Number R13 1x fr A B D E H 1 2 Problem 5 20 Points The CLP water park is considering the purchase of a new water slide. The cost to 3 purchase the equipment is $3,500,000 4. CLP Slide Analysis 15 Points with an additional $250,000 for installation. The equipment has an expected life of 6 years and will be depreciated using a MACRs 7 year class, (Given) 5 Cost of Equipment S 3,500,000 The first year the ticket price will be $4.25 and increase as predicted. The total 6 Installation Charge S 250,000 fixed costs of the project are $320,000/year. 7 Life in Years 6 The variable cost is 33% of sales. 8 MACRS Class 7 After 6 years the ride will dismantled at a cost of $115 000 and sold for $450,000. 9 Riders per year 450,000 The cost of capital is 12% and the marenial tax rate is 35% 10 Rides per Day 3. Calculate the initial outlay, the annual after tax cash flows, and the terminal 150 value 11 Days per Season 120 12 Variable Cost per Rider 33.00% 13 Annual Fixed Costs 320,000 14 Salvage Value 450.000 15 Removal Cost 115,000 16 WACC 17 Tax Rate 3594 18 19 20 21 CLP Water Slide Operating Cash Flow Statement 22 Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 23 Ticket Price $ 4.25 S 4.30 $ 4.35S 4.40 S 4.50 $ 4.60 24 Revenue $1.912.500 $2.025.000 25 Variable Cost 26 Fixed Cost 27 Depreciation 535,714 918,367 655,977 468,555 334,682 334,682 28 Pre-Tax Cach Flow 29 Tite 21 Bond Valuation Cap. Rationing Scenario Sensitivity Cap. Budgeting Goal Seek Regression 1290 R13 x fr D E F G H $ S s B 320,000 450,000 115,000 12% 35% CLP Water Slide Operating Cash Flow Statement Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 4.25 $ 4.30 S 4.35 S 4.40 S 4.50 $ 4.60 $1.912.500 *** ########## $2.025.000 13 Annual Fixed Costs 14 Salvage Value 15 Removal Cost 16 WACC 17 Tax Rate 18 19 20 21 22 23 Ticket Price 24 Revenue 25 Variable Cost 26 Fixed Cost 27 Depreciation 28 Pre-Tex Cash Flow 29 TE 30 Add: Depreciation 31 Terminal Cash Flow 32 After-Tax Cash Flows 33 34 Net Present Value 35 IRR 36 MIRR 37 38 39 40 535,714 918,367 655,977 468,555 334,682 334,682 (3.750,000) 1 Bond Valuation Cap. Ratloning Scenario Sensitivity Cap. Budgeting Goal Seck Regression For FC 04.0 Normal Formatting. Table Clipboard . Font Alignment Number R13 1x fr A B D E H 1 2 Problem 5 20 Points The CLP water park is considering the purchase of a new water slide. The cost to 3 purchase the equipment is $3,500,000 4. CLP Slide Analysis 15 Points with an additional $250,000 for installation. The equipment has an expected life of 6 years and will be depreciated using a MACRs 7 year class, (Given) 5 Cost of Equipment S 3,500,000 The first year the ticket price will be $4.25 and increase as predicted. The total 6 Installation Charge S 250,000 fixed costs of the project are $320,000/year. 7 Life in Years 6 The variable cost is 33% of sales. 8 MACRS Class 7 After 6 years the ride will dismantled at a cost of $115 000 and sold for $450,000. 9 Riders per year 450,000 The cost of capital is 12% and the marenial tax rate is 35% 10 Rides per Day 3. Calculate the initial outlay, the annual after tax cash flows, and the terminal 150 value 11 Days per Season 120 12 Variable Cost per Rider 33.00% 13 Annual Fixed Costs 320,000 14 Salvage Value 450.000 15 Removal Cost 115,000 16 WACC 17 Tax Rate 3594 18 19 20 21 CLP Water Slide Operating Cash Flow Statement 22 Year o Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 23 Ticket Price $ 4.25 S 4.30 $ 4.35S 4.40 S 4.50 $ 4.60 24 Revenue $1.912.500 $2.025.000 25 Variable Cost 26 Fixed Cost 27 Depreciation 535,714 918,367 655,977 468,555 334,682 334,682 28 Pre-Tax Cach Flow 29 Tite 21 Bond Valuation Cap. Rationing Scenario Sensitivity Cap. Budgeting Goal Seek Regression 1290 R13 x fr D E F G H $ S s B 320,000 450,000 115,000 12% 35% CLP Water Slide Operating Cash Flow Statement Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ 4.25 $ 4.30 S 4.35 S 4.40 S 4.50 $ 4.60 $1.912.500 *** ########## $2.025.000 13 Annual Fixed Costs 14 Salvage Value 15 Removal Cost 16 WACC 17 Tax Rate 18 19 20 21 22 23 Ticket Price 24 Revenue 25 Variable Cost 26 Fixed Cost 27 Depreciation 28 Pre-Tex Cash Flow 29 TE 30 Add: Depreciation 31 Terminal Cash Flow 32 After-Tax Cash Flows 33 34 Net Present Value 35 IRR 36 MIRR 37 38 39 40 535,714 918,367 655,977 468,555 334,682 334,682 (3.750,000) 1 Bond Valuation Cap. Ratloning Scenario Sensitivity Cap. Budgeting Goal Seck Regression

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts