Question: For fixed - rate bonds it's important to realize that the value of the bond has a ( n ) q , ( constant /

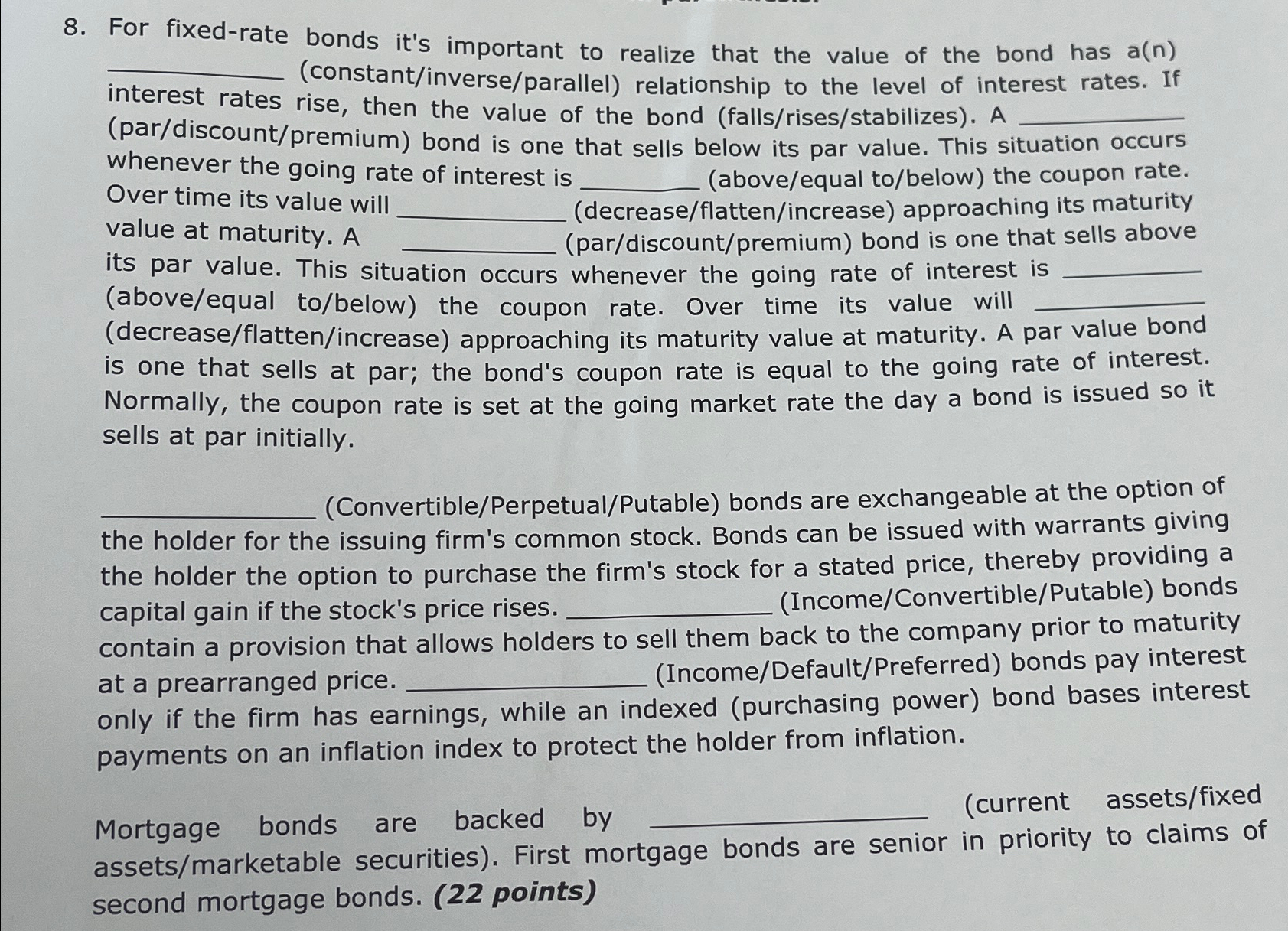

For fixedrate bonds it's important to realize that the value of the bond has constantinverseparallel relationship to the level of interest rates. If interest rates rise, then the value of the bond fallsrisesstabilizes A pardiscountpremium bond is one that sells below its par value. This situation occurs whenever the going rate of interest is aboveequal tobelow the coupon rate. Over time its value will decreaseflattenincrease approaching its maturity value at maturity. A pardiscountpremium bond is one that sells above its par value. This situation occurs whenever the going rate of interest is aboveequal tobelow the coupon rate. Over time its value will decreaseflattenincrease approaching its maturity value at maturity. A par value bond is one that sells at par; the bond's coupon rate is equal to the going rate of interest. Normally, the coupon rate is set at the going market rate the day a bond is issued so it sells at par initially.

ConvertiblePerpetualPutable bonds are exchangeable at the option of the holder for the issuing firm's common stock. Bonds can be issued with warrants giving the holder the option to purchase the firm's stock for a stated price, thereby providing a capital gain if the stock's price rises. IncomeConvertiblePutable bonds contain a provision that allows holders to sell them back to the company prior to maturity at a prearranged price. IncomeDefaultPreferred bonds pay interest only if the firm has earnings, while an indexed purchasing power bond bases interest payments on an inflation index to protect the holder from inflation.

Mortgage bonds are backed by current assetsfixed assetsmarketable securities First mortgage bonds are senior in priority to claims of second mortgage bonds. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock