Question: For flow - through entities, such as partnerships, how does the tax law use partner basis adjustments to prevent double taxation of partnership income? A

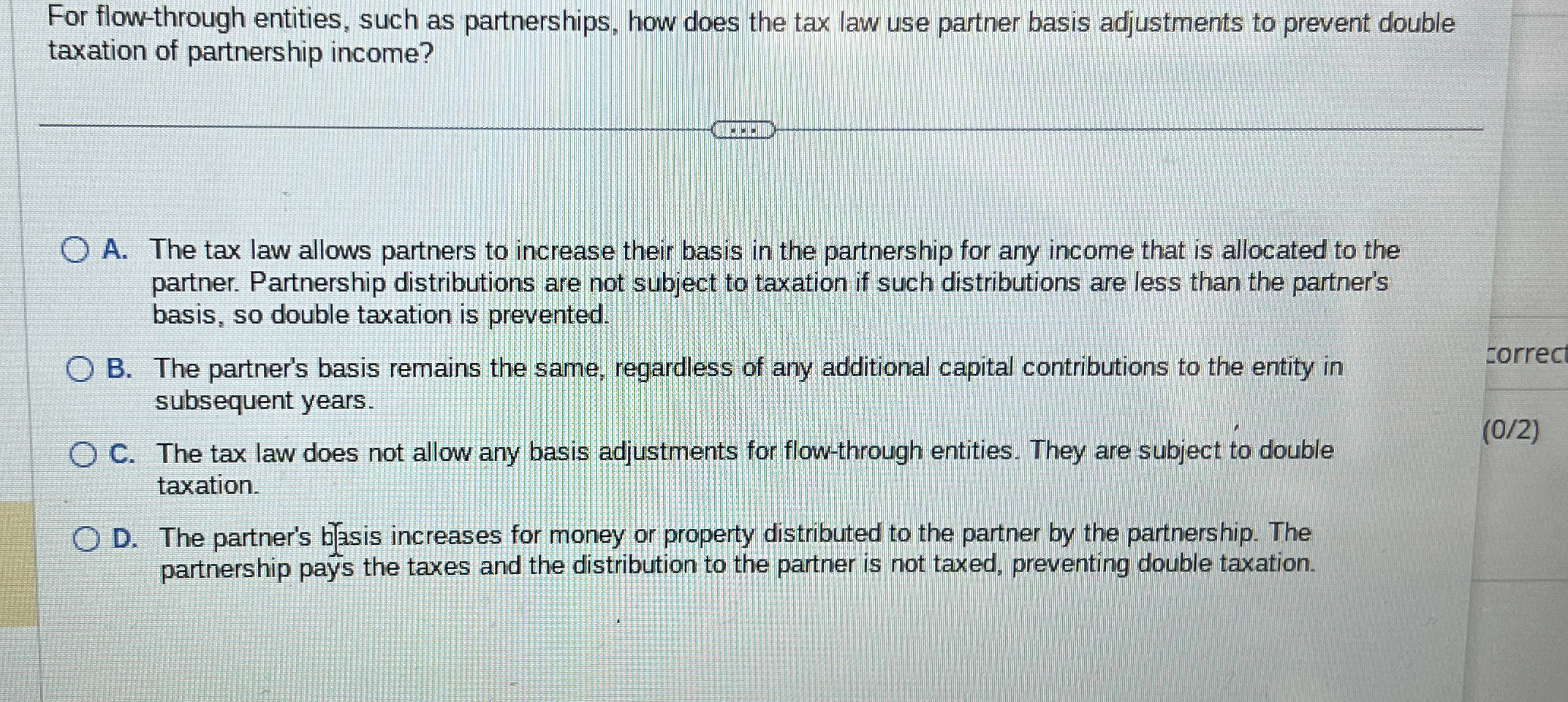

For flowthrough entities, such as partnerships, how does the tax law use partner basis adjustments to prevent double taxation of partnership income?

A The tax law allows partners to increase their basis in the partnership for any income that is allocated to the partner. Partnership distributions are not subject to taxation if such distributions are less than the partner's basis, so double taxation is prevented.

B The partner's basis remains the same, regardless of any additional capital contributions to the entity in subsequent years.

C The tax law does not allow any basis adjustments for flowthrough entities. They are subject to double taxation.

D The partner's basis increases for money or property distributed to the partner by the partnership. The partnership pays the taxes and the distribution to the partner is not taxed, preventing double taxation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock